- BoJ has subtly removed the 1% “hard-capped” upper limit of the 10-year JGB yield which suggests an imminent end to YCC may come sooner than expected.

- Upbeat revised inflation forecasts for FY 2023 to FY 2025 gave a boost to the Japanese stock market where the Nikkei 225 has managed to stage a rebound from its key 200-day MA acting as a support at 30,490,

- The JPY has ignored the indirect mild hawkish guidance from BoJ, and the JPY is the weakest major currency (-1.10% intraday) so far against the US dollar.

- The current 2-year/10-year yield premium spreads between US Treasuries and JGBs have narrowed which does not support the current bullish tone seen in the USD/JPY.

- Watch the 150.90 key medium-term resistance on USD/JPY.

The Bank of Japan (BoJ) has kept its key policy short-term interest rates unchanged at -0.1%, the sole major central bank that still maintains negative interest rates while the rest of the developed world has already exited from accommodative monetary policies except for China.

10-year JGB yield is no longer hard-capped at 1%

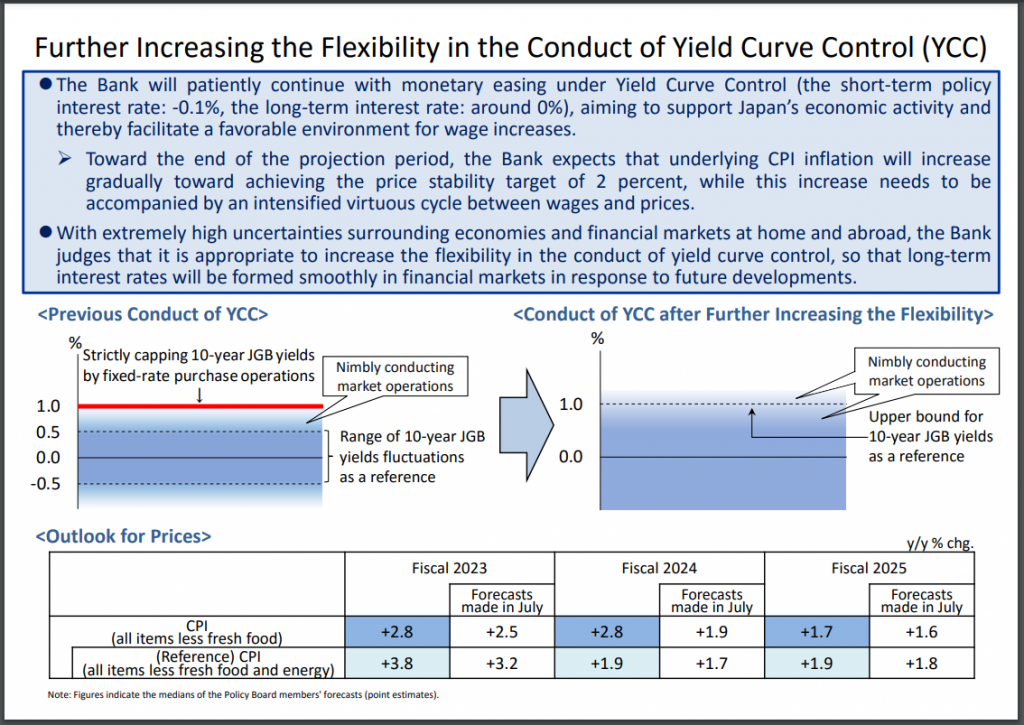

Interestingly, BoJ has now introduced another “innovative” way of communicating its forward guidance on its monetary policy by the removal of its 1% hard-capped upper limit of the yield curve control programme (YCC) on the 10-year Japanese government bond (JGB) yield via a redefinition of the 1% as a “loose upper bound” rather than a rigid ceiling.

Also, it has removed the pledge to guard the 1% level on the 10-year JGB yield which in turn put a stop to its daily unlimited bond buying operation.

It seems to be a sneaky move by BOJ, instead of choosing to increase the upper limit of the YCC to a higher “hard” upper limit of 1.5%, it chooses to now use the 1% upper limit as a reference with the “nimbly conducting market operations” balloon box pointing above the 1% reference level (see Figure 1).

Fig 1: New ultra-flexible yield curve control programme on the 10-year JGB yield (Source: Bank of Japan)

It is the third time since last year December that BoJ has adjusted the effective upper limit of the 10-year JGB yield which clearly suggests the ongoing challenges it faces in maintaining the YCC as it owns more than 50% of outstanding JGBs since the start of the YCC programme in September 2016 that led to an increase in microstructure risk of the JGB market.

