- No clear forward guidance and “shadow accommodative vibes” in BoJ’s latest monetary policy led to a continuation of the rally in USD/JPY (JPY sell-off).

- Cautious now for USD/JPY bulls as it is now resting at the 20/151.95 major resistance zone where both verbal and real FX intervention has occurred in the past.

- BoJ Governor Ueda’s press conference later is likely to be critical with near-term key support at 148.70 to watch on the USD/JPY.

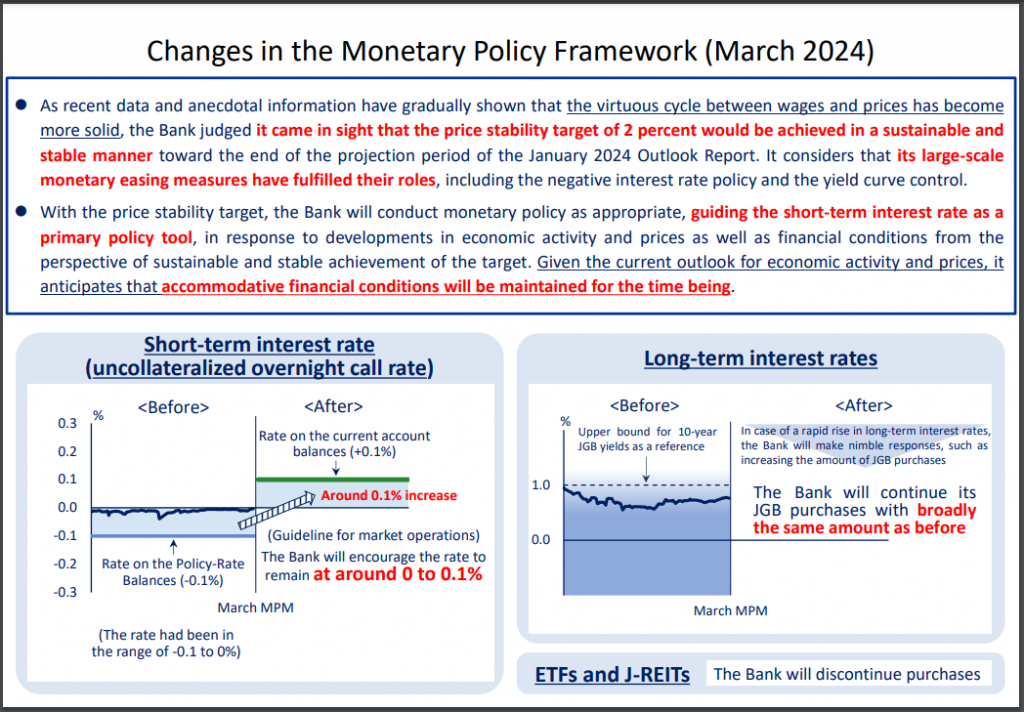

Bank of Japan (BoJ) has not created a “shock” to the market participants as it ended its short-term negative interest rates today; it raised its overnight rate to 0% to 0.1% from -0.1% and scrapped other unorthodox quantitative easing measures such as the “Yield Curve Control” (YCC) programme on the 10-year Japanese Government Bond (JGB), and discontinued its purchases in equity index exchange-traded funds, and J-REITS in today’s BoJ’s monetary policy decision outcome.

These outcomes have been “well-telegraphed” by local Japanese press such as Nikkei Asia, Jiji, and Kyodo in the past week which in turn created a “sell the fact” on the JPY as BoJ’s latest monetary policy statement does not provide any details or clues on the next step of its monetary policy normalization plans in terms of short-term interest rate trajectory.

