- The recent 4-week rally of EUR/CHF from 19 June has started to show signs of exhaustion.

- The ongoing weakness of the France CAC 40 has triggered a negative feedback loop towards EUR/CHF.

- Watch the 0.9780 key short-term resistance on the EUR/CHF.

The EUR/CHF cross pair has managed to recover its initial losses inflicted from 10 June to 19 June that has been triggered by the political uncertainties from the abrupt French legislation snap election announcement made by French President Macron on 9 June.

It has rallied by 295 pips/3.10% from the 19 June low to hit an intraday high of 0.9774 on 15 July on the onset of the 2nd round of the French legislation election on 7 July which resulted in a hung parliament as neither party (far-right, far-left, and Marcon’s centrist alliance) managed to gain a single majority foothold.

Weakness in the French stock market has stalled the rally in EUR/CHF

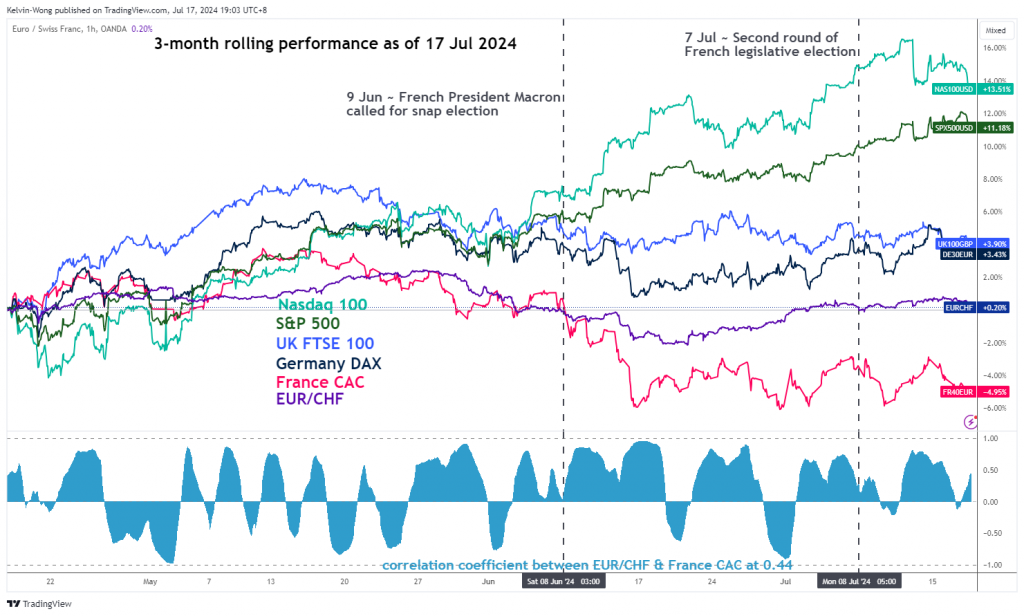

Fig 1: 3-month rolling performance CAC 40, EUR/CHF & other major stock indices (US, Germany, UK) as of 17 July 2024 (Source: TradingView, click to enlarge chart)

Based on a three-month rolling performance time frame, the French benchmark stock index, CAC 40 has continued to languish ex-post 2nd round of the Fench legislation election. It has recorded a loss of -5% at this time of the writing and underperformed against the German DAX (+3.45%), UK FTSE 100 (+3.90%), US S&P 500 (+11.17%), and US Nasdaq 100 (+13.50%) over the same period (see Fig 1).

Interestingly, the current weakness seen in the French CAC 40 seems to have a negative feedback loop cascading effect on the EUR/CHF as its 60-period rolling correlation coefficient has increased significantly to 0.44 from -0.11 seen previously on Tuesday, 16 July.

Bearish momentum condition detected in EUR/CHF

Fig 2: EUR/CHF major trend as of 17 Jul 2024 (Source: TradingView, click to enlarge chart)

Fig 3: EUR/CHF short-term trend as of 17 Jul 2024 (Source: TradingView, click to enlarge chart)

The prior 4-week rally of EUR/CHF from 19 June to 15 July has stalled at a key resistance area of 0.9780 which confluences with the former medium-term ascending channel support from 29 December 2023 low and the 61.8% Fibonacci retracement of the most recent decline from 28 May 2024 high to 19 June 2024 low.

In addition, the weekly MACD trend indicator and its signal line have continued to inch downward after a bearish crossover signal flashed out on the week of 10 June (see Fig 2).

Also, the shorter-term 4-hour RSI momentum indicator has just staged a bearish momentum breakdown below its former ascending support on Tuesday, 16 June after a prior bearish divergence condition seen at its overbought zone.

These observations suggest that short to medium-term bearish momentum conditions have resurfaced on the EUR/CHF.

If the 0.9780 key short-term pivotal resistance is not surpassed to the upside, and a break below 0.9680 near-term support may see further weakness on the EUR/CHF to expose the next intermediate supports at 0.9600 (also the 200-day moving average) and 0.9480 in the first step (see Fig 3).

On the other hand, a clearance above 0.9780 negates the bullish tone for the next intermediate resistances to come in at 0.9840 and 0.9925.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.