WTI rallied yesterday to a high of $97.65, continuing the strong up trend that has been in play since 14th where price was at a low of $91.40. This bullishness is not really surprising as prices was already seen broadly supported above 96.25 despite broad bearish sentiment seen in other risk assets. Certainly the better than expected Crude Inventory numbers from the Department of Energy helped push prices higher, but it should be noted that prices has already broken the 96.7 resistance level before the news was announced. Hence, it is not the surprisingly low inventory build up that inspired current bullish sentiment – price is already bullish to begin with, and the higher implied demand simply drove prices up even higher.

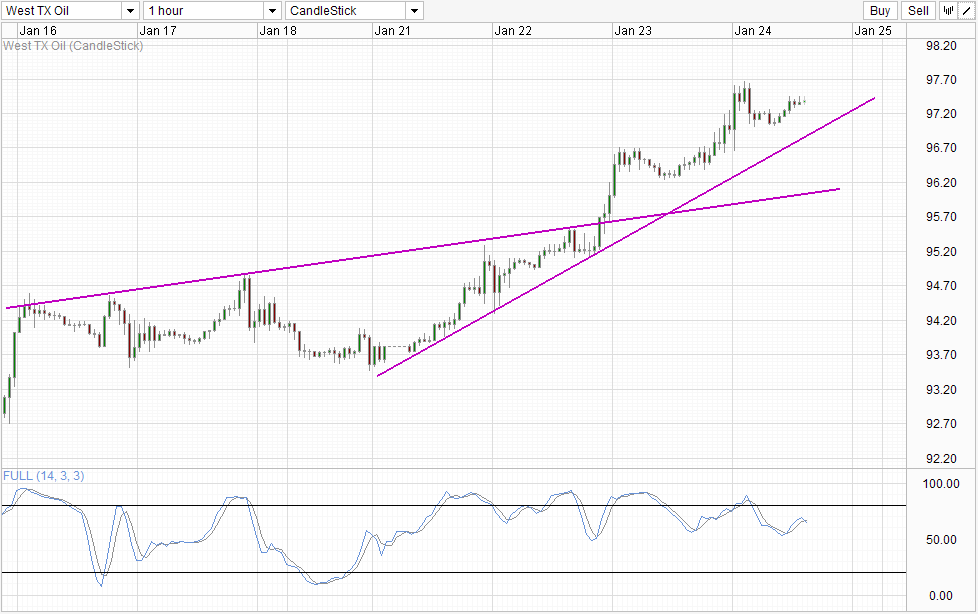

Hourly Chart

However, it’s not an entire bed of roses for bulls. Prices started to pullback towards the end of US session. This is not really surprising as the inventory numbers aren’t the most bullish either. The inventory draw-down has stopped, and inventory stock is building up again. Considering that Oil production is expected to increase in US, the purple patch which saw 7 consecutive weeks of inventory draw-down will most likely be over soon and prices of WTI may start to reverse once more on oversupply.

What is interesting is that the bearish pullback stopped around the pre DOE announcement level, and subsequently rallied once more. This suggest that market has fully digested the info, and current rally does not run the risk of being too optimistic/bullish about the DOE numbers, and represent a much sustainable growth based on current bullish sentiment.

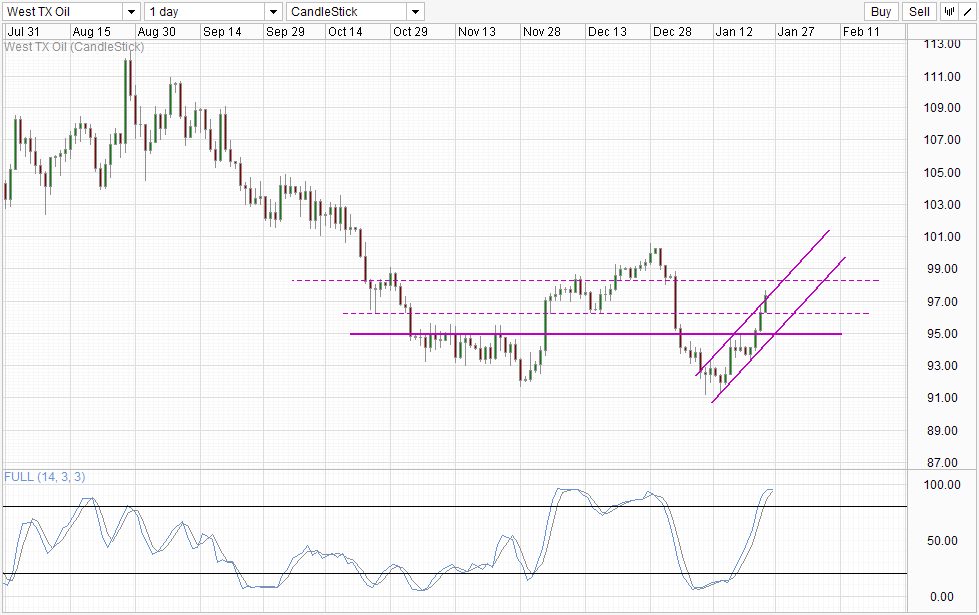

Daily Chart

The ability for further short-term bullish venture is important as price is currently testing the Channel Top seen on the Daily Chart, with Stochastic readings favoring a bearish cycle push towards Channel Bottom or 96.25 support – whichever comes first. Hence, if short-term momentum continue to push higher, we could see a breakout scenario on the Daily Chart, and opens up the possibility of 98.25 as a bullish target. Failure to do so will most likely result in quick bearish reversal in prices as current bullish market sentiment in WTI seems to be against both short-term risk trends and long-term supply/demand.

More Links:

AUD/USD – Drops to New Low Below 0.8750

EUR/USD – Surges Back to Resistance at 1.37

GBP/USD – Surges to New Multi-Year High Above 1.66

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.