- The prior 6-month weakness of the Swiss franc against G-10 currencies has seen a short-term bullish reversal due to safe haven demand.

- Ongoing political uncertainty arising from the upcoming French legislative elections reinforced the ongoing CHF strength which led to three consecutive weekly losses on the EUR/CHF cross pair.

- A surprise dovish stance from the SNB monetary policy decision out on Thursday, 20 June may put a short-term halt to the ongoing CHF strength.

- EUR/CHF short-term downtrend remains intact ahead of SNB, watch the 0.9610 key short-term resistance.

During the first quarter of 2024, the Swiss franc has tumbled against most of the G-10 currencies, especially against the US dollar where it underperformed the worst with a current year-to-date intraday loss of 7.3% printed on 27 March.

The CHF’s prior underperformance was due to the dovish stance adopted by the Swiss central bank, SNB which was the first mover among the major developed nations’ central banks to end its interest rate hike cycle on 18 March and enacted its first interest rate cut of 25 basis points (bps) in nine years on its policy rate to bring it down to 1.5%.

CHF’s earlier weakness has reversed to the upside

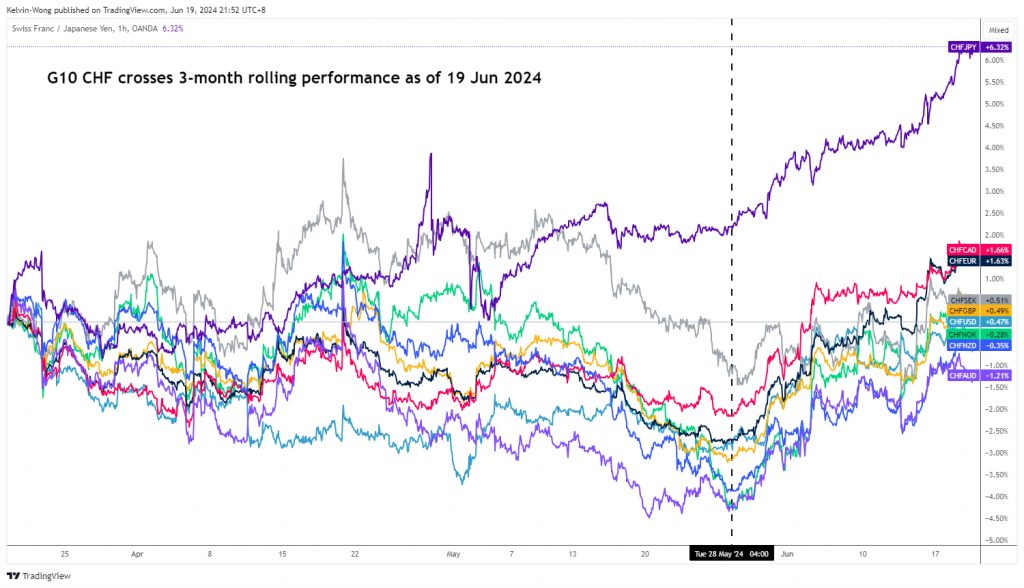

Fig 1: 3-month rolling performances of G-10 CHF crosses as of 19 Jun 2024 (Source: TradingView, click to enlarge chart)

The fortunes of the earlier battered-down Swiss franc started to reverse in late May and further gained strength against the Euro since early June (based on a 3-month rolling basis, the CHF has gained 1.6% against the Euro, see Fig 1) due to political uncertainty in France, a key anchor economy within the European Union where Le Pen’s right-wing party is gaining a significant foothold over French President Macron’s centrist party in the upcoming French legislation election, first round of voting on 30 June.

