- GBP/USD saw a bounce despite weak UK PMI data, attributed to US Dollar weakness.

- The Bank of England may consider interest rate cuts due to slowing inflation, potentially weakening the Pound Sterling.

- GBP/USD technical analysis shows potential for a bullish bounce, but a break below the trendline could lead to a larger correction.

Most Read: Gold (XAU/USD), Silver (XAG/USD) Print Fresh Highs as the DXY Eyes 105.00

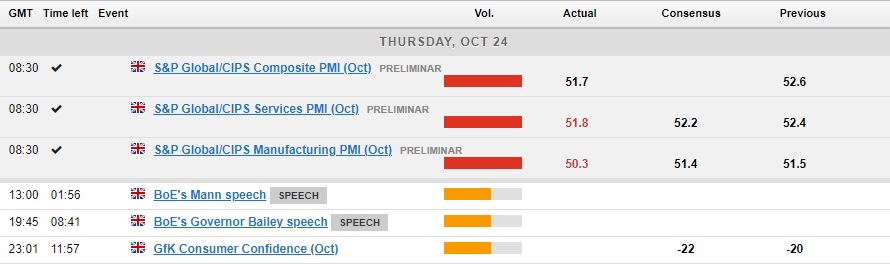

Cable has enjoyed a decent bounce this morning off a key confluence level. Despite weak PMI data, some US Dollar weakness has helped GBP arrest its slide. Preliminary October Composite PMI in the UK edged lower to 51.7 from 52.6 in October. This begs the question, can Pound Sterling extend its recovery?

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

October data pointed to a moderate increase in UK private sector output, but the rate of expansion slowed for the second month running to its lowest since November 2023. Survey respondents widely commented on the impact of delayed decision-making among clients and heightened economic uncertainty in October. Employment was a particularly weak spot, with overall staffing numbers decreasing for the first time in 2024 to date.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “Business activity growth has slumped to its lowest for nearly a year in October as gloomy government rhetoric and uncertainty ahead of the Budget has dampened business confidence and spending. Companies await clarity on government policy, with conflicts in the Middle East and Ukraine, as well as the US elections, adding to the nervousness about the economic outlook.

Encouraging for the Bank of England (BoE) is the fact that further cooling of input cost inflation to the lowest for four years opens the door for the Central Bank to take a more aggressive stance towards lowering interest rates, should the current slowdown become more entrenched.

This obviously means that the Pound Sterling may face further weakness as rate cut bets intensify. However, given that the DXY is at extremely overbought levels and GBP/USD is at extremely oversold levels, there is still a chance that Cable may rise back above the 1.3000 and potentially higher as well. A lot of this would hing on how the US Dollar performs over the coming days and weeks.

There are a host of big events over the coming days which could impact markets and relate directly to the GBP and US Dollar. Chief of those being the US election which draws closer with market participants likely to hedge their bets ahead of the big day. This could mean volatility and some whipsaw price action.

On the other end of the pond we have the UK budget on October 30, which is the first from the UK Labour Government. Big tax increases seem likely because of the rising demands on government funds. More investment is on the way, but will it mean even more borrowing? That’s the big question for markets, and Reeves will need to handle it carefully. There are a host of questions which could spark volatility heading into the event as well.

GBP/USD Technical Analysis

GBP/USD had a brief bounce at the back end of last week that failed to break through the 1.3100 handle before pushing lower. This saw cable break below the 100-day MA and finally test the long-term ascending trendline that has been in play since the April 22 lows.

All of this was discussed in the GBP price action piece last week: GBP Price Action Ideas: GBP/USD, GBP/JPY and EUR/GBP

The test of the ascending trendline just below the 100–day MA and key support level do look promising for a bullish bounce. However, the first hurdle would be a daily candle close back above the 100-day MA and then of course the psychological 1.3000 handle.

This would then set the stage for a retest of the resistance area resting just below the 1.3100 range (denoted by the red block on the chart). Acceptance above this level could open up a deeper retracement toward the 1.3250-60 range.

Alternatively, a break of the trendline would be significant and could open up a longer term correction toward the 1.2750 handle for cable. Such a move would hinge on the idea of a continued rally for the US Dollar and DXY in particular. The 200-day MA currently rests around the 1.2800 and could prove key as well.

Later today we have speeches from both Catherine Mann and Andrew Bailey of the Bank of England (BoE) which could stoke some short-term volatility. Any comments around rate cuts etc, may also have a more material impact. This would obviously hinge on what the comments are and where policymakers see rates heading in the months to come.

GBP/USD Daily Chart, October 24, 2024

Source:TradingView.com

Support

- 1.2940

- 1.2800

- 1.2750

Resistance

- 1.3000

- 1.3100

- 1.3250

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.