100.0 remains a formidable resistance for WTI crude. Prices managed to shoot all the way up to 100.82 last Friday, and appeared to have conquered the century level by closing the week at 100.07. However, instead of shooting higher, prices actually sunk below 100.0 quickly during market open, suggesting that underlying sentiment in Crude Oil is bearish. This bearish sentiment is even more impressive when we consider that Asian stocks are mostly bullish during early session, which should have dragged prices higher.

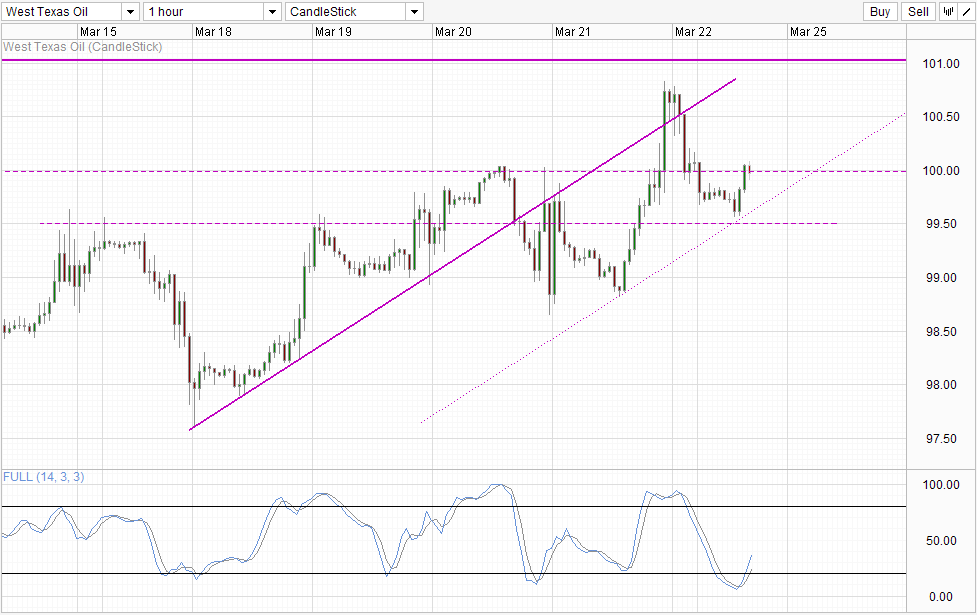

Hourly Chart

It is not all doom and gloom though, even though Chinese Manufacturing PMI was worse than expected, we did not really see a significant drop in prices, with prices being supported by the “Channel Bottom” that appears to be in play right now. This could be due to the overall bullish risk appetite that has finally worked through to Crude Oil prices and is keeping prices afloat. Currently price has recovered significantly and is re-testing the 100.0 mark, and if the newly drawn Channel is indeed relevant, then we could potentially see prices pushing up towards Channel Top and/or 101.0 resistance. Even in the event that the Channel is not relevant to price action, Stochastic readings is also bullish and suggest that we are within a bullish cycle currently, hence a move back above 100.0 is not unreasonable especially since the bullish signal can be considered as coinciding with a bullish rebound off 99.5 support even though prices did not really reach there.

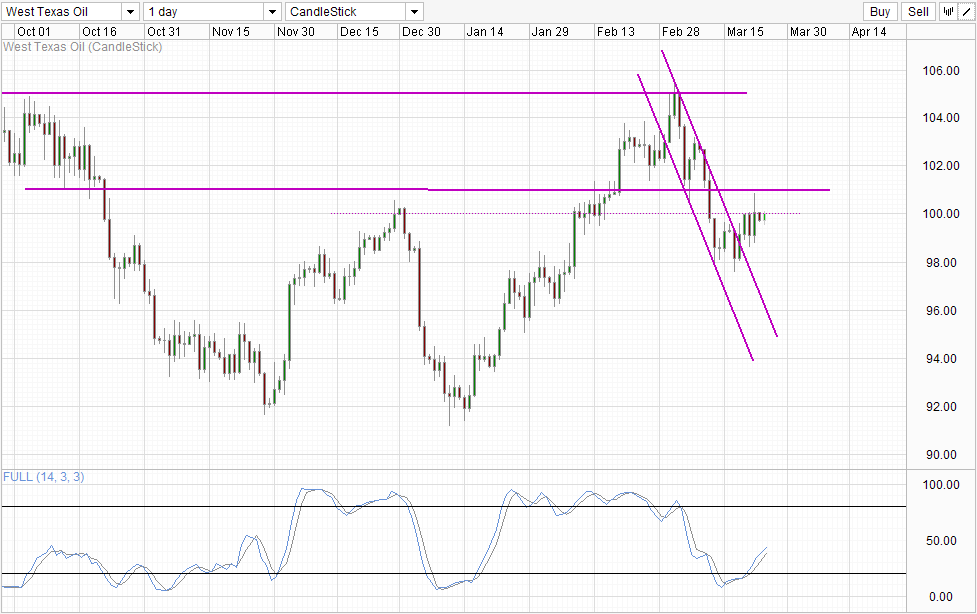

Daily Chart

Daily Chart is actually bullish as prices is trading above the descending Channel Top. Also, Stochastic readings is also amidst a bullish cycle right now, supporting the scenario for a push towards 101.0 at the minimum if the stoch cycle is able to play out fully. However, all these is only possible if 100.0 is broken. Failure to do so and we could easily see prices pushing back lower towards descending Channel Top, and the uptrend will be at risk of being invalidated, which will invite even greater selling pressure.

Fundamentally, demand for Crude is not expected to grow in leaps and bounds in 2014 as global growth rates remain low. The latest data from China and Germany are proof that traders/analysts have been over optimistic about how far the economy has recovered. As such, downside risk of Crude Oil is high as market has priced in the global recovery premium way ahead of time (which explains the rally from 92.0 to 105 in 2014). With WTI Crude facing oversupply/export restrictions which reduces demand, the impact is even greater, and we should be seeing lower Crude Prices moving forward.

That being said, there are huge speculative interest in WTI Crude as well, hence traders should not simply short blindly, and make sure that market sentiment/momentum is towards the downside (which is not happening now) before shorting to avoid unnecessary heartaches.

More Links:

EUR/USD Technicals – Slight Bullish Correction Seen But Remain Bearish Beneath 1.381

AUD/USD Technicals – Bearish Start Against Broad Bullishness In Asian Market

Gold Technicals – Back Below 1,335 Despite Institutional Speculators Purchases

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.