Increasing credit risk factor in France’s sovereign bonds

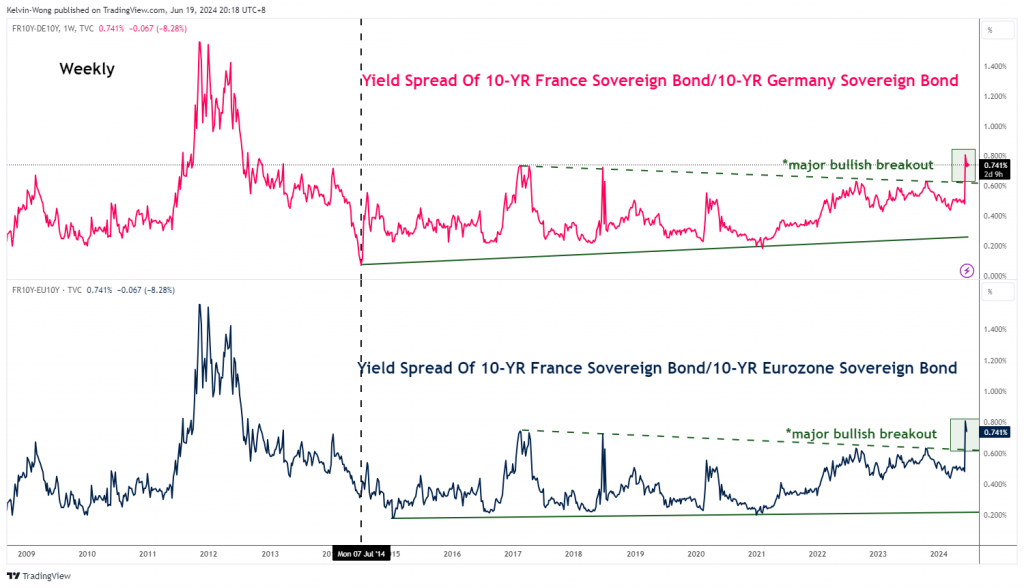

Fig 2: Yield spread of 10-year French & German government bonds as of 19 Jun 2024 (Source: TradingView, click to enlarge chart)

Increasing political clout gained by the French right-wing National Rally political party may hamper the growth prospect of the French economy as it tends to favour looser fiscal policies that may drive up the budget deficit which may eventually lead to higher taxes in the future.

The potential widening of France’s budget deficit through deeper expansionary fiscal policies pushed by the right-wing party may increase the credit risk factor in the market pricing mechanism on France government bonds, which is being reflected in the current movements of yield spread between the 10-year French and German government bonds.

The spread between the French and German 10-year government bond yields had widened to almost a 12-year high of 81 bps last Friday, 14 June. Even though it has eased off a bit since the start of this week, the spread is trading at an elevated level of 0.74% which still suggests political uncertainty in the Eurozone implied by the upcoming outcome of the French legislative election, in turn, drives the current downside pressure seen in the EUR/CHF cross pair (see Fig 2).

So far, the EUR/CHF has recorded three consecutive weekly losses of 4% since the end of May and started this week on a weak note as it printed an 18-week low of 0.9478 at this time of the writing.

A dovish SNB may halt the EUR/CHF bearish trend

On this Thursday, 20 June, the SNB will announce its latest quarterly monetary policy decision outcome. The SNB is well-known “notoriously” to surprise market participants, for example, its most recent unexpected 25 bps interest rate cut in March ahead of ECB, and the most shocking was the abandonment of the EUR/CHF fixed peg in January 2015.

Mixed speeches from SNB officials where they mentioned that they estimated that Switzerland’s real long-term neutral rate is to be anchored around zero. Given that its official policy interest rate is currently at 1.5% and inflation is at 1.4%, Hence, at these current rates, it imply there is still room for a cut.

On the other hand, SNB President Jordan has highlighted that a too-weak domestic currency is most likely the source of higher Swiss inflation. Therefore, such a remark supports the case of not cutting rates at this juncture to prevent imported inflation.

Hence, if the SNB decides to issue dovish guidance tomorrow, 20 June either by another surprise cut or by revising its inflation forecast downward, the Swiss franc may resume its bearish trend which is likely to see a potential floor at least in the short-term to halt the ongoing EUR/CHF weakness.

EUR/CHF short-term downtrend remains intact ahead of SNB

Fig 3: EUR/CHF long-term secular trend as of 19 Jun 2024 (Source: TradingView, click to enlarge chart)

Fig 4: EUR/CHF short-term trend as of 19 Jun 2024 (Source: TradingView, click to enlarge chart)

Since the bearish breakdown from its 50-day moving average at the start of this month, 3 June, the price actions of the long-term secular downtrend phase in place since April 2018 (see weekly chart depicted in Fig 3) have resumed its major bearish impulsive sequence.

Current price actions in the past four weeks have continued to evolve within a minor descending channel in place since its minor swing high of 0.9925 printed on 28 May 2024 which suggests an ongoing minor downtrend phase.

In addition, the hourly RSI oscillator has continued to flash a bearish momentum condition as it continued to print “lower highs” below the 50 level.

If the 0.9610 short-term pivotal resistance (also confluences closely with the 200-day moving average) is not surpassed to the upside, another leg of the impulsive downmove sequence may unfold to expose the next near-term supports at 0.9445 and 0.9390 in the first step (see Fig 4).

On the other hand, a clearance above 0.9610 negates the bearish tone for a potential minor mean reversion countertrend rebound for the next intermediate resistances to come in at 0.9680 and 0.9745/9775 (also the 50-day moving average).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.