- RBA surprised the market with a 25 basis points hike to bring the policy cash rate to 3.85%

- Emphasis on inflation targeting over concerns about the heightened risk of slower growth

- AUD/USD breached above the 50-day moving average, resurgence of short-term upside momentum.

The Reserve Bank of Australia (RBA) has surprised market participants’ view of a second consecutive pause of its key policy cash rate with a hike of 25 basis points to bring it to 3.85%.

Concerns about sticky inflation and entrenched high inflationary expectations

The accompanying RBA Governor Philip Lowe’s statement has indicated fears of sticky inflation via services and rising unit labour costs despite both the headline and trimmed mean CPI cooled from a 30-year high in Q1 2023; the current concerns are medium-term inflationary expectations remain well anchored and the risk of having to hike interest rates higher for longer later to reduce the high inflation expectations entrenched in peoples’ minds outweighs the benefits of keeping the cash rate unchanged at 3.6%; as it may cause a larger rise in unemployment.

Secondly, RBA is also concerned that the risk of ongoing high inflationary expectations contributes to larger increases in both prices and wages given that the current limited space capacity in the economy and a close to a 50-year low rate of seasonally adjusted unemployment at 3.5%.

Thirdly, it emphasizes priority remains to return inflation to the target at 3% to 2%; the central forecasts remain that it takes a couple of years before inflation hit the upper limit of the target range; inflation growth is expected to slow down to 4.5% by end of 2023 and 3% in the middle of 2025.

RBA forward guidance has become “wishy-washy”

Going forward, it seems RBA has a wishy-washy stance on its forward guidance, and right now, the emphasis is on inflation targeting rather than addressing the negative knock-on effects from tightening monetary policy lags toward economic growth amid a slowing global economy reinforced by the latest weak China’s manufacturing PMI data despite acknowledgment that the path to achieving a soft landing remains a narrow one.

AUD/USD moved higher ex-post RBA decision

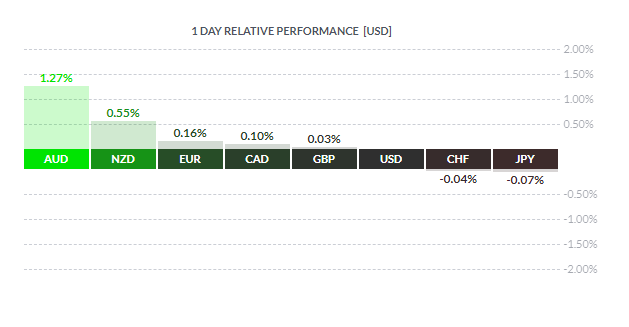

The AUD/USD has squeezed up higher and rallied by 1.27% and 89 pips from its current intraday low of 0.8890: making it the strongest performer against the US dollar among the major currencies at today’s Asian session at this time of the writing.

Fig 1: major currencies intraday performance against USD as of 2 May 2023 (Source: finviz.com , click to enlarge chart)

The AUD/USD has squeezed up higher and rallied by 1.27% and 95 pips from its current intraday low of 0.8890: making it the strongest performer against the US dollar among the major currencies at today’s Asian session at this time of the writing.

It has now breached above the 50-day moving average acting as a resistance at 0.6680 which may trigger a further short-term upside momentum. The next resistance is coming in at around 0.6800 which is the medium-term range top in place since 4 April 2023 while key short-term support lies at 0.6580 (click here to view the technical analysis chart in the previous article).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.