- USD/JPY gapped down in today, Asian opening session and shed -0.9% intraday.

- The current intraday weakness in the USD/JPY has moved in line with the thinning of Trump winning odds over Harris in the US presidential election as it slipped to 53.8% on Sunday based on data from betting market (Polymarket).

- Prior to the weekend slide in Trump’s winning odds, several technical factors have turned bearish that indicate a potential pause on US dollar strength against the yen.

- Watch the 151.55 intermediate support (potential downside trigger) on the USD/JPY.

This is a follow-up analysis of our prior report “USD/JPY Technical: 4 weeks of JPY persistent weakness led by political factors” published on 25 October 2024. Click here for a recap.

The USD/JPY has rallied and hit the 153.80 intermediate resistance as it printed an intraday high of 153.88 on 28 October.

The USD/JPY has not made any further headway as it struggled to make a clear breakout above 153.80 reinforced by the Bank of Japan’s (BoJ) steadfast guidance on its recent monetary policy decision on Thursday, 31 October where BoJ Governor Ueda reiterated that the Japanese central bank remained committed in normalising its prior decade plus of ultra-accommodative monetary policy by gradually hiking interest rates if economic data align with its forecasts despite the on-going political uncertainty in Japan after the loss of the incumbent Liberal Democratic Party (LDP) led coalition’s majority seating in the lower house of the parliament.

A slight unwinding of Trump Trade as Trump’s winning odds slipped

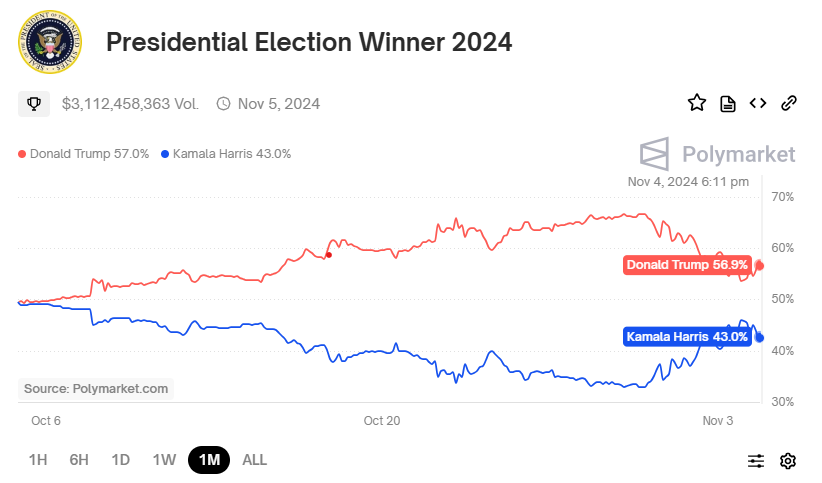

Fig 1: US presidential election candidates’ winning odds as of 4 Nov 2024 (Source: Polymarket, click to enlarge chart)

The global markets in the past four weeks have also been impacted by the potential outcome of 5 November US presidential election.

The “Trump Trade” narrative of a stronger US dollar driven by a higher long-term US Treasury yields that triggered an increase in yield premium spreads against the rest of worlds’ sovereign bonds has moved in direct lock step with the movements on the betting odds of Polymarket, a popular betting market tracked by global macro traders for this upcoming US presidential election.

From18 October to 31 October, the betting odds have indicated a higher chance of Republican presidential nominee Trump winning the White House that hovered comfortably above 60% against Harris and shot up to as to high of 67% on 30 October which also saw the USD/JPY rallied by 2.6% over the same period.

The winning odds of Trump has started to slip to below 60% over the weekend where it declined to a low of 53.8% on Sunday, 3 November before it inched up slightly to 56.9% at this time of the writing (see Fig 1).

Interestingly, the thinning of Trump’s winning chances from the betting market over the weekend has triggered a sell-off in the US dollar at the opening of today, 4 November Asian session where the USD/JPY gapped down and shed -0.91% intraday to print an Asian session low of 151.60 before it recovered slightly to the 152.00 handle at this time of the writing.

Technical factors are supporting a potential medium-term corrective decline in USD/JPY

Fig 2: USD/JPY medium-term & major trend phases as of 4 Nov 2024 (Source: TradingView, click to enlarge chart)

Fig 3: US Treasuries-JGBs yield spreads medium-term trend as of 4 Nov 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the recent price actions of the USD/JPY have suggested a potential medium-term bearish reversal after a rally of 10.2% from its 16 September 2024 low of 139.58.

For the recent week ended 1 November, the USD/JPY has shaped a weekly “Spinning Top” candlestick pattern coupled with a bearish divergence condition seen at the overbought region of its daily RSI momentum indicator (see Fig 2).

Intermarket analysis via the yield spread between the 10-year and 2-year US Treasuries over Japanese Government Bonds (JGBs) have also indicated a potential pause in the recent one-month rally seen in the USD/JPY as the 2-year and 10-year spreads have staged a retreat right below their respective key intermediate resistances at 3.84% and 3.70% respectively (see Fig 3).

Watch the 154.70 medium-term pivotal resistance on the USD/JPY and a breakdown below its intermediate support of 151.55 (also the 20-day and 200-day moving averages) may kickstart a medium-term corrective decline sequence to expose the medium-term supports of 146.90 and 144.80 in the first step.

However, a clearance above 154.70 invalidates the bearish scenario for an extension of the ongoing medium-term uptrend to see the next medium-term resistance coming in at 158.35 (also close to the last BoJ’s intervention level that took place on 11 July).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.