FOMC minutes could tell us how close they are to rate cuts

It’s been a turbulent start to the year, one in which we’ve seen significant shifts in expectations for the economy, interest rates, and the markets.

This past week was evidence of that with inflation exceeding expectations while retail sales dived at the start of the year. That’s not made the Federal Reserve’s job of determining when the correct time to start cutting rates any easier.

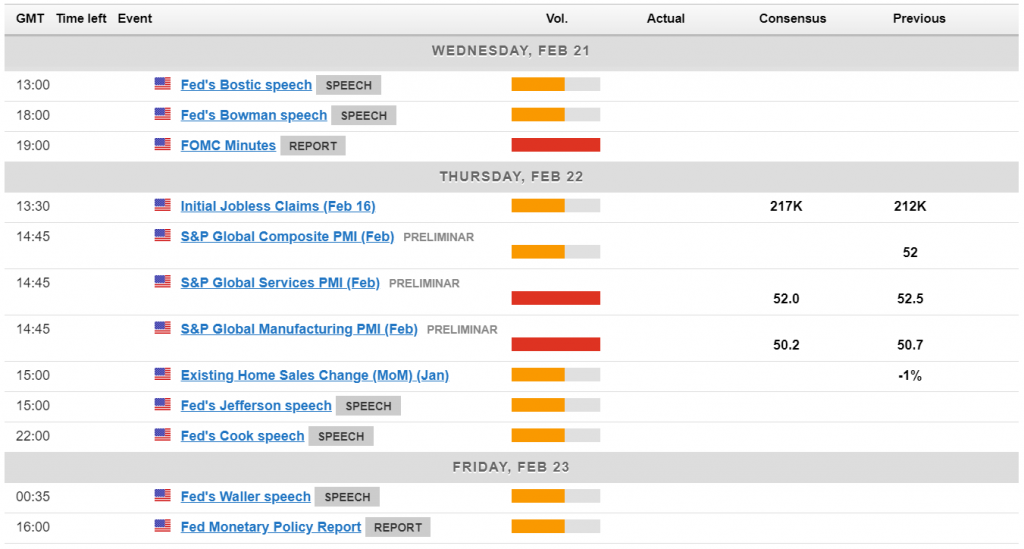

The mixed data since the last meeting though makes the FOMC minutes – released on Wednesday – all the more interesting. March appears unlikely for the first cut but the minutes could tell us how close policymakers think they are.

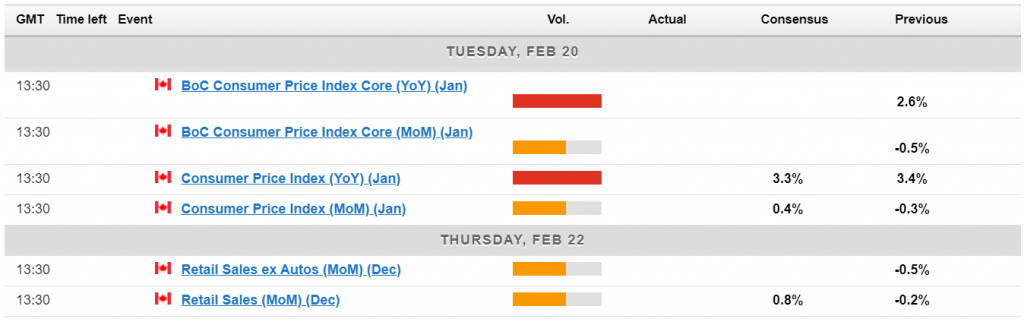

Is inflation set to fall again in Canada?

There’s a lot of economic data being released next week which will be of keen interest to traders, particularly in light of what we’ve seen elsewhere recently.

Easing expectations have been scaled back across the board recently, with the Bank of Canada not expected to start cutting rates until July. Weaker inflation and retail sales reports next week could see that brought forward.

USDCAD Daily

Source – OANDA

USDCAD pulled back towards the end of the week after once again running into resistance in a key Fibonacci retracement zone. It rallied earlier in the week with little momentum – as per the divergence between price and the MACD and stochastic – which may suggest the rally this year has been exhausted.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.