- Bitcoin has recovered from a sharp selloff earlier in the week, rising from around 89000 to nearly 98500 post CPI.

- ETF flow data shows three consecutive days of net outflows for Bitcoin as correlation with Nasdaq grows.

- Could a Trump Presidency lead to significant capital inflow into Bitcoin in 2025?

- Technically, Bitcoin is at a critical juncture breaking the 50-day moving average and eyeing the 100k handle.

Most Read: Gold (XAU/USD) Price Tug-of-War Continues. Breakout Incoming?

Bitcoin has staged an impressive recovery since Monday afternoon lows around the 89000 mark. Cryptocurrencies were also affected by US jobs data ahead of the weekend and the stronger US Dollar early on Monday was in part responsible for the sharp selloff.

The recovery has been swift however with Bitcoin rising from a Monday low of around 89000 to end the day just shy of the 95000 handle. Yesterday the worlds largest Crypto by market cap edged above the key 95000 handle to trade at a high of 97339 (helped by softer than expected US PPI data) before facing some resistance by the 50-day MA.

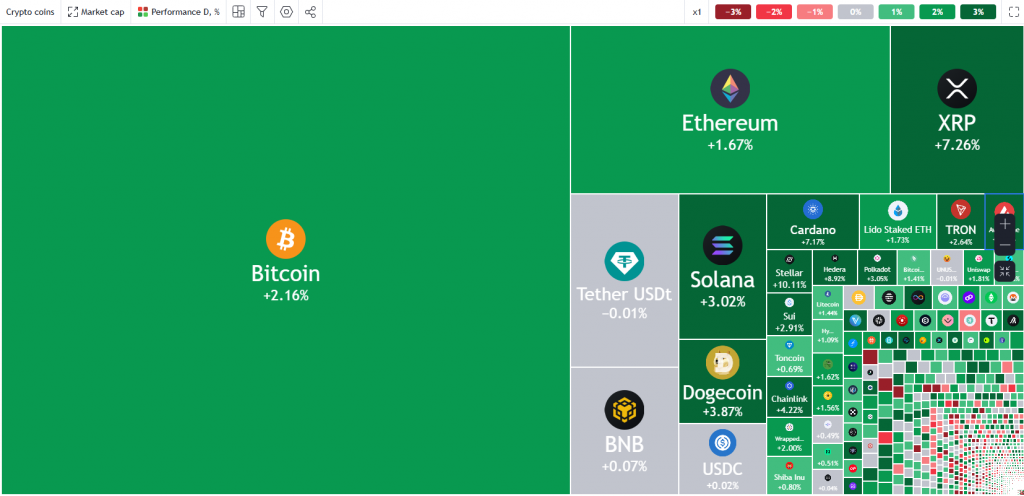

Let us take a look at the performance of the Crypto market for the day.

Crypto Heatmap (post CPI), January 15, 2025

Source: TradingView (click to enlarge)

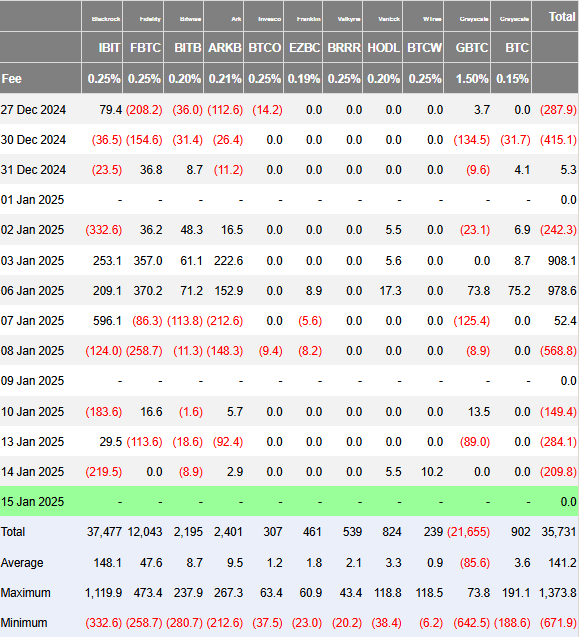

ETF Flow Data Shows 3 Successive Days of Outflows

Looking at ETF flow data courtesy of Farside investors, Bitcoin has recorded three consecutive days of net outflows with the largest being on Monday. Bitcoin started the week recording $284.1m of net outflows and followed that up with outflows totaling $209.8m yesterday.

It will be interesting to gauge whether ETF flows turn positive again ahead of the Trump inauguration next week.

Source: Farside Investors (click to enlarge)

There could be a host of reasons for this but one which has gained traction this week stems from a report showing the increase in correlation between US indices (particularly Nas100) and Bitcoin.

K33 Research Report – Nasdaq vs Bitcoin Correlation

K33 Research’s latest “Ahead of the Curve” report highlights that the crypto market is facing the same challenges affecting global markets. Over the past month, Bitcoin (BTC) and the Nasdaq have become more closely linked, with their current 30-day connection reaching its highest point in 2024.

According to K33’s analyst, Trump is expected to push for policies that grow the economy, extend the 2017 tax cuts, and provide more tax breaks for working-class Americans. These actions could be positive for riskier investments like crypto. The analyst also noted that Trump is likely to introduce crypto-friendly policies, which could benefit the crypto market.

