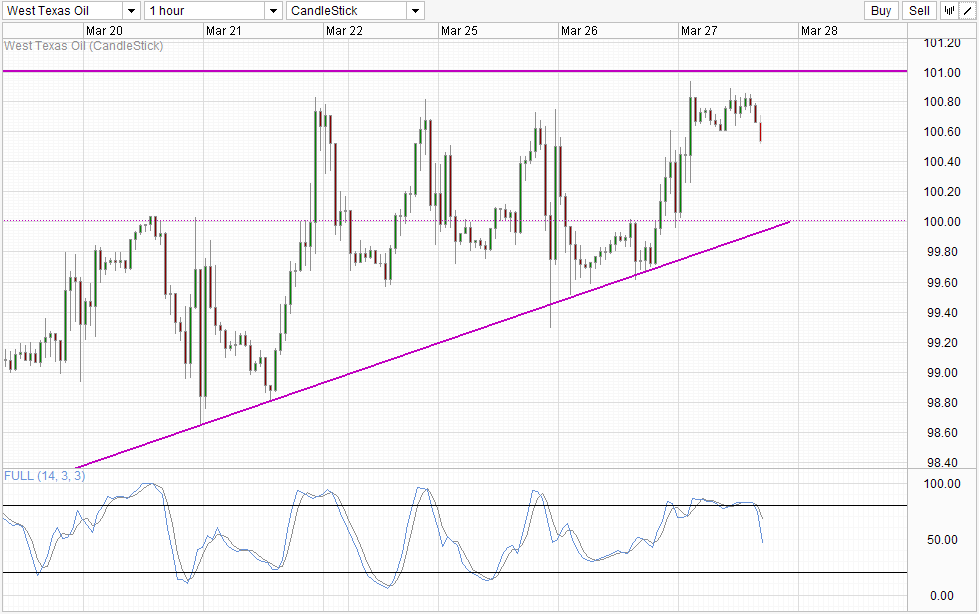

WTI Crude climbed strongly yesterday despite latest Department of Energy report reflecting a much higher than expected build up in crude inventories. Prices pushed lower immediately when report was released at 10.30am EST, falling from a high of 100.6 to 100.18. Prices did rebound higher in the subsequent 30 mins, staying above the 100.2 support but eventually fell to a low of 99.96 in the following 30 mins.

Hourly Chart

This should have been the opportunity for bears to seize initiative. Momentum was bullish before the data release with price rebounding off the rising trendline and avoiding a bearish breakout of 99.6. The timing of the decline was also perfect – US stocks were descending, adding risk off bearish pressure. Furthermore, the turnaround at 100.6 would have made it 4th consecutive lower highs since last Friday, and that is yet another bearish technical sign for bears to take advantage of.

Hence, this failure of bears to “seize the day” is a huge testament to bullish strength, and the move to 100.93 is a reflection of this bullishness. Nonetheless, given that there is nothing fundamental supporting this bullish push, it is not surprising to see that prices failed to tag 101.0 significant resistance. The question that we need to ask is whether bulls have given their last hurrah. Looking at how prices did not really push up higher during Asian hours despite a strong bullish recovery in risk appetite during the afternoon suggest that the underlying bullish sentiment has waned. As such, a move back to the rising trendline should not be difficult especially since European stocks appears to be mildly bearish.

Technicals concur, with 100.6 support is broken and Stochastic readings is showing a sharp bearish cycle. If price manage to break the rising trendline with ease, a push to 100.0 round figure will be possible, and the likelihood of stronger bearish reprisal becomes greater as it is unlikely that there will be much underlying bulls left after yesterday’s significant push.

More Links:

S&P 500 – On Verge Of Breaking 1,850

EUR/USD Technicals – 1.376 Next Bearish Target

Gold Technicals – Aiming For 1,300 Break

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.