- The higher beta risk-sensitive AUD has started to see a turnaround to the upside against the US dollar in the past two sessions.

- Reinforced by risk-on behaviour in global stock markets coupled with today’s China Premier Li Qiang’s verbal intervention that advocated more “forceful” measures to negate the rout in the China equities.

- AUD/USD’s minor bullish reversal unfolding with next intermediate resistances at 0.6640 and 0.6735.

This is a follow-up analysis of our prior report, “EUR/AUD Technical: AUD’s underperformance remains sticky” published on 17 January 2024. Click here for a recap.

Since last Thursday, 18 January the recent US dollar strength has started to dissipate which has come in line with a risk-on behaviour in global stock markets except for China and Hong Kong equities that are still mired in structural long-term bearish configurations.

The US S&P 500 rallied to a fresh all-time high last Friday, 19 January after similar bullish feats were seen earlier on the Dow Jones Industrial Average and Nasdaq 100. This positive reflexive animal spirits feedback loop in equities has spilled over to the foreign exchange market where the higher beta (risk-on/risk-off) sensitive currencies such as the Aussie (AUD) has managed to catch a bid and stalled its previous multi-week sell-off against the US dollar.

Recent AUD weakness has stalled supported by China’s plan to stabilize the stock market rout

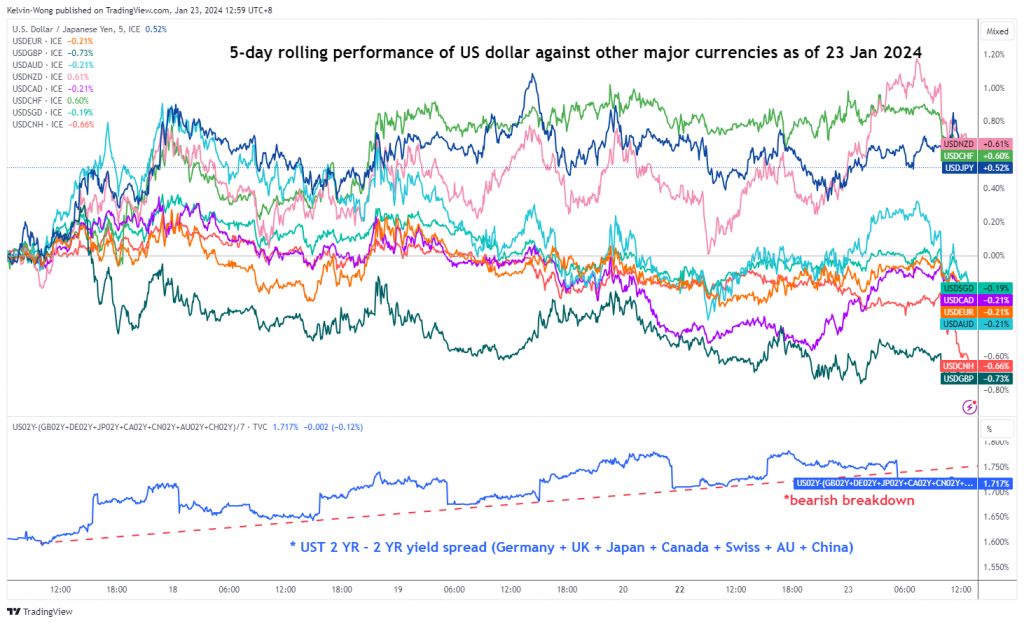

Fig 1: 5-day rolling performances of the US dollar against other currencies as of 23 Jan 2024 (Source: TradingView, click to enlarge chart)

Based on a 5-day rolling performance, the US dollar has now recorded a loss of -0.2% against the AUD, the third strongest performing currency after CNH (offshore yuan), and GBP against the US dollar at this time of the writing.

Today’s Asian session’s outperformance of the AUD is primarily driven by potential further indirect stimulus measures from Australia’s key trading partner, China.

After another horrendous start to the week in China and Hong Kong stock markets, the CSI 300, Hang Seng Index, and Hang Seng China Enterprises Index declined by -1.5% to -2.4% toward multi-year lows.

China’s Premier Li Qiang has issued a “verbal intervention” today to ask Chinese authorities to embark on more forceful measures to stabilize the major bearish trend phases of China’s benchmark stock indices. Thereafter, several media outlets reported that Chinese policymakers are attempting to mobilize about 2 trillion yuan from offshore accounts of Chinese state-owned companies, as part of a stabilization fund to buy onshore China equities via the Hong Kong exchange link.

AUD/USD traded back above the key 200-day moving average

Fig 2: AUD/USD medium-term trend as of 23 Jan 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the multi-week decline of the AUD/USD from its 28 December 2023 high of 0.6871 to the recent 18 January 2023 low of 0.6526 may have formed a minor inflection point at the 0.6520 medium-term support.

In addition, it has reintegrated back above the 200-day moving average with the daily RSI momentum indicator that flashed a bullish condition near its 30-level oversold region.

Watch the 0.6570 key short-term support

Fig 3: AUD/USD minor short-term trend as of 23 Jan 2024 (Source: TradingView, click to enlarge chart)

The minor pull-back from yesterday, 22 January Asia session high of 0.6614 managed to stall at 0.6570 which also confluences with the 50% Fibonacci retracement of the minor rally from last Wednesday, 17 January low to 22 January high.

The near-term resistance will be at 0.6640 (also the 50-day moving average & the minor descending trendline from the 28 December 2023 high), and clearance above it sees the next intermediate coming in at 0.6735.

On the flip side, failure to hold at 0.6570 negates the bullish tone to expose the 0.6520 medium-term support.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.