- The US Dollar Index (DXY) has rebounded since Friday’s jobs data release, driven by altered rate cut expectations.

- EUR/USD is particularly affected by the DXY recovery, with the Euro’s recent strength potentially waning due to poor German data and shifting rate cut expectations.

- The DXY’s technical analysis suggests further upside potential, with immediate resistance at 102.16 and 102.60.

Most Read: S&P 500, Nasdaq 100 – ‘Soft Landing’ Optimism Leads to Early Week Gains

The US Dollar Index (DXY) has seen a stark turnaround since the jobs data release on Friday. The immediate aftermath left the US Dollar reeling as the DXY looked set to print fresh lows. However, as the data was digested and market participants altered their rate cut expectations, the DXY roared to life and has continued that recovery to start the week.

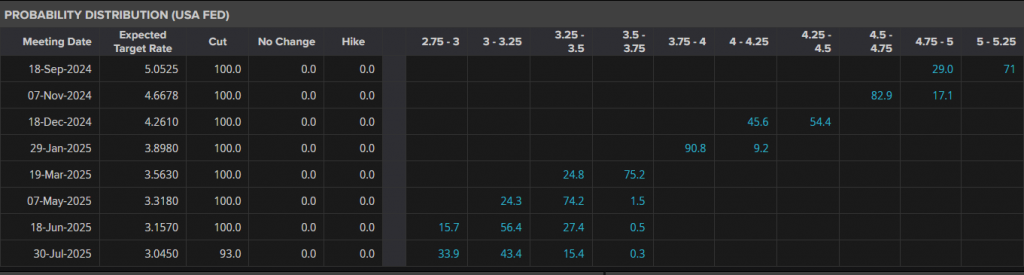

US Federal Reserve Interest Rate Policy Probability

Source: LSEG (click to enlarge)

Looking at FX pairs and the one that grabs my attention the most is EUR/USD which to me appears to be the biggest loser from the DXY recovery, let me explain. The Euro enjoyed a stellar run against the greenback since the last ECB meeting as markets grew more aggressive with regards to the Fed rate cut cycle. However, over the last 10 days or so this narrative has changed somewhat.

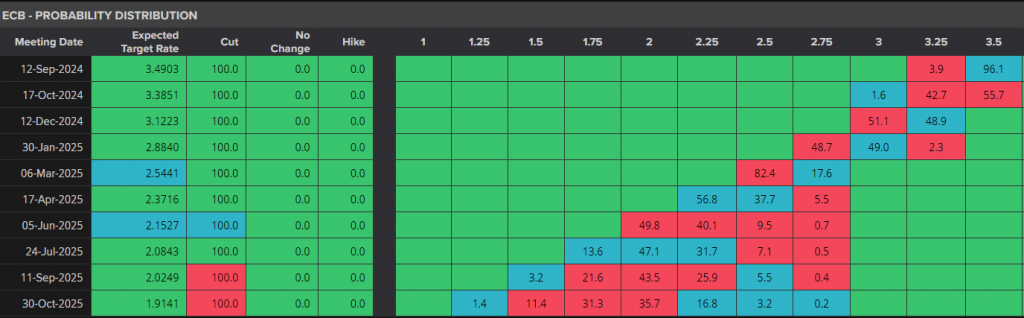

A batch of poor data from Germany (Europe’s most industrialized economy) shows the challenges facing the European Central Bank. The ECB are all set to cut rates by another 25 bps on Thursday just the DXY looks set for a recovery. Markets are now pricing in a 25 bps cut from the Fed and as I see it a lot of that may already be priced in. If indeed that is the case, then the rate cut on September 18 may have a muted impact on the US Dollar and thus leave EUR/USD in a tight spot.

Market analysts have been touting a level around 1.12 for EUR/USD by year end, which remains a possibility. Given that September and October are usually strong months fro the USD and the fact that a lot of the 25 bps cut expected by the Fed may be priced in, this could leave the Euro vulnerable to further losses.

