Crude Oil enjoyed a strong rally yesterday as risk appetite was broadly positive during US session which saw stocks enjoying one of the strongest day in 2 weeks. However the rally was short-lived, with prices falling quickly back below 103.0 support level. This is not really the fault of WTI, as broad risk trends were retracing much of their earlier gains during New York afternoon as well and it is natural that WTI which were lifted by risk trends previously followed the decline.

That being said, there are still signs of weakness for WTI Crude – yesterday’s rally barely clear the swing high seen on 20th Feb while stocks managed to break away from last week’s ceiling and more importantly managed to keep prices above the previous resistance unlike Crude Oil which is trading below the floor of last Thursday/Friday trade. Also, while stocks ignored the bearish economic numbers that was released during early US session, the same cannot be said about WTI where prices did not have a smooth upward trajectory unlike Stocks. Certainly traders may argue that the reason for the less than straightforward rally in WTI yesterday can be attributed to the fact that 103.0 resistance provided a much more difficult task for price to move higher, but this doesn’t change the bearish label we’re giving WTI as we’re trading below 103.0 once again – and any potential rally moving forward will likely face significant resistance once again.

Hourly Chart

It’s not all doom and gloom for bulls though. Price is currently approaching the rising trendline which is expected to provide support. Even if the trendline is broken we should still be able to see significant support from 102.5 round figure stretching all the way to last Friday’s swing low. Given that Stochastic readings are currently within the Oversold region, the likelihood of prices collapsing from here out is lower and should broad risk appetite start to enter once more we should be able to see WTI prices climbing or at the very least stay flat in the future.

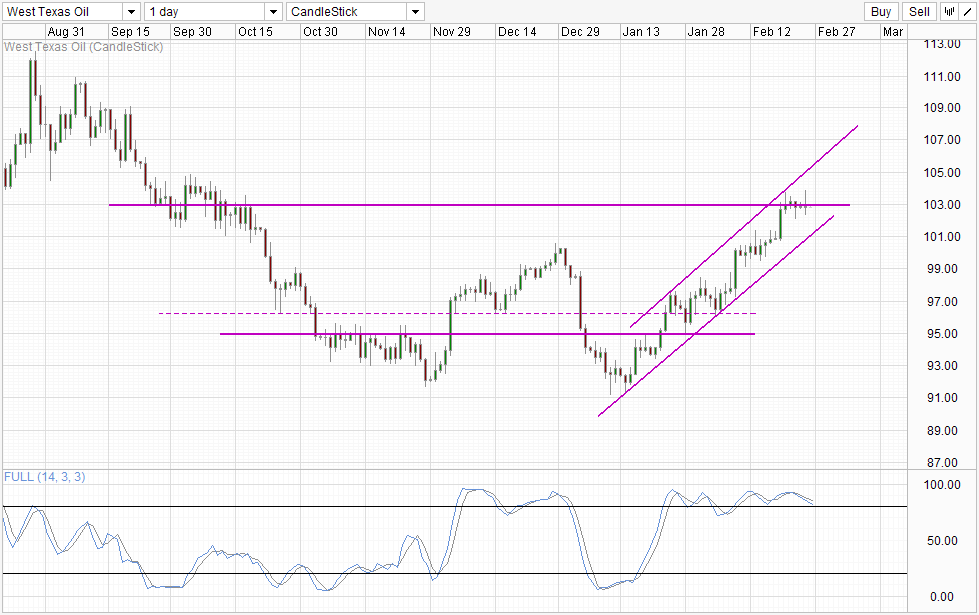

Daily Chart

Daily Chart does not give us any new insight either as we remain close to the 103.0 level. Bullish momentum remains intact even though the likelihood of a price top being in place is possible and perhaps even more likely given that a short-term correction scenario is opened with the rebound off Channel Top seeking Channel Bottom. However, with price sticking close to 103.0 for the past 4 trading days it is hard to draw conclusion on directionality.

Fundamentally, we need to be aware that downside risk for broad risk trend is increasing as well. Till now we’ve not seen any significant pullbacks in Stocks after an extended rally in 2013. Also, analysts have been expecting stock prices to fall in the month of Feb but price has actually gained strongly despite no major positive economic news release in the month of Feb that can justify this rally. As such, it is reasonable to say that market has been too optimistic as a whole, and should risk appetite disintegrate, Crude Oil which is showing relative weakness is likely to suffer even more.

More Links:

GBP/USD – Pound Choppy At Start of Week

USD/CAD – Loonie Starts Off Week with Gains

AUD/USD – Little Movement As Aussie Flirts With 90 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.