- USD/CHF is currently at a key confluence zone near 0.9000, facing obstacles for further decline.

- The rate differential between SNB and FED will likely have an impact on USD/CHF moving forward.

- Price action and technicals suggest a potential bullish reaction, with a push towards 0.9100 possible.

Most Read: UK Election 2024: Impact Analysis on GBP and FTSE 100

USD/CHF has returned to a significant confluence zone near the 0.9000 level. This marks the first bearish day in ten sessions and encounters numerous obstacles that must be overcome for the decline to persist

The Swiss Franc has been under pressure since the Swiss National Bank (SNB) opted for a second rate cut in 2024 at the June 20 meeting. The impact of the rate cut in June saw USD/CHF rise from around the 0.8840 mark to recent highs of 0.9950.

Signs of softening data from the US particularly on the inflation front has meant that market participants are keeping the door open for rate cut from the US Federal Reserve in September. This has weighed on the US dollar of late, thus seeing USD/CHF claw its way back to the psychological 0.9000 mark.

Impact of Rate Differential Moving Forward

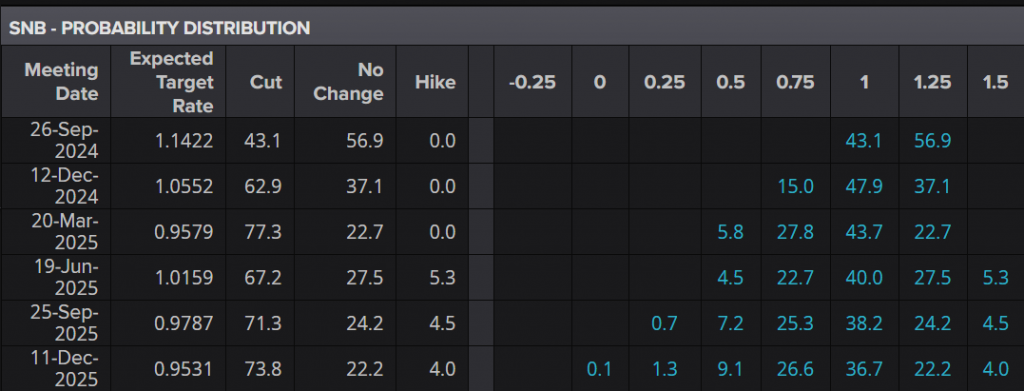

Moving forward, the rate differential between the SNB and the FED will play a significant role in USD/CHF. Markets are currently pricing in around a 43% chance of another rate cut by the SNB in September and a 63% chance of a December cut. If the Fed only cut once this year and the SNB cut again in December,USD/CHF could continue to rise for the majority of Q3 and Q4.

SNB Interest Rate Probabilities

Source: LSEG

US ADP, PMI Data and The Week Ahead

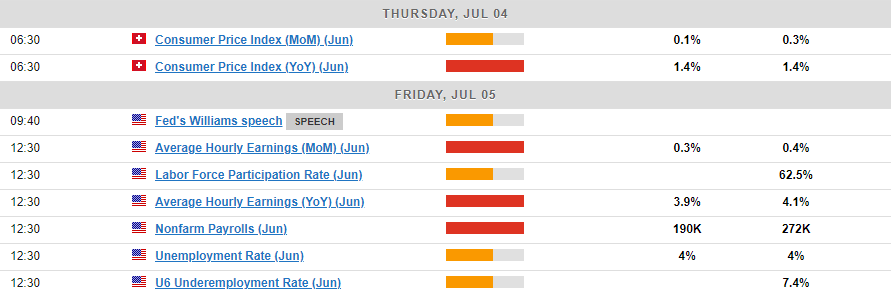

There is still a host of data ahead this week which could have an impact on USD/CHF. First we have Swiss unemployment and CPI inflation data out tomorrow morning which is followed on Friday by the all important US NFP jobs report and unemployment rate.

The data releases on Friday could be key following the S&P Global PMI data released today and the Jolts numbers earlier this week. The services PMI data released earlier in the day revealed that employment returned to growth.

However in keeping with the recent tradition of mixed data signals from the US, the ADP employment report came in below expectations with a print of 150k. According to Nela Richardson, Chief Economist at the ADP “Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month”. The data also revealed that job creation among private employers slowed for the third straight month. As I said , mixed signals once more which continues to keep hopes alive (at least in the minds of market participants) of a September rate cut.

Heading into the rest of the week, the only thing I would caution about is that tomorrow is the Independence day holiday in the US, while the UK election takes place as well. Given the combination of the two, there is a very likely chance that we could see a muted market, particularly in the US session as low liquidity may be the order of the day before a busy Friday.

For all market-moving economic releases and events (GMT-Time), see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

USD/CHF is back trading at a key confluence area at 0.9000. This area presents a host of challenges for bears with an ascending trendline, psychological level and the 100-day MA all rest at this key level.

This will also be the third touch of the ascending trendline which usually hints at another leg to the upside. The wick rejection on the H2 timeframe below, another sign of the buying pressure in play around the 0.9000 level.

Price is already exhibiting a bullish reaction here and could be helped by the data ahead for the rest of the week. A push toward 0.9100 should not be ruled out. Alternatively a daily candle close below the psychological 0.9000 mark may open up a deeper retracement back toward the June 20 lows.

Support

- 0.9000

- 0.8982

- 0.8900

Resistance

- 0.9022

- 0.9040

- 0.9100

USD/CHF H2 Chart, July 3, 2024

Source: TradingView.com (click to enlarge)

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.