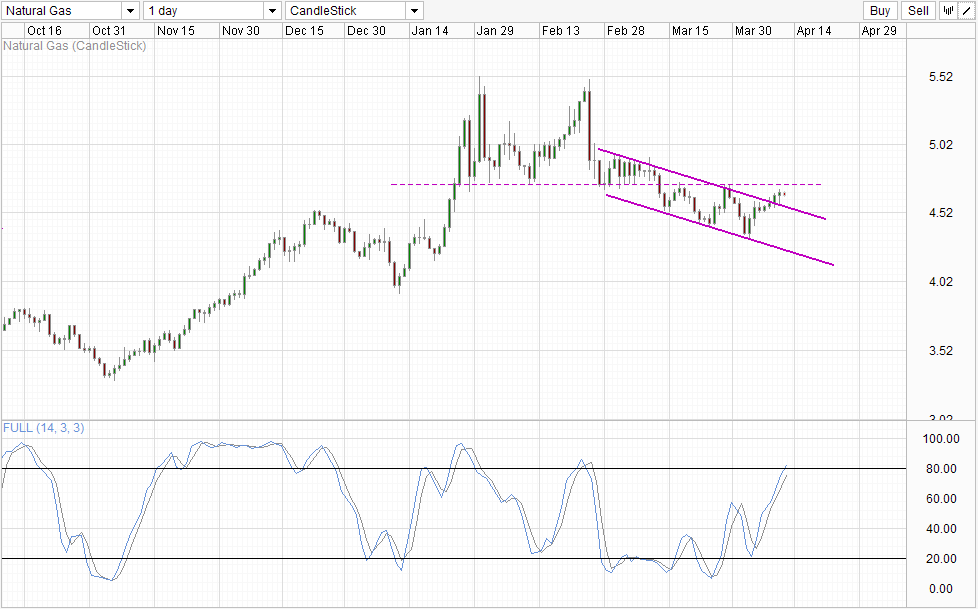

Fresh tension between Ukraine and Russia drove Natural Gas higher recently, allowing prices to break away from the descending Channel that has been in play ever since the break of 4.72 support. However, bearish pressure isn’t over, as we remain below the aforementioned support turned resistance level with Stochastic indicator heading into the Overbought region, close to the previous bearish reversal turning point. Hence, prices could still push lower and either we see prices falling back into the Channel, or prices may simply straddle Channel Top lower at a slower pace.

That being said, there is no evidence that short-term momentum is failing, as such it is still entirely possible and may even be more likely that prices will continue to head towards 4.72 in the immediate future. The Energy Information Administration weekly report on Nat Gas Storage will be helpful to determine short-term sentiment. Analysts are expecting an increase in inventory which will break the series of weekly inventory drawdown stretching all the way from 21st Nov 2013. Should we see a decrease in inventory count once more but prices fail to move significantly in the immediate aftermath or in the next few trading days, the likelihood of a bearish reversal may be at hand. Conversely, should inventory build up more than expected yet prices continue to stay afloat or even more higher, this would indicate that short-term sentiment is still bullish and we can see a test of 4.72 moving forward if we haven’t already reach there with a slight chance of breaking the said resistance.

Fundamentally, it should be noted that the cold weather is over, and we are deep into spring with summer coming. As such, demand for Nat Gas for heating purposes is definitely going to go down. Industrial demand may pick up slightly due to the increased cost in WTI Crude but bullish pressure from this is expected to be limited as these industrial users tend to be highly price sensitive, and may even switch to cheaper coal should Nat Gas prices rise up too much. Furthermore, with growth of industrial activity appearing to be slowly down not just in US but across the world, we may even be seeing lesser demand, not higher. As such, outlook for Nat Gas remain bearish and traders playing current bullish momentum will need to be aware that bearish reversal may be coming just around the corner.

More Links:

WTI Crude – Bulls Fully Back In Force

Gold Technicals – Confirmation Of 1,315 Break Needed For Further Bullish Push

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.