Hence, it is an indirect way of upping the upper limit without a new higher “hard level” so that BoJ will not be trapped next time or gamed by speculators if they want to exit YCC completely soon without triggering a potentially disorderly scenario that may trigger negative repercussions in the global financial markets.

Upbeat inflationary forecasts boost positive sentiment in the Japanese stock market

In addition, upbeat inflationary (core-core) forecasts were revised upwards for FY2023 (3.8% y/y vs 3.2% y/y in July), FY2024 (1.9% y/y vs 1.7% y/y in July), and FY2025 (1.9% y/y vs 1.8% y/y in July) indicate a slight hawkish forward guidance which suggests that monetary policy adjustment away from short-term negative interest rates remains on track in the first half of next year which in turn negates imported inflation via a stronger JPY that is likely a boost to consumer sentiment.

The Nikkei 225 has reacted positively and managed to bounce off the key 200-day MA acting as a support at 30,490 for the third time in the past week. In the short to medium term, domestic demand-sensitive sectors such as Retail Trade, Banks, and Financials are likely to see potential positive reactions due to a boost to consumer sentiment and a steeper JGB yield curve (see Figure 2).

Fig 2: JGB yield curves as of 31 Oct 2023 (Source: TradingView, click to enlarge chart)

In the short term, JPY’s weakness has continued to be stubbornly persistent where the JPY is the worst performing major currency against the US dollar where it shed -1.10% intraday at this time of the writing.

The USD/JPY has completely erased yesterday’s (30 October) US session loss after it printed an intraday low of 148.80 and rallied to hit a current intraday high of 150.76 during the European session today.

Narrowing of the yield premium of US Treasuries over JGBs do not support current bout of JPY weakness

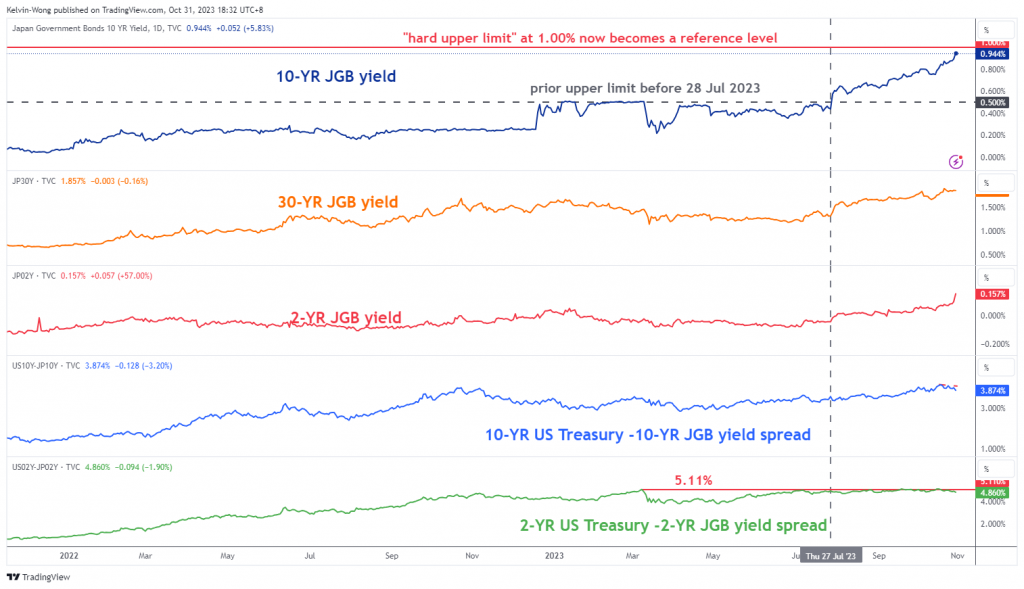

Based on an intermarket perspective, the ongoing swift up move of the USD/JPY may not be sustainable as the 10-year JGB yield is now able to move more “freely” on the upside as the 1% is no longer a hard cap and it rallied to a fresh year-to-date high of 0.96% today, its highest level not seen since May 2013.

In addition, the shorter-term 2-year JGB yield that is more sensitive to the short-term interest rate policy has risen by a steeper pace to close at 0.16% today.

All in all, the 2-year and 10-year yield premium of the US Treasuries over JGBs have continued to narrow this week which in turn does not support the current bullish tone seen in the USD/JPY as it is now approaching the upper limit of the key medium-term resistance zone of 150.30/150.90. (see Figure 3).

Fig 3: JGB yields, yield spreads & USD/JPY medium-term trend as of 31 Oct 2023 (Source: TradingView, click to enlarge chart)

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.