Auld Lang Syne to 2023 and welcome 2024! Here is a recap of the key highlights that shocked global markets in 2023 and the potential emerging themes to look out for in 2024 as well as my “Chart Of The Year”.

2023 key highlights & cross-assets performances in the past 2 years

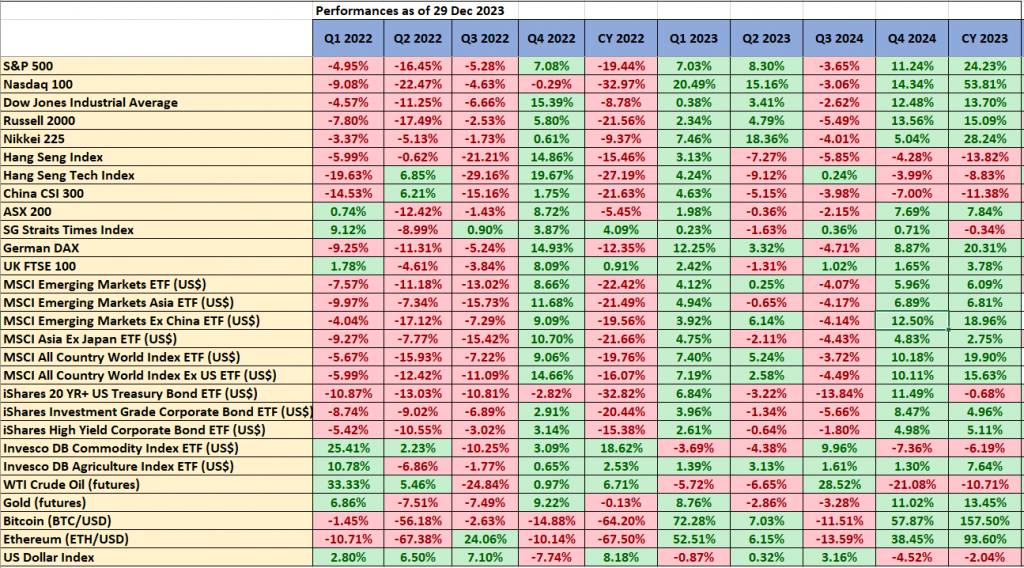

Fig 1: Cross assets performances as of 29 Dec 2023 (Source: TradingView, click to enlarge chart)

- The US Federal Reserve’s stance of keeping interest rates higher for a longer period in the first half of 2023 triggered a resilient US dollar environment in the absence of a recession scenario in the US that led the US stock market to outperform the rest of the world.

- The outperformance of the US stock market in 2023 was led by the Magnificent 7 (Apple, Amazon, Microsoft, Alphabet/Google, Nvidia, Meta, Tesla) mega-cap technology stocks that have stronger balance sheets and are skewed toward “AI productivity” theme play. Also, these 7 stocks have a significant combined market-cap weightage in the Nasdaq 100 that recorded an annual gain of 54% in 2023 (2.3 times S&P 500’s 2023 returns).

- US regional banking crisis that led to the collapse of Silicon Valley Bank & First Republic Bank due to poor balance sheet risk management reinforced by outsized mark-to-market losses on longer-term US Treasuries (higher US Treasury yields via Fed’s tightening monetary policy). It also indirectly led to the demise of Credit Suisse which eventually was brought over by rival UBS.

- The US regional banking crisis was just a blip, negated by a liquidity backstop orchestrated by the US Treasury; the Bank Term Funding Program (BTFP).

- The risk-off behaviour in Q3 reversed abruptly in Q4 to a raging risk-on FOMO behaviour triggered by a significant easing liquidity condition in the US; the rapid drawdown of the Fed’s overnight reverse repo facility from a peak of US$2.55 trillion in December 2022 to US$683.25 billion (-74%) for the week of 11 Dec 2023 as money market funds that choose to invest their surplus cash in short-term US Treasury bills instead (rather than parking in overnight reverse repos facility) which in turn helped to fund the US Treasury general account (also US Treasury’s issuance switch from longer-term Treasuries to T-bills for funding needs).

- A rise in the expectations of a Fed’s dovish pivot where the first Fed funds rate cut is priced in to come as early in March 2024 indicated by the CME FedWatch tool that led to a slide of 120 basis points (bps) in the US 10-year Treasury yield from a 16-year high of 5% printed on 23 October 2023, synchronized with a weakening US dollar that kickstarted a rally in almost all asset classes (equities, bonds, gold, cryptocurrencies) except oil & China-related risk assets.

