- Despite a recent slowdown in Australia’s monthly CPI for December 2023, the Australian central bank, RBA has chosen to remain on the cautious side and push back rate cut expectations.

- RBA’s monetary policy statement has stated that service inflation may remain sticky on the high side, and overall inflation may take some time to reach RBA’s target of 2% to 3%.

- Last week’s AUD weakness against the US dollar has started to taper off intraday, supported by the renewed hawkish vibes from RBA.

- The EUR/AUD cross pair may see further short-term weakness, watch the 1.6475 near-term support (potential downside trigger level).

This is a follow-up analysis of our prior report, “EUR/AUD Technical: AUD’s underperformance remains sticky” dated 17 January. Click here for a recap.

Since our last analysis, the EUR/AUD has rallied as expected in the short term and hit the 1.6655 resistance (printed an intraday high of 1.6675 on 18 January). Thereafter, it traded sideways between 1.6675 and 1.6350 in the past three weeks.

The Australian central bank, RBA has concluded its first monetary policy meeting of 2024 today and maintained its policy cash rate at 4.35% for the third consecutive time as expected.

Despite the recent softness seen in Australia’s inflation data where the monthly CPI indicator has decelerated for the third consecutive month to 3.4% annualized in December 2023 from 4.3% in November and the lowest reading since November 2021, the latest RBA monetary statement is still peppered by hints of hawkish vibes.

Hawkish RBA’s monetary policy statement

The latest statement has indicated an acknowledgment that inflation in Australia is easing but it remains high, and it will take some time yet before it hits RBA’s target range of 2% to 3%. Secondly, service price inflation has declined at a more gradual pace in line with the RBA’s earlier forecasts, and remained high which may be persistent, a similarity with global service price inflation trends. Thirdly, it noted that the economic outlook is uncertain, and the Board remains highly attentive to inflation risk (rather than recessionary risk).

Overall, it applies that the first RBA rate cut may not come in H1 of 2024, and even a chance of a further hike is still on the cards.

Recent AUD weakness has started to taper off

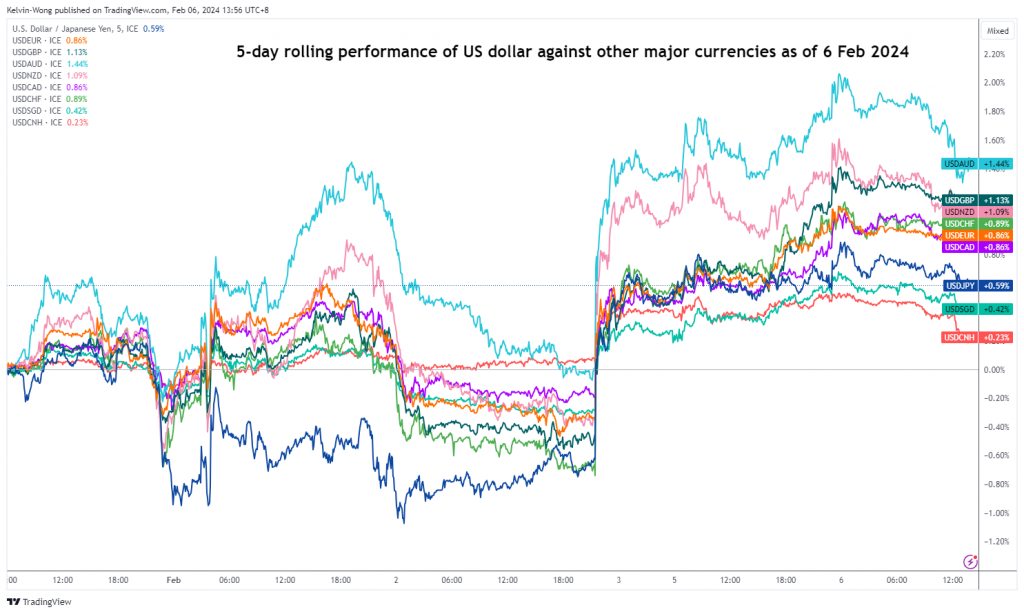

Fig 1: 5-day rolling performances of US dollar against other currencies as of 17 Jan 2024 (Source: TradingView, click to enlarge chart)

The recent significant pace of AUD sell-off that has taken shape after last week’s FOMC and surprisingly strong US non-farm payroll jobs data for January has started to reverse some of its movements; the US dollar is now only showing a gain of +1.4% from a high of +2.05% against the AUD at the start of this week on Monday, 5 February at this time of the writing.

EUR/AUD’s 200-day moving average support looks vulnerable

Fig 2: EUR/AUD medium-term trend as of 6 Feb 2024 (Source: TradingView, click to enlarge chart)

Fig 3: EUR/AUD short-term trend as of 6 Feb 2024 (Source: TradingView, click to enlarge chart)

Today’s intraday rebound seen in the AUD after RBA’s hawkish vibes has put the EUR/AUD on the path of vulnerability for the cross pair to potentially inch lower at least in the short-term horizon.

The short-term up move from the 2 January 2024 low of 1.6129 has stalled at the medium-term descending trendline in place since the 17 August 2023 swing high now acting as a resistance at around 1.6655.

The daily RSI momentum indicator has also threaded lower right below a parallel descending resistance at the 65 level and formed a lower high which suggests medium-term upside momentum is likely to have dissipated (in turn supports lower price actions of EUR/AUD potentially).

Watch the 1.6475 near-term support (also the 200-day moving average), a break below it reinforces a further potential short-term weakness in the EUR/USD to expose the next intermediate supports at 1.6330 and 1.6150.

On the flip side, a clearance above 1.6655 pivotal resistance invalidates the bearish tone for further recovery for the next intermediate resistance to come in at 1.6840 in the first step.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.