- The potential upcoming interest cut on 6 June from the ECB is likely to have been fully priced in by the markets.

- The forward guidance by ECB officials on the timing of subsequent rate cuts is murky and the consensus forecasts for the current Eurozone core inflation deceleration trend may have plateaued in May.

- These factors are likely to support a further potential widening of the premium seen in the Eurozone/Switzerland 2-year sovereign bond yield spread.

- Watch the key medium-term support of 0.9830 on the EUR/CHF

This is a follow-up analysis of our prior report, “EUR/CHF Technical: Bullish exhaustion condition detected after 2-month of rallies” published on 17 April 2024. Click here for a recap.

Since our last analysis, the EUR/CHF cross pair has staged a minor corrective slide and almost hit the support zone of 0.9540/9470 as highlighted. It printed an intraday low of 0.9565 on 19 April, staged a bullish reversal, and rallied by 3.8% (365 pips) in the next four weeks to hit the current 52-week high of 0.9930 seen today at this time of the writing.

After the recent Swiss National Bank (SNB) surprise rate cut by 25 basis points (bps) on its main policy interest rate to bring it down to 1.50%, its first cut in nine years on 21 March, the Swiss franc (CHF) has underperformed against other G-10 currencies except against the Japanese yen (JPY).

The ongoing slow crash of Swiss franc (CHF)

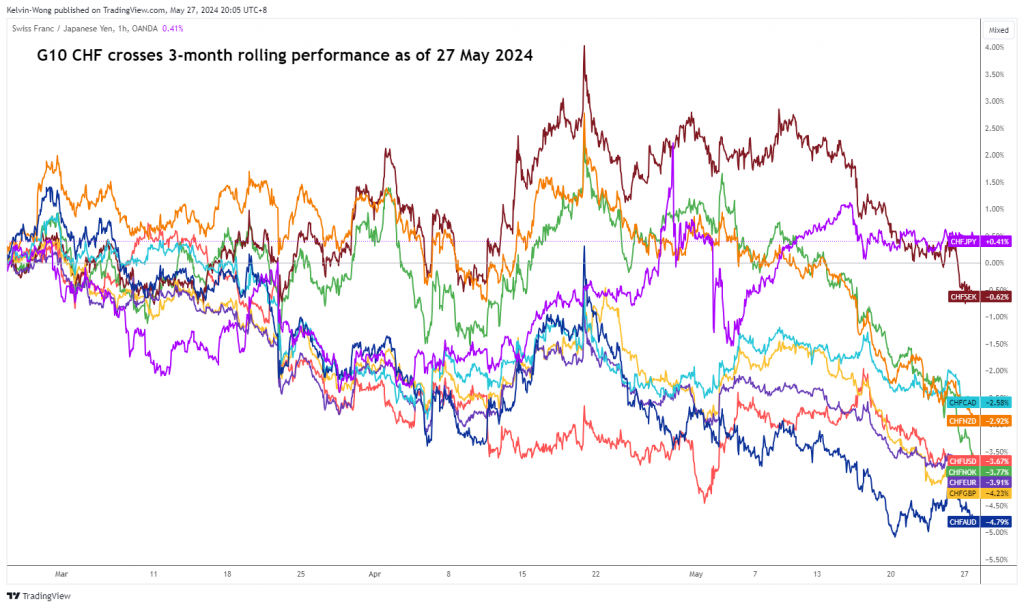

Fig 1: 3-month rolling performance of CHF against G-10 currencies as of 27 May 2024 (Source: TradingView, click to enlarge chart)

Based on rolling 3-month relative performance as of 27 May, the CHF has tumbled by 3.9 % against the EUR; and ranked the third weakest CHF cross pair before CHF/GBP (-4.3%), and CHF/AUD (-4.8%) (see Fig1).

The 2-year Eurozone sovereign bond yield is still trading at a premium over Switzerland

Since the last European Central Bank (ECB) monetary policy meeting in April, ECB officials have guided market participants for a widely anticipated first interest cut of 25 bps in the Eurozone for the upcoming 6 June meeting after being on hold for a fifth consecutive month.

The potential first rate cut from the ECB is likely to have been almost fully priced in since it is well “telegraphed” but the timing for the next subsequent interest rate cuts is murky as officials have given mixed views on the inflationary and economic growth trends in the Eurozone.

Some of the less dovish officials; ECB Chief Economist Philip Lane told the Financial Times in an interview published on Monday, 27 May that the ECB will need to keep policy in “restrictive territory” through 2024 despite it is on track to cut interest rate in June.

In addition, it seems that Lane’s concerns are also being echoed by the private sector economists’ consensus forecast for the preliminary Eurozone core inflation data (excluding food and energy) for May out this Friday, 31 May. The forecast is calling for an unchanged pace at 2.7% y/y and if it turns out as expected, it will be the second consecutive month of a similar pace of increase since April which implies that the deceleration trend of Eurozone inflation has tapered off after eight consecutive months of slowdown in inflationary growth.

Murky forward guidance from ECB officials on the timing of the second interest rate cut coupled with an expectation that the ongoing deceleration trend in the Eurozone’s core inflation growth may plateau in May is likely to have supported the current yield premium seen in the shorter-term 2-year Eurozone sovereign bonds over Switzerland sovereign bonds of the same tenure.

The premium of the 2-year sovereign bond yield spread between the Eurozone and Switzerland has continued to widen since the start of the year and recently it has staged a medium-term bullish breakout on 21 March and traded higher by 18 bps to hit 1.99% at this time of the writing (see Fig 2).

Watch the 0.9830 key medium-term support on the EUR/CHF

Fig 2: EUR/CHF medium-term trend with 2-year sovereign bond yield spread of Eurozone/Switzerland as of 27 May 2024 (Source: TradingView, click to enlarge chart)

Overall, the widening of premium seen in the 2-year sovereign bond yield spread between the Eurozone and Switzerland has supported the ongoing medium-term uptrend phase of the EUR/CHF cross pair in place since the 29 December 2023 low of 0.9254.

If the 0.9830 key medium-term pivotal support holds, the EUR/CHF may see another round of potential impulsive upmove sequence for the next medium-term resistance zone to come in at 1.0040/1.1000 (also confluence closely to the long-term secular descending trendline from April 2018 swing high).

On the flip side, a break below 0.9830 negates the bullish tone to expose the next medium-term supports at 0.9680 and 0.9575 (also the key 200-day moving average).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.