What a Strange Week

Sentiment has taken a bit of a knock at the end of the trading week, as many stock exchanges around the world close is observance of Labor Day.

It’s been a very strange week in all honest. We rallied early on ahead of some huge earnings results and central bank meetings, as investors swerved the kind of caution that usually accompanies such major announcements. We then got a legitimate boost from Gilead and the Remdesivir trial, along with decent corporate results from Microsoft and Facebook. And we’ve finished the week weighing up the prospect of US tariffs on China. Weird.

It doesn’t help when tech heavyweights Apple and Amazon leave investors scratching their heads. Prior to the results, Amazon’s stock was 13% above its pre-COVID peak, having suffered the plunge that everyone else did in late February/early March. That’s an impressive 52% gain from its March lows as the belief was that the company had done rather well out of the crisis. And then the company announces that any gain from sales will be wiped out by the cost of keeping workers healthy and processes running, leading to a potential operating loss of $1.5 billion in the second quarter.

The upside is that a number of the heavy hitters have now reported and the busiest week is behind us and we’ve come out of it unscathed. Who knows what lies ahead and next week is still busy on the earnings front. But this week was a huge potential banana skin and there’ll be some relief that it could have gone a lot worse. Assuming we survive today that is, with futures a couple of percent lower, I may be speaking too soon.

Oil pares gains as production cuts ramp up

Oil prices have staged an impressive rebound this week after a rocky start, as the USO – America’s largest oil ETF – opted to avoid another May contract scenario and shed its June holdings. This represented around 20% of its $3.6 billion portfolio so traders were naturally keen to get out the way and compress prices to very generous levels, if you’re a buyer. The price rebounded shortly after but still trades below $20.

The production cuts are finally kicking in with Saudi Arabia reportedly implementing agreed reductions ahead of schedule, the OPEC+ deal officially underway as of today, Norway announcing a reduction of 250,000 barrels per day and ConocoPhillips culling 265,000 this month, rising to 460,000 next. Others will likely follow, at which point we may see downside pressures ease on oil prices and near contracts. Prices are still extremely low though and the next two weeks will likely see extreme volatility return.

Can gold continue consolidation in this environment?

It’s been a strange week again for gold. It remains broadly aligned with risk assets but not necessarily reliably so at this point and even its relationship with the dollar has become a little sketchy. It seems after a period of turbo-charged volatility, the yellow metal has settled into a consolidation phase, with $1,660 providing the floor and $1,750 the ceiling. Quite a broad range, granted, but given the environment, something has to give. Either the world’s going to become a more predictable and relaxed environment, or this can’t last.

Bitcoin halving proving a bullish event for cryptos

The bitcoin halving event is nearing and it seems the extra publicity the crypto space is getting as a result is having the usual effect. Bitcoin dragged its feet through $7,500 resistance but once $8,000 fell it took off. The cryptocurrency fell short of $10,000 psychological resistance to trade just below $9,000 at the time of writing. The halving itself isn’t a bullish event – something that seems to have broad agreement which is strange to see, normally everything is bullish for some reason – but publicity often is so the coming weeks may generate interest and support cryptos. Whether it can be sustained after that I’m very sceptical.

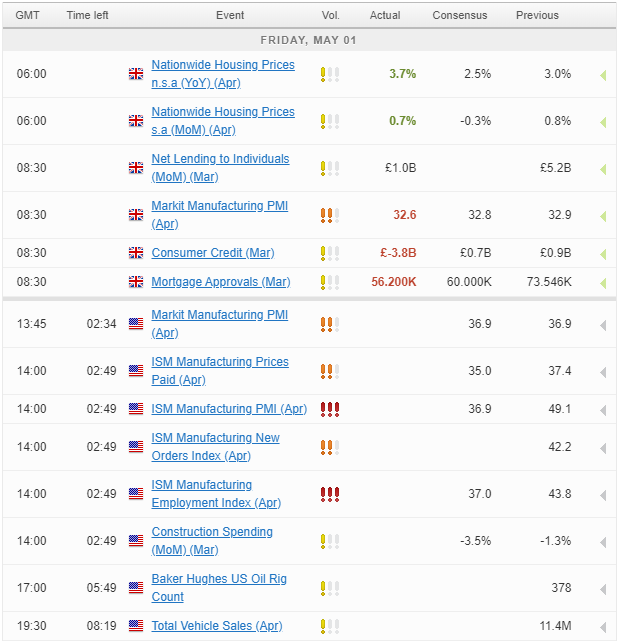

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.