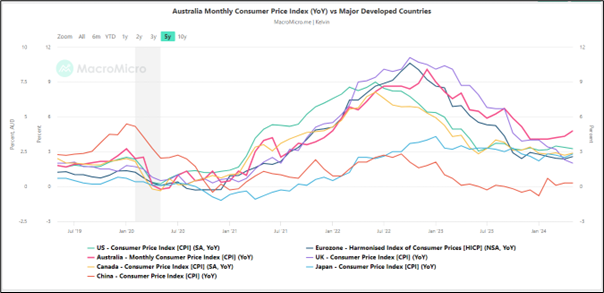

- Australia’s monthly CPI has increased to 4% from 3.6% in April, a sign of a sticky and elevated consumer inflationary trend.

- The odds of an RBA interest rate in the near-term horizon have reduced which increased the yield premium of 2-year Australian government bond over JGB.

- AUD/JPY is likely on a path of bullish acceleration within its medium-term & major uptrend phases.

The Aussie dollar has outperformed the other major currencies (EUR, GBP, CHF, CAD, JPY & NZD) as it recorded an intraday gain of 0.46% against the US dollar at this time of the writing.

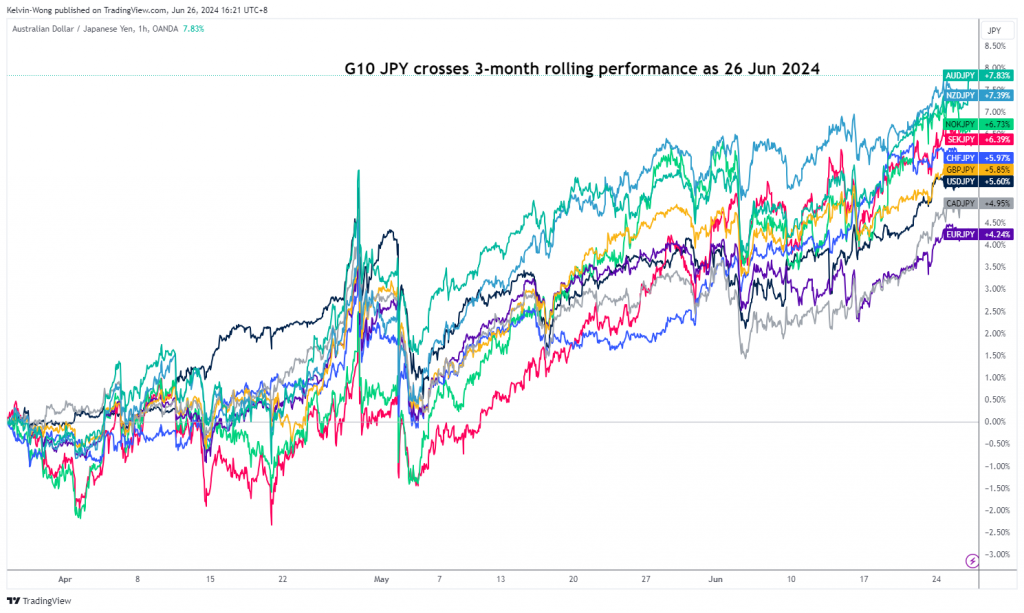

AUD/JPY is the top performer among the G-10 yen crosses

Fig 1: 3-month of rolling performances of G-10 JPY crosses as of 26 Jun 2024 (Source: TradingView, click to enlarge chart)

Notably against the Japanese yen, the AUD/JPY has risen to be the top-performing G-10 JPY cross pair with a gain of 7.8% on a rolling three-month basis (see Fig 1).

The main catalyst for today’s spike in the Aussie dollar strength has been the revival of sticky, and elevated consumer inflation in Australia. The monthly CPI indicator has increased to 4% in May, up from 3.6% in April, and above the consensus expectations of 3.8%.

The latest reading from the monthly CPI has shown that the consumer inflationary trend in Australia has increased to its highest level since November 2023, more or less reinforcing the cautious stance adopted by the Australian central bank, RBA in its last monetary policy meeting in June to stay vigilant to upside risks to inflation.

Divergence of Australia’s inflationary trend against the other major developed countries

Fig 2: Monthly CPI (y/y) of Australia, US, UK, Eurozone, Canada, Japan & China as of May 2024 (Source:MacroMicro, click to enlarge chart)

Hence, the odds have been significantly reduced for an impending RBA interest rate cut in 2024 as the monthly CPI indicator has supported a reacceleration of consumer inflationary trend in Australia and also a significant divergence against the inflationary trends of other key major developed economies (US, UK, EU, Canda, Japan & China) (see Fig 2).

Bullish acceleration in AUD/JPY

Fig 3: AUD/JPY major & medium-term trends as of 26 Jun 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the bullish breakout above its former four-week range configuration from 29 April 2024 has reinforced a bullish acceleration movement within its medium-term and major uptrend phases of the AUD/JPY (see Fig 3).

Intermarket analysis via the latest movements from the yield spread between the 2-year Australian government bond and the Japanese government bond (JGB) has reinforced the potential impulsive upmove sequence of the AUD/JPY as the 2-yield spread has just staged a medium-term bullish breakout which suggests an increasingly positive yield premium in the 2-year Australian government bond over the 2-year JGB.

Key medium-term pivotal support on the AUD/JPY is at 105.00/104.50 with the next medium-term resistances coming in at 107.70/109.10 and 111.85 (also the upper boundary of its long-term secular ascending channel from the March 2020 low) from a multi-week horizon.

On the other hand, failure to hold at 104.50 negates the bullish tone to kickstart a deeper corrective decline sequence to expose the next medium-term support at 100.80, and below it sees 98.50 next (key long-term pivotal support that also confluences with the 200-day moving average).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.