Such data may be contributing to ETF outflows as institutional investors looked at Bitcoin as a sort of portfolio hedge providing diversification. However if the correlation with US stocks continues this could result in allocations for equities and Bitcoin being split rather than having their own allocations.

In an interview with Bloomberg on Tuesday, VanEck’s CEO, Jan van Eck stated that ‘it is disappointing to note the correlation between Bitcoin and Nasdaq over the past 6 months. Mr van Eck went further by saying that many people are looking at Bitcoin for the first time which is not what you want (referring to the growing correlation). If you look at the ten-year correlations, they are almost zero, which is really what diversification should be. We’ll have to see how Bitcoin performs going forward.’

Such comments tend to support the idea that the higher the correlation between the Nasdaq and Bitcoin, the greater the chance that outflows may increase due to portfolio diversification and positioning.

Trump Inauguration to Fuel Crypto Rally?

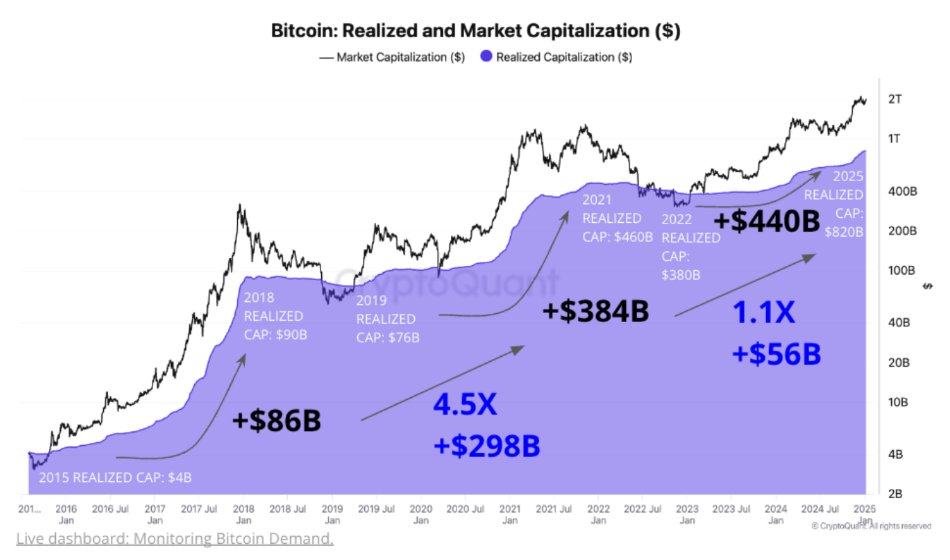

As you can see from the K33 research report above, there is optimism that a Trump Presidency will provide a major boost to the crypto industry.

According to CryptoQuant, About $520 billion of fresh capital could flow into Bitcoin in 2025. In the context of favorable regulatory, monetary and cyclical conditions, it’s reasonable to expect capital to continue flowing into Bitcoin in 2025 the data and analytics provider added.

The idea of a bullish run in 2025 for crypto is further supported by Pantera Capital, who claims that the upcoming inauguration of Donald Trump should propel Bitcoin to new heights.

Another interesting one to keep an eye on as inauguration day draws closer.

Bitcoin realized cap data

Source: CryptoQuant (click to enlarge)

An accompanying chart (above) shows Bitcoin’s realized market cap with the combined value of the supply as it moves on chain since 2015. If the market follows historical patterns, CryptoQuant said, the $520 billion tally becomes attainable. Such a move would no doubt fuel rallies in price but leaves one with many questions.

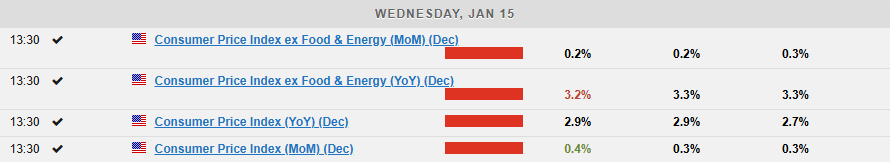

US Data Could Temporarily Drive Bitcoins Price

US inflation data came out a short while ago with the Core inflation print YoY softer than expected. It will be interesting to see if this helps propel Bitcoin toward the 100000 mark and beyond.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis – BTC/USD Rests at Critical Juncture

Bitcoin (BTC/USD) from a technical standpoint on the daily timeframe the overall price action has been messy.

The reason for my observation stems from the lack of a convincing break of the previous swing low around 91800.

Though prices plunged below $90000 handle for a moment on Monday the swiftness with which prices rose suggest strong buying pressure remains in play.

As things stand, BTC/USD is a critical juncture as it tests 50-day MA which could serve to cap gains.

A failure to break back above and find acceptance could lead to a sharper selloff.

A rejection of this level brings the 95000 and 90000 into play, before attention turns to the 91804 and 90000 handle.

Bitcoin (BTC/USD) Daily Chart, January 15, 2025

Source: TradingView.com (click to enlarge)

Support

- 97500

- 95000

- 91804

Resistance

- 100000

- 102261

- 103647

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.