Natural Gas jumped higher once again, approaching the recent 5 year high reached slightly under 1 month ago. Reason for the rally? The cold weather that just doesn’t seem to go away which has increased demand and brought production level lower as facilities are not able to operate at full capacity due to the weather. However, it should be noted that market should have already priced in such a scenario with analysts consensus for Natural Gas Storage to fall by -255 billion cubic feet last week. In fact, the actual decline was lower at -250 billion, suggesting that the shortage of Nat Gas isn’t as severe as we expected, yet prices continue to stay afloat.

This irrationality does not bode well for the long-term bullish prospect of Nat Gas, and the downside risk moving forward as there seems to be high level of speculation right now, and once the cold weather subside or when these speculators hit their buying limit, the next possible move would be to unwind their long positions – resulting in a sharp bearish reversal.

Looking at Futures, we can see a huge premium between short-dated delivery vs long-dated delivery. Futures for Mar delivery now stands at $6.42 while April’s is at $5.15, a huge disparity that cannot be justified by demand alone especially when we remember that Nat Gas curve has always been in contango until Jan this year. Even if Nat Gas curve does not revert back to normal backwardation, current short-term delievery premium will almost certainly narrow as spring draws nearer and nearer, dragging current price lower in the process.

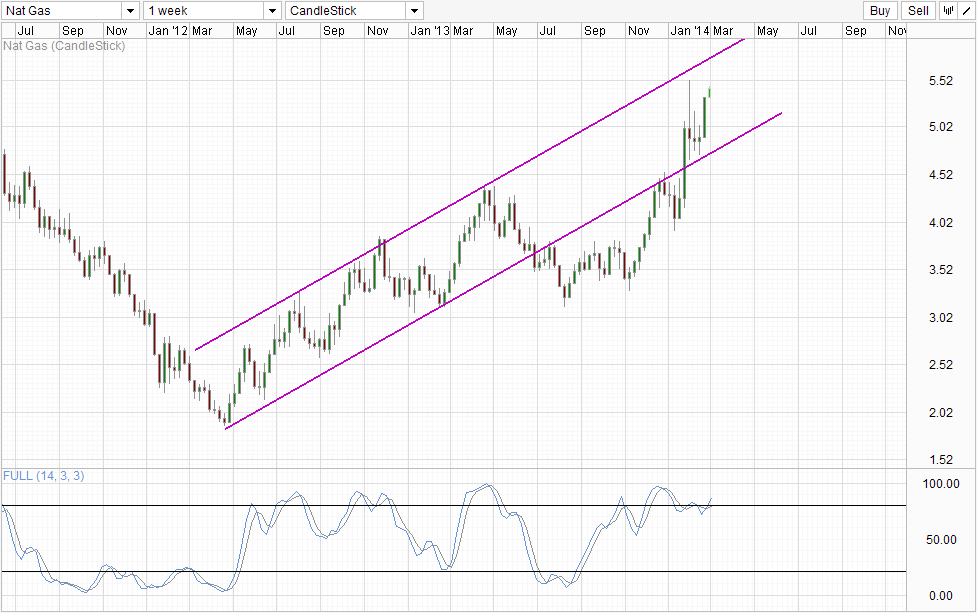

Weekly Chart

Technicals are also not optimistic for bulls. Stochastic readings suggest that we are overbought, and there isn’t much room to climb with Channel Top close by. As such, even in the event that current long-term bullish momentum will continue, a short/mid term bearish correction cannot be ignored.

A last but important point to take note, there is additional political pressure for Nat Gas price to be low. It is no secret that Obama administration wants higher utilization rate for Nat Gas as it is a cleaner energy source and by encouraging more factories in US to use it, the dependency on foreign crude will be lower. Unfortunately, there are evidence that producers are switching from Nat Gas to coal when prices are above $5.00, and as such it is likely that Obama administration may artificially lower price if prices remain above this level. Even in the event that nothing is done, demand will naturally fall, and without corporate demand for Nat Gas, it is unlikely that consumer demand (using it for residential heating purposes) will be able to push prices much higher from here out.

More Links:

Gold Technicals – Losing Bullish Momentum But Staying Afloat For Now

WTI Crude – Bears Starting To Gain Strength

AUD/USD Technicals – Lower In The Morning But No Panic For Bulls

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.