- US Dollar Index Plummets on Revised Jobs Data and Dovish Fed Minutes

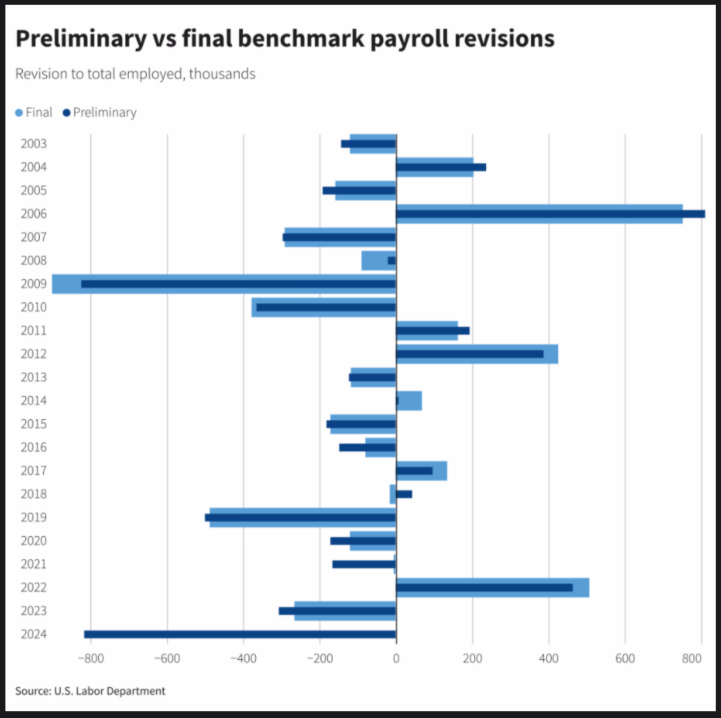

- BLS Revises US Job Growth Downward. Biggest Downward Revision Since the Global Financial Crisis.

- Fed Rate Cuts Priced In? Powell’s Jackson Hole Speech in Focus.

Most Read: Bitcoins (BTC/USD) Steady Range: Mt Gox Impact and Future Outlook

The US Dollar has been treading water and is on course for a four day losing streak. A brief bounce earlier in the day was overshadowed by a steep downward revision in payroll data from the US Bureau of Labour Statistics.

The Bureau of Labor Statistics (BLS) recently revised its data, showing that the U.S. added 818,000 fewer jobs than initially thought for the year ending in March 2024. This suggests the job market was cooling faster than expected, with about 68,000 fewer jobs added each month.

Historical Payroll Revisions

Source: BLS, Refinitiv

In early August, the BLS reported 114,000 new jobs in July 2024, which is lower than the revised 179,000 in June and the forecast of 175,000. This is the steepest downgrade since the Global financial crisis suggesting the job market is a lot softer than originally anticipated. This is not a surprise as there have been some analysts who have been touting this for months but being the minority their views were largely overlooked by market participants.

The only upside is that investors had already expected aggressive rate cuts. With the recent drop in the US Dollar, it seems investors might have already factored in many of the expected cuts.

This was further encapsulated by the minimal reaction to the Fed minutes release. The minutes showed that Fed policymakers agreed that July may be appropriate for a rate cut but opted to wait till September. This no doubt further cements the rate cut narrative heading into the September meeting.

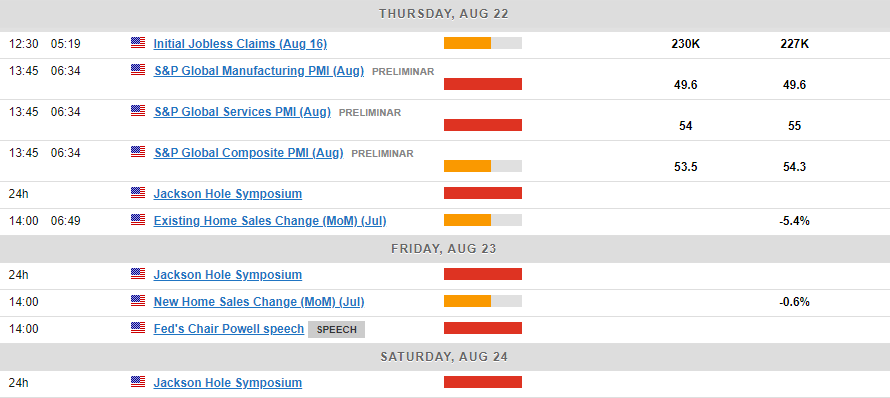

Federal Reserve President Jerome Powell is expected to speak at the Jackson Hole Symposium on Friday. Market participants were expecting volatility and perhaps some clarity regarding September rate cuts. However, today’s data means the Fed has little choice but to start cutting rates in September and begs the question… How much impact will the Powell Speech have on markets given yesterday’s developments?

Later in the day though we also have preliminary S&P PMI data which could give further insight into the US economy. Expect some volatility but barring a significant miss of consensus, i do not expect the data to have a major impact on rate cut expectations.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

US Dollar Index (DXY) Technical Analysis

The US Dollar Index (DXY) is facing heavy selling pressure, but today’s daily candle shows indecision with nearly equal wicks on both sides, hinting at a possible midweek reversal.

The DXY is close to the crucial 100.00 level, which was last breached in July 2023, and breaking this could trigger a faster selloff.

I’m concerned about how much of the FED’s upcoming rate cuts have already been priced in.

On the upside, immediate resistance is at 102.160, the August 5 swing low, before 102.64 becomes significant.

US Dollar Index Daily Chat, August 22, 2024

Source:TradingView.com

Support

- 100.50

- 100.00

- 99.00

Resistance

- 102.16

- 102.64

- 103.00

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.