- China’s post-Covid re-opening bullish theme play on China and Hong Kong stock markets fizzled out after Q1 due to a heightened deflationary risk spiral caused by a persistent weak property market in China. The Hang Seng Index ended 2023 with a fourth consecutive annual loss of -14% (prior years’ losses of -15% in 2022, -14% in 2021 & -3% in 2020); its worst performance streak since 2000.

- Due to China’s structural weakness (deflationary risk spiral), China, and Hong Kong stock markets failed to respond to the cyclical upswing in risk assets during Q4 2023 reinforced by renewed US dollar weakness. The CSI 300 and Hang Seng Index recorded losses of -7% and -4.3% respectively in Q4 whereas the MSCI Emerging Markets Ex China exchange-traded fund gained by +12.5% over the same period, slightly outperformed the US S&P 500’s Q4 return of +11.24%

- The Japanese yen (JPY) plummeted to a 33-year low against the US dollar in Q3 2023 due to the Bank of Japan (BoJ)’s newly appointed Governor Ueda’s reluctance to offer firm guidance to normalize its short-term negative interest rate policy despite Japan’s core inflation rate had exceeded BoJ’s 2% target for the 20th consecutive month.

Emerging themes for 2024

- A potentially weaker US dollar due to the shrinkage of the US Treasury yield spread premium against the rest of the world, and a potential major JPY strength revival triggered by internal economic factors (service prices in Tokyo rose at their fastest pace since 1994 to a record gain of 3% y/y in November 2023, indicating an increase in the odds of sustainable wage-driven inflationary growth), political and business groups’ mounting pressures against a weaker JPY.

- The rest of the world equities may outperform the US stock market due to a weaker US dollar environment. Keep a lookout on China for potentially more “generous” fiscal and monetary policy stimulus measures that may stoke positive animal spirits in the short to medium term for China and Hong Kong stock markets.

- The stepped-up dovish expectations on the upcoming Fed’s interest rate cut cycle compiled with rosy earnings forecasts by analysts polled by FactSet that are projecting an earnings growth of +11.5% y/y for the US S&P 500 in CY 2024, a significant improvement from an expected CY 2023 earnings growth of just 0.6% which in turn have indicated another year of goldilocks scenario for the US economy.

- In contrast, the hastened speed of 6 interest rate cuts by the Fed in 2024 projected by market participants in the interest rates futures market also implied a probable US recession-liked scenario in 2024. In addition, the latest November 2023 data of the Conference Board US Leading Economic Index (LEI) has continued to flash a recession signal reinforced by weakness in the housing and labour market. If a recession hits the US economy in the second half of 2024, earnings downgrades are likely to materialize and the initial projected S&P 500 CY 2024 earnings growth rate of +11.5% is likely to be tapered to the downside which in turn may trigger a risk-off scenario that can overshadow the initial positive feedback loop from easing liquidity conditions.

- Potential heightened geopolitical tension between the US and China that may also spark a risk-off scenario in the latter part of 2024; the recently concluded China’s annual economic work plan conference attended by the top leadership stated that 2024 top priority will be on building a modern industrial system with a focus on developing cutting-edge technologies and artificial intelligence. Making high-tech industrialization a key priority in 2024 is likely to invite more scrutinization from neo-conservative US politicians that may put a strain on the current US-China relationship in the run-up to the November 2024 US presidential election. There is likely to be intense debate among the presidential candidates and finger-pointing again at China’s current industrialization policy that needs to be “neutralized” due to its potential national security threat to the US.

Chart Of The Year – a potential major top in USD/JPY

Fig 2: USD/JPY major trend as of 2 Jan 2024 (Source: TradingView, click to enlarge chart)

- The price actions of USD/JPY have declined by 8% to hit an intraday low of 140.25 in December 2023 after a bearish reaction from its 151.95 long-term pivotal resistance printed in mid-November 2023.

- The USD/JPY has traced out a potential impending major bearish reversal “Double Top” configuration considering the developments of its price actions from October 2022 to November 2023.

- In addition, the weekly MACD trend indicator has flashed out a bearish divergence condition over the same period (October 2022 to November 2023) which indicates the major uptrend phase from the March 2020 low of 101.18 has started to lose upside momentum which in turn increases the odds of a multi-month corrective decline to unfold next.

- A breakdown with a weekly close below 137.65 support exposes the next major support zone of 130.70/127.10 (also the neckline of the “Double Top” & 50% Fibonacci retracement of the prior major uptrend phase from March 2020 low to November 2023 high).

- On the other hand, a clearance above 151.95 invalidates the bearish scenario to see the next major resistance coming in at 159.30 in the first step.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.