The Canadian dollar fell against most of its major trading partners as oil prices gave back a third of its post-Christmas rally. With no major economic data expected this week from Canada, the moves in the loonie will likely take a queue from oil prices and the general risk play from the greenback.

Since West Texas Intermediate crude prices topped out at $76.90 in early October, the over 40% freefall has been for the most part a plunge with a couple dead cat bounces. Oil made a key low on Christmas Eve at $42.36 on thin volume. If we see price able to hold that level through to the New Year, we could see the Canadian dollar be ripe for a pullback.

Just a few months ago, calls for the Bank of Canada (BOC) to raise rates were high, the 25-basis point hike that was fully expected at the January 9th meeting was pushed off to the summer, but that could off the table as expectations for a cut are starting to materialize. If we do see both the Fed and BOC become more dovish, we could see that be a wash on the monetary policy front.

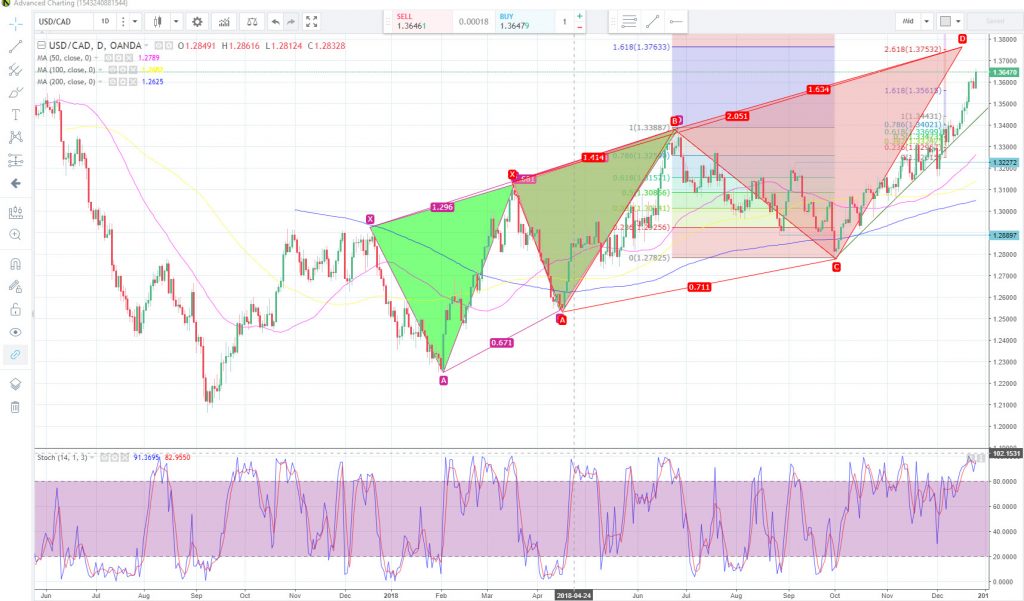

Price action on the USDCAD shows that the bullish trend became firmly in place once price recaptured the 50-day SMA. The rally is over extended and the Slow Stochastics is displaying extreme oversold conditions. If the bullish move provides one last thrust higher, we could see the formation of a bearish butterfly pattern around the 1.3720 level. Point D is targeted with the 200% Fibonacci expansion level of the X to A leg and the 161.8% Fibonacci expansion level of the B to C move. If valid we could see a significant reversal target the 1.3400 region. If the pattern is invalidated, we could see a clear path towards the 1.3950 to 1.4000 zone.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.