- Oil exits oversold territory

- China increases gold reserves for a sixth consecutive month

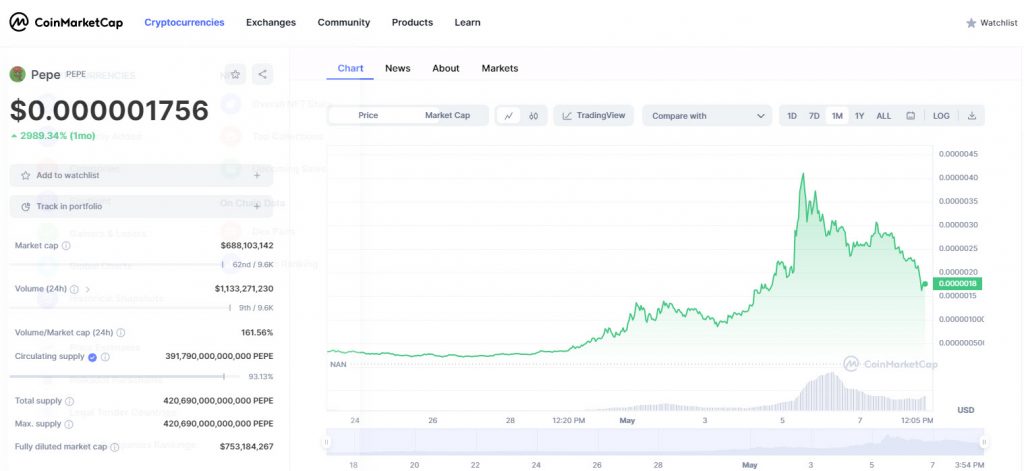

- Pepe Coin craters while Bitcoin struggles

Oil

Oil prices continue to edge higher as the crude demand outlook is pummeled with mixed signals. The latest jobs report wasn’t as good as the headline implied and today’s Fed survey showed loan demand is falling off a cliff. The oil market was extremely oversold and it will probably continue to stabilize as long as Wall Street is still confident the Fed will cut rates later this year. Oil prices won’t be able to rise that much from here given all the growth demand fears, but expectations are high for OPEC+ to try to keep prices above the $70 a barrel level.

WTI crude will likely form a range above the mid-$70s to the mid-$80s if the macro backdrop doesn’t completely deteriorate. There are a lot of risks on the table, but optimism is growing for debt ceiling drama and banking jitters to remain as short-term problems.

Gold

Gold looks like it wants to make another run towards record territory. Too many recessionary risks are on the table for gold to see a significant pullback. Gold is also getting strong demand from China and that should improve going forward. China posted its sixth straight monthly increase with gold reserves.

Gold could get a catalyst from an in-line inflation report. Treasury yields are rising again but for that to continue, pricing pressures can’t be too sticky. Gold might be stuck in a range until we get that key inflation report.

Crypto Weakness

The headlines have not been friendly for Bitcoin to start the trading week. Binance had to pause bitcoin withdrawals for a couple of hours as the number of unconfirmed transactions hit a record high. To address the issue, Binance had to increase the fees and that won’t be well received across the cryptoverse. Binance withdrawal fees will jump from around $5.59 to $27.94 per withdrawal.

What is not helping Bitcoin is all the attention going to meme coin Pepecoin. Pepe made a run above the $1-billion market capitalization, which is ludicrous. The meme coin has collapsed, triggering massive losses for those who joined the party too late.

For the global crypto market cap to make a serious run higher, these meme coins can’t be attracting this much attention.

- Source CoinMarketCap

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.