- Today’s Asia session US dollar strength triggered by the first round of the US Presidential Election debate has started to dissipate ahead of US PCE inflation.

- The recent 11 days of rally seen in the USD/JPY has reached an overstretched condition.

- Short-term bullish exhaustion condition detected on the USD/JPY after a test on the 161.10 short-term pivotal resistance.

The earlier pop-up of the US dollar strength against the major G-10 currencies seen during today’s early Asian session, 28 June triggered by Trump’s better debate performance and protectionist vibes-based policies over Biden on the onset of the first live US Presidential Election debate has dissipated at this time of the writing.

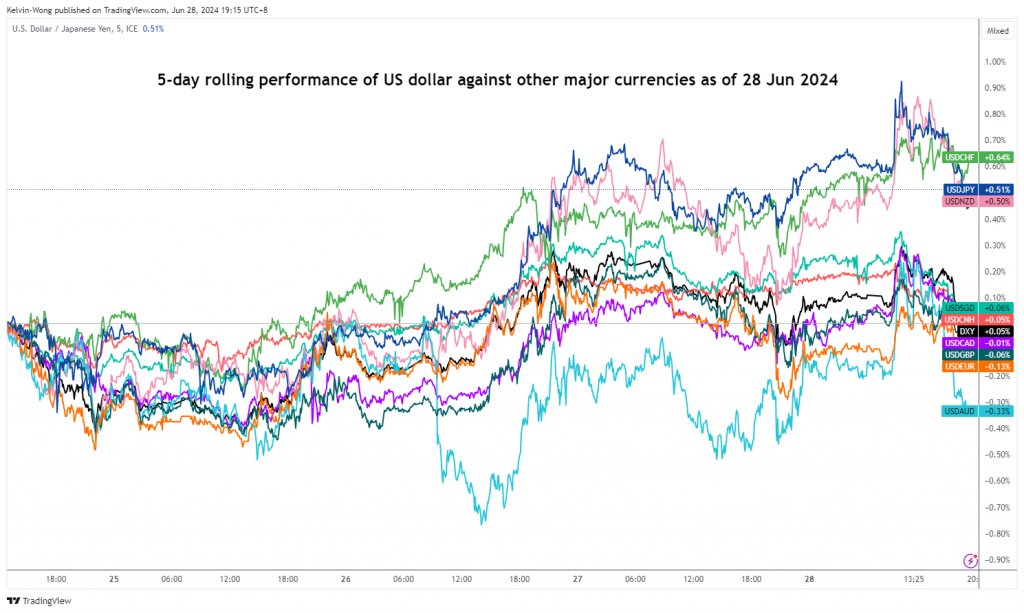

Fig 1: 5-day of rolling performances of US dollar against major currencies as of 28 Jun 2024 (Source: TradingView, click to enlarge chart)

Based on the current 5-day rolling performances of the major currencies against the US dollar, the earlier outperformance of the USD against the Japanese yen has dwindled from an intraday peak of +0.91% printed in today’s Asian session to +0.51% during the European session (see Fig 1).

In the lens of technical analysis, the medium-term uptrend phase of the USD/JPY from 3 May 2024 low of 151.86 has reached an overstretched condition after 11 consecutive days of swift rallies in place since 13 June 2024

Overstretched rally condition detected

Fig 2: USD/JPY medium-term & major trends as of 28 Jun 2024 (Source: TradingView, click to enlarge chart)

The daily Bollinger Bandwidth of the USD/JPY has also risen rapidly from its 2-month low of 1.64 on 14 June 2024 to a current intraday value of 4.41 as of Friday, 28 June which suggests an increase in volatility that increases the odds of an imminent minor pull-back in the price actions of the USD/JPY within its medium-term and major uptrend phases (see Fig 2).

Short-term momentum is flashing bullish exhaustion condition

Fig 3: USD/JPY short-term trend as of 28 Jun 2024 (Source: TradingView, click to enlarge chart)

In the shorter-term time frame on the hourly chart, the 1-hour RSI momentum indicator flashed out a bearish divergence condition after the USD/JPY hit its 161.10 short-term pivotal resistance today.

A break below 159.90 near-term support may trigger a potential minor mean reversion corrective decline to expose the next near-term supports at 159.10 and 158.30/158.00 (also the rising 20-day moving average).

On the flip side, a clearance above 161.10 invalidates the mean reversion decline scenario to see the continuation of the impulsive upmove sequence for the next intermediate resistances to come in at 161.80 and 162.40.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.