WTI prices behaved as we expected yesterday. Prices tanked after peaking above 104.5 following a surprise bullish push during European session even though there was very little reasons to justify the push. Hence, a reversal was always expected and bears duly responded.

The much higher build up in Crude Inventory reported by DOE (+10 million vs 2.3 million expected and 7.6 API estimate) certainly helped to pile bearish pressure on a lower implied demand. But it should be noted that prices have topped way before the numbers were released. Hence, it is reasonable to believe that the DOE numbers mere accelerated or exacerbated the decline rather than resulted in a fundamental shift in sentiment.

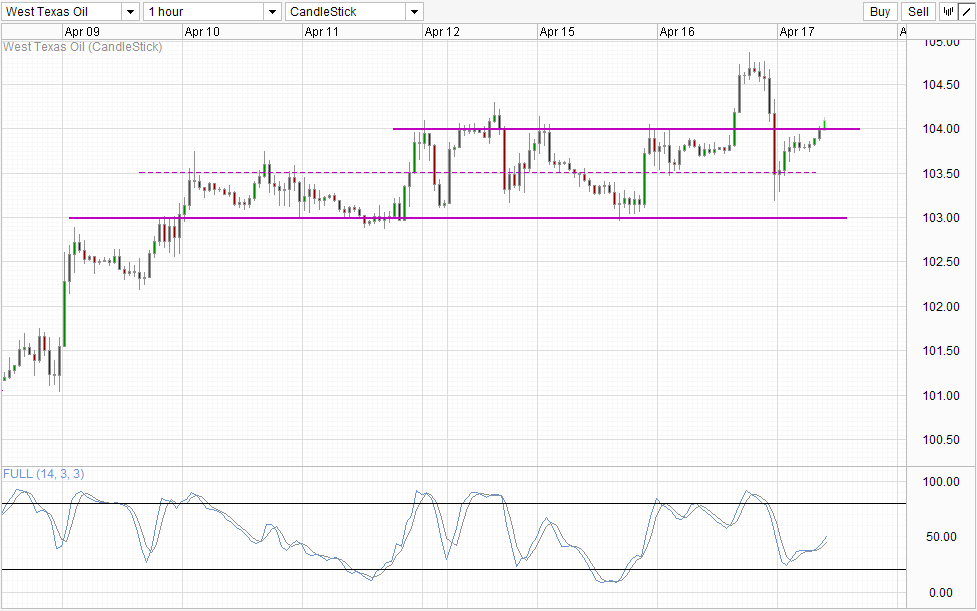

The implication is that for whatever reasons, overall sentiment is still be bullish for WTI. Price action agrees as prices managed to rebound off 103.5 soft support, and is trading back above 104.0 round figure once again without any good justification once again.

Given the lack of strong fundamental reasons for further gains, it is imperative that traders seek further confirmations that current pop above 104.0 can move significantly higher. In this case, a break of 104.15 – 104.3 may be necessary to demonstrate strong bullish convictions, but we should still remember that “significantly higher” here is highly subjective, and may simply mean a move towards yesterday’s high or perhaps 105.0 round figure resistance. This is the inherent risk of trading on sentiment momentum alone which is not supported by any short-term fundamentals and traders will need to evaluate their risk/reward ratio to determine if going long above 104.3 for an outlook of around 50 pips more is worth the risk.

More Links:

EUR: Deflation Still A Non-Issue?

Gold Technicals – 1,300 Broken As Bearish Momentum In Full Force

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.