- The Japanese Yen has seen significant volatility in recent weeks, influenced by factors like US Dollar recovery and mixed Japanese economic data.

- USD/JPY shows potential for retesting the 150.00 level, with resistance at 146.37 and support around 143.60.

- EUR/JPY mirrors USD/JPY’s movements, with resistance at 163.50 and the potential for a 200-pip rally if it breaches the 200-day MA.

Most Read: Bitcoins (BTC/USD) Steady Range: Mt Gox Impact and Future Outlook

JPY Fundamental Overview

The Japanese Yen has had a wild ride over the past couple of weeks with Yen pairs experiencing whipsaw price action. Things are settling down of late but the potential for further headwinds still exists.

The US Dollar is seeing a small recovery this morning which has helped USD/JPY push away from the psychological 145.00 handle. This comes after yesterday saw significant volatility in the pair following the downwardly revised jobs data and Fed minutes releases.

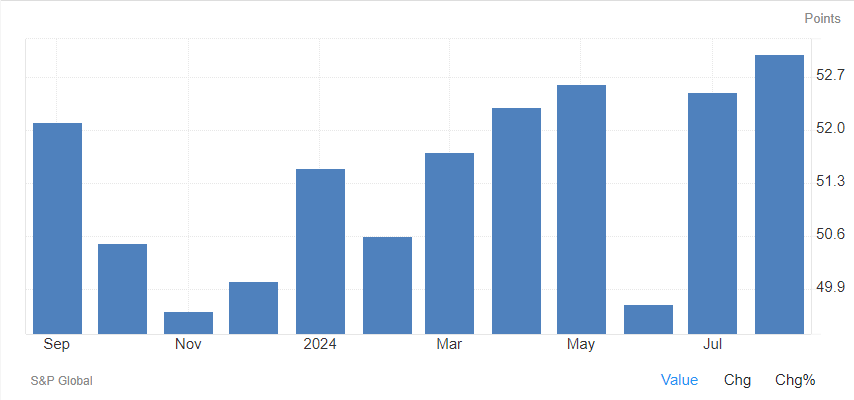

A slew of Japanese data was released in the Asian session with a mixed reception. Composite and Manufacturing PMI inched higher from a month earlier The composite print was the highest print since May 2023.

Japanese Composite PMI Hits Highest Level Since May 2023

Source: Trading Economics (click to enlarge)

The au Jibun Bank Japan Manufacturing PMI increased to 49.5 in August 2024 from a four-month low of 49.1 in the previous month, compared with market forecasts of 49.8, pointing to the second straight month of contraction in factory activity, preliminary estimates showed. It also marked the sixth consecutive month of decline in the manufacturing sector this year due to new orders shrinking further, with foreign sales falling at a stronger rate.

Lastly, business confidence data showed marginal signs of improvement as well.

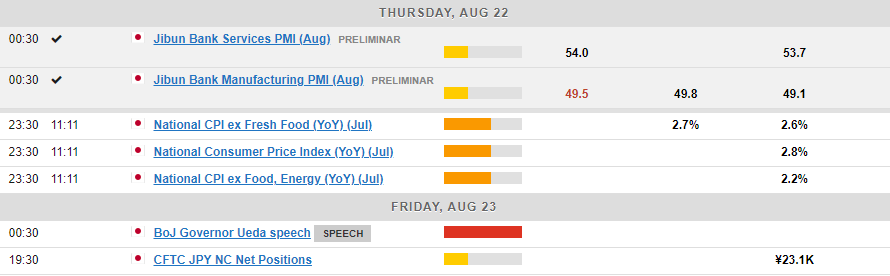

Bank of Japan’s Kazuo Ueda is set to testify before the Japanese parliament on Friday, where legislators will scrutinize the central bank’s July interest rate hike. Additionally, local inflation figures are scheduled for release tomorrow.

The week will wrap up at the Jackson Hole Symposium which brings the spotlight on Central Bank Leaders from both the US and UK. Jerome Powell and Andrew Bailey are both expected to deliver remarks which could stoke volatility and affect USD/JPY and GBP/JPY ahead of the weekend.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Japanese Yen Technical Outlook

USD/JPY

From a technical perspective, USD/JPY’s recent price action saw a green daily candle, ending a 3-day losing streak. Although USD/JPY failed to retest the 150.00 level late last week, there’s potential for another attempt at this psychological threshold.

Today’s daily candle is on track to complete a morning star candlestick pattern off a key support area, theoretically signaling higher prices. However, with upcoming Japan inflation data, the Jackson Hole symposium, and BoJ Governor Ueda’s parliamentary appearance, the risks remain significant.

On the upside, resistance lies at 146.37, tested earlier today. A break above this could shift focus to last week’s highs at 149.38. Conversely, a breach of the 145.00 level may open the path for a retest of the August 5th low at 141.67, though USD/JPY must first navigate support around the 143.60 handle.

USD/JPY Daily Chart – August 22, 2024

Source: TradingView.Com (click to enlarge)

EUR/JPY

EUR/JPY is closely mirroring the USD/JPY chart, a trend that has become more evident in recent months. Yesterday, EUR/JPY formed an inverted hammer, and this morning’s brief push higher encountered resistance near yesterday’s highs.

Immediate resistance is at 163.50, with the 200-day moving average just above at 164.13. A breach of this level could trigger a 200-pip rally towards the 166.21 handle and the 100-day moving average.

On the downside, a move lower from current prices will need to navigate the 162.00 level before bringing the psychological 160.00 handle into focus.

EUR/JPY Daily Chart – August 22, 2024

Source: TradingView.Com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.