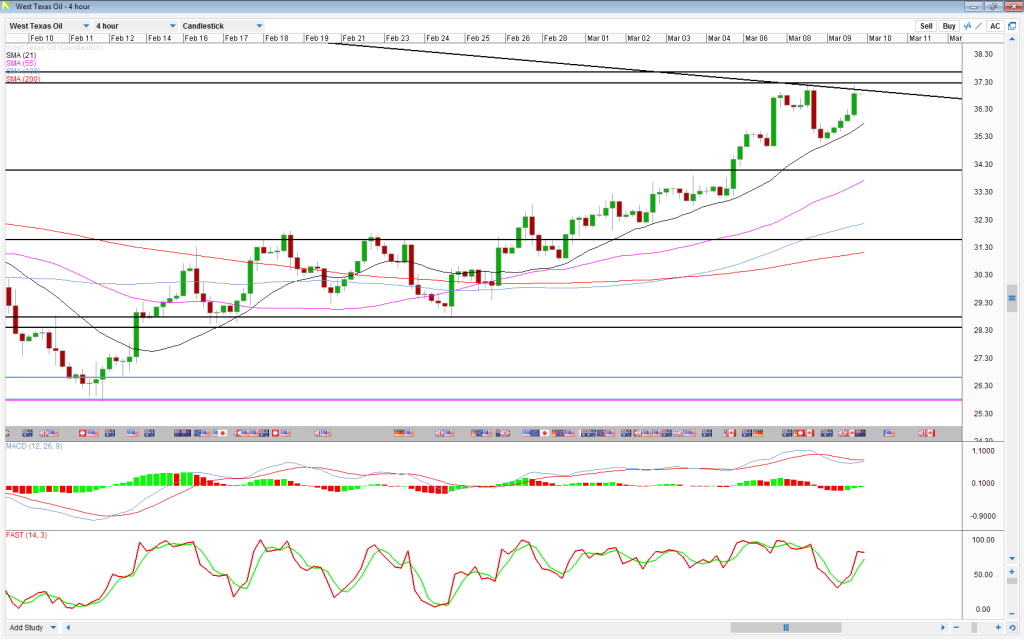

WTI crude is back on the rise on Wednesday following a brief stint in the red the day before which appears to have been primarily driven by profit-taking at a technical resistance level.

WTI had continued its push higher on Tuesday but ran into resistance around $37.25, an area that it has failed to break above in December and January.

It spent the rest of the session in consolidation mode but failed to close below Monday’s opening level or even trade below its lows, which suggested the move had not gathered any real momentum.

That proved to be the case today as it continued its push higher and now it once again faces the test of trying to break above a zone that on three occasions has proven too difficult, between $37.25 and $37.60.

As it stands, it is once again facing strong resistance at this level, which could be a sign that it is topping out. Another failure to break above here could result in a double top forming, with the top at $37.25 and the neckline at $35.10.

Of course, this is only completed once the neckline is broken, but it may suggest that the correction in the bear move is completed and further downward pressure lies ahead.

Alternatively, if we do see a break above this resistance zone, we could see WTI push on, with $39.50 – $40 being the next key resistance zone, having previously provided support. It also marks the 38.2% retracement of the move from 6 May highs to 11 February lows.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.