- Bitcoin’s recent price drop is its largest since late 2022, but the current downtrend appears shallower than previous cycles.

- Factors contributing to the dip include Mt. Gox repayments and Bitcoin sales by the German government.

- Solana saw a boost following news of potential spot Solana ETFs to be listed on CBOE.

Most Read: Gold Price Outlook: Can Gold Prices Surpass $2400/oz?

Crypto prices have been in somewhat of a free fall over the past two weeks. After several months of stable prices, Bitcoin has seen its biggest drop since late 2022. It’s now trading below the 200-day moving average, causing many short-term holders to face unrealized losses.

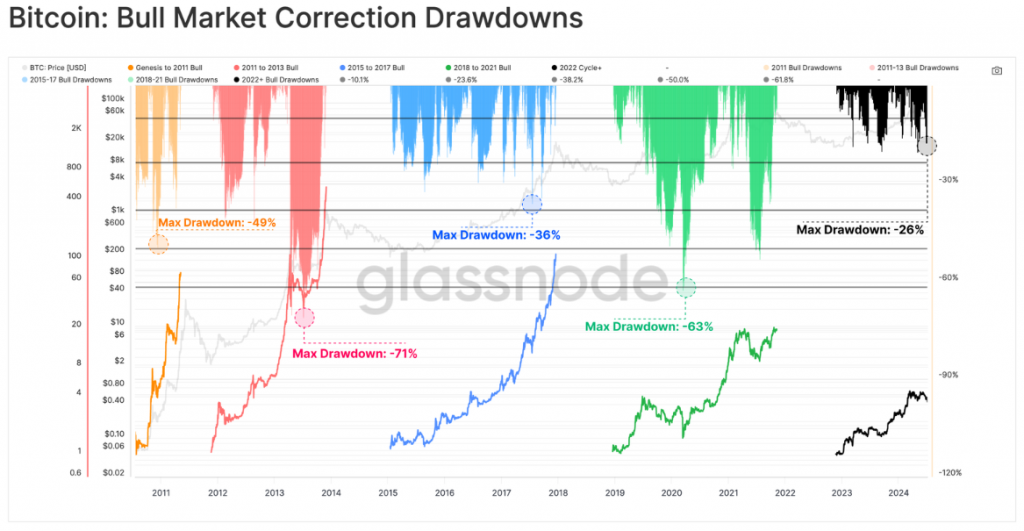

Bitcoin prices tend to move in cycles and the latest cycle has similarities and differences from past cycles. Following the collapse of FTX, the market enjoyed approximately 18 months of steady price gains. However, after reaching the $73k ETF high, it entered three months of range-bound trading. Between May and July, the market saw its deepest correction of this cycle, with a drawdown exceeding -26% from the all-time high.

A decline of 20% usually signals a bear market, with Bitcoin however some perspective is needed as the moves are usually larger than conventional instruments. Looking at the current Bitcoin downtrend and it is much shallower than previous ones which could be a sign that the crypto market thanks to mainstream adoption (Bitcoin ETF) may be normalizing in line with other instruments. This could just be my optimism talking.

Let us take a look at the past cycles and downtrends in Bitcoin prices following significant gains.

Source: Glassnode

German Bitcoin Sales, Mt. Gox Repayments

The recent dip in crypto and bitcoin prices may be traced to repayments by Mt. Gox, the former exchange platform. The repayments have added extra supply to the market coupled with the German Government selling their Bitcoin as well.

According to Arkham, on June 25, 2024, the wallet labeled “German Government (BKA)” sold 900 BTC through three separate transactions. The first transaction of 200 BTC was sent to Coinbase, and the second transaction of 200 BTC went to Kraken. A third transaction, involving 500 BTC, was sent to a previously unknown wallet. Despite these transfers, the wallet still holds 46,359 Bitcoin, worth over $2.8 billion.

The sale of bitcoin by German authorities coupled with the Mt. Gox repayments have no doubt been a contributing factor to the recent drop in bitcoin and crypto prices.

Solana ETF

Solana was another stellar performer yesterday as news filtered through that spot Solana exchange-traded funds (ETFs) are expected to get a final decision by mid-March next year after the Chicago Board Options Exchange (CBOE) applied on Monday to list ETFs from VanEck and 21Shares.

On July 8, CBOE submitted two applications: one for the 21Shares Core Solana ETF and another for the VanEck Solana Trust. The CBOE compared the proposed Solana funds to spot Bitcoin and Ether ETFs, which the SEC approved earlier this year. They stated that Solana’s decentralization, speed, and capacity make it resistant to manipulation that could harm investors.

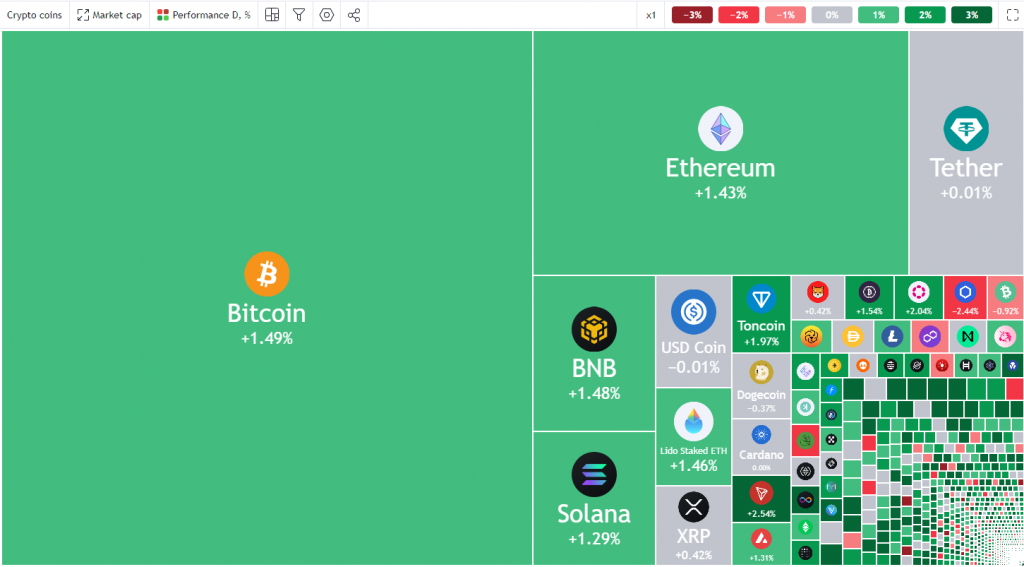

Heatmap of the Crypto Markets for July 9, 2024

Source: TradingView

Technical Analysis BTC/USD

From a technical perspective, Bitcoin is showing some concerning signs. First, the long-term upward trendline has been broken and retested. Second, a death cross pattern is about to form as the 50-day moving average crosses below the 100-day moving average, signaling bearish momentum despite today’s price pullback.

The immediate resistance is the 200-day moving average, just above the current price at 58,823. If Bitcoin breaks above this, it could retest the 60,000 level. Beyond 60,000, the next resistance levels are 61,750 and then around 65,000 where the 50 and 100-day moving averages lie.

If Bitcoin drops lower, the first support area will be the recent lows around 53,500, followed by the psychological level at 50,000.

Support

- 53500

- 50000 (psychological level)

- 45000

Resistance

- 58823

- 60000 (psychological level)

- 61750

- 65000

Bitcoin (BTC/USD) Daily Chart, July 9, 2024

Source: TradingView.com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.