Now of course this could change very quickly as we have seen this year, with each data release shifting expectations a considerable amount. However, this week’s US data which comes in the form of CPI and PPI are no longer driving market participants’ decisions making. Labor data is now driving sentiment and decision making and could mean that this week’s US data may do little to shift the needle in regards to rate cut expectations.

Now looking at a comparison of rate cut expectations for the remainder of the year and there is a hope for the Euro as the year end approaches. Markets are pricing in two more 25 bps cuts from the ECB, but the December meeting is currently 50%. In contrast, the Fed is seen delivering three 25 bps cuts at each remaining meeting this year which could work in the Euros favor.

In the short-term however, I see challenges for the Euro especially if the US Dollar recovery continues to gather pace.

ECB Interest Rate Policy Probability

Source: LSEG (click to enlarge)

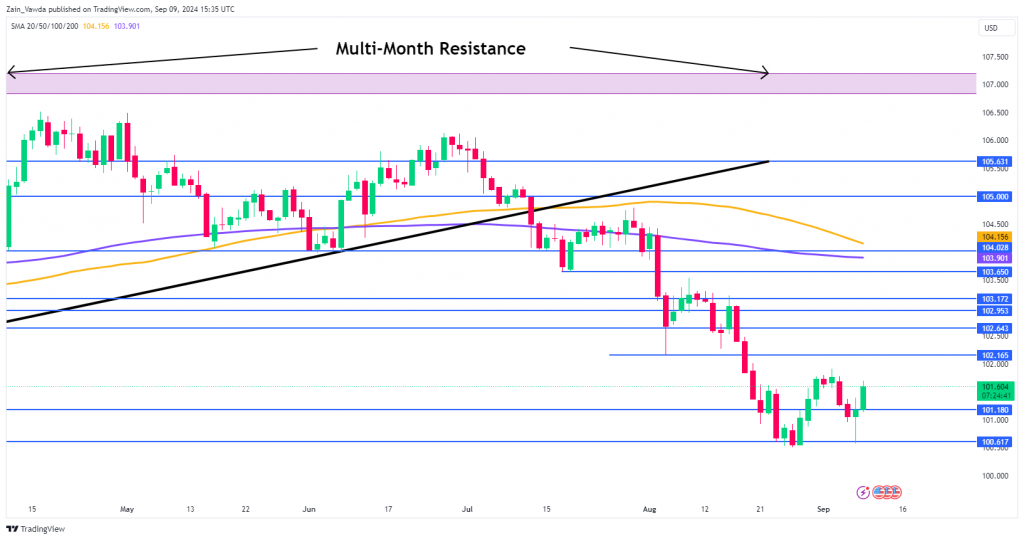

Technical Analysis

The US Dollar Index (DXY) is on course for a morningstar candlestick pattern off a key support level. This coupled with a higher low suggest that further upside may be in the offing in the days ahead.

Immediate resistance ahead is provided by the 102.16 handle before the 102.60 mark becomes a serious consideration.

Conversely, a break back to the downside has to navigate its way past support at 101.18 before the recent lows of 100.50 become a possibility. Beyond that the key psychological 100.00 lies in wait.

US Dollar Index Daily Chat, September 9, 2024

Source:TradingView.com (click to enlarge)

EUR/USD Technical Analysis

From a technical standpoint, EUR/USD has printed a fresh lower high at the back end of last last week. Having topped out just shy of the 1.1200 handle on August 26, the pair has been on a steady trajectory to the downside.

During the middle of last week, bulls made an attempt to take charge once more but Fridays significant selloff and resurgent US Dollar brought pair back below the 1.1100 handle. As things stand, immediate support rests at the psychological 1.1000 level with 1.0948 the next area of interest.

A bullish continuation from here will require bulls to navigate the 1.1100 and 1.1200 resistance areas before any further upside is possible.

EUR/USD Daily Chat, September 9, 2024

Source: TradingView.com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.