USD/JPY spiked up ex-post BoJ

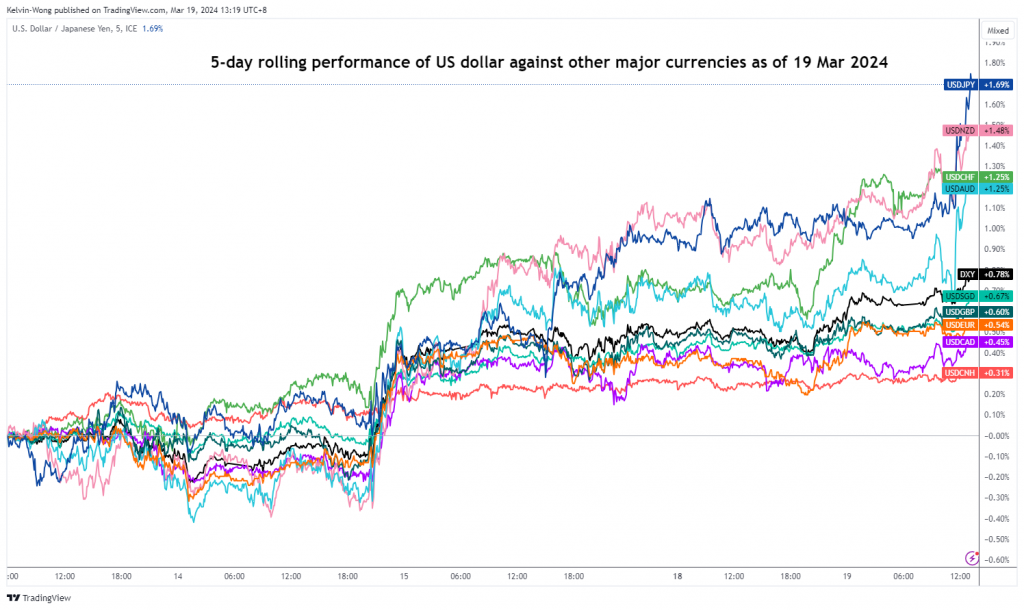

Fig 1: 5-day rolling performance of USD against other major currencies as of 18 Mar 2024 (Source: TradingView, click to enlarge chart)

The USD/JPY has continued its rally in place since 8 March after it recovered from a retest close to the key 200-day moving average that is acting as support at 146.20 (printed an intraday low of 146.48 on 8 March). In today’s Asian session ex-post BoJ, it added an intraday gain of +0.68% to print a current intraday high of 150.20 at this time of the writing and based on a 5-day rolling performance basis, the USD/JPY is the best-performing pair versus other major US dollar crosses with a gain of +1.7% (see Fig 1).

New BoJ’s monetary policy framework

Fig 2: New monetary policy framework as of 19 Mar 2024 (Source: Bank of Japan website, click to enlarge)

The lack of more “forceful hawkish guidance” in its policy statement triggered this bout of sell-off in the JPY. Even though, it has removed its previous pledge of “not hesitate to take additional easing measures if necessary” but maintained its decades-long “accommodative vibes” by stating that it will continue its JGB purchases with broadly the same amount and may increase the amounts if there is a rapid rise in long-term interest rates (see Fig 2).

Hence, it seems to imply there is some form of “residual shadow” quantitative easing initiatives in BoJ’s monetary policy framework despite the official announcement of the removal of YCC that prevented JPY’s strength from emerging at this juncture.

USD/JPY spiked up towards 150.20/151.95 major resistance zone

Fig 3: USD/JPY major & medium-term trends as of 19 Mar 2024 (Source: TradingView, click to enlarge chart)

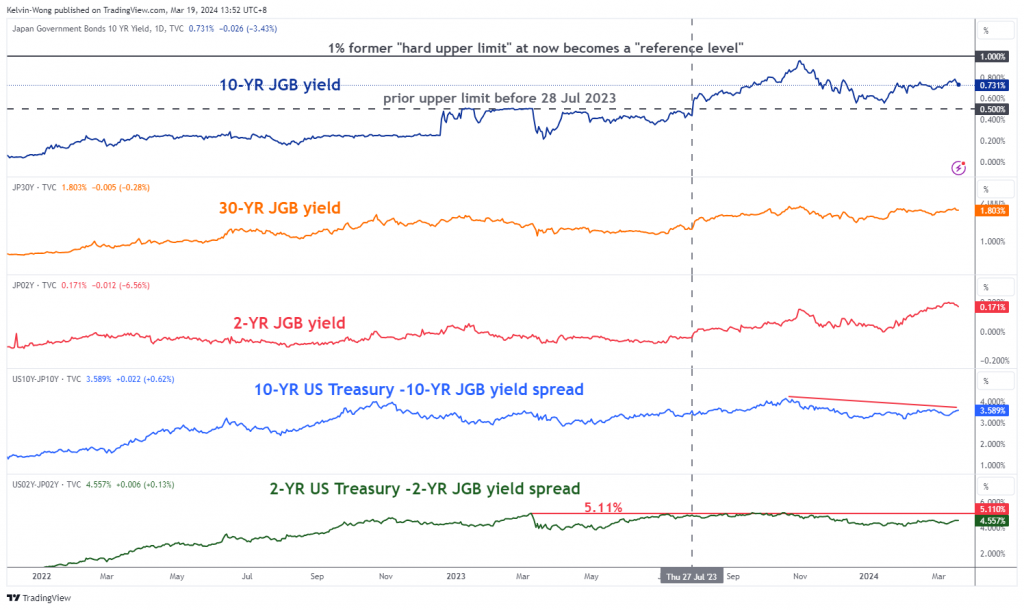

Fig 4: US Treasuries/JGB yield spreads medium-term trends as of 19 Mar 2024 (Source: TradingView, click to enlarge chart)

Market participants have viewed the latest BoJ’s monetary policy outcome as dovish for the JPY where the USD/JPY has rallied towards the 150.20/151.95 major resistance zone at this time of the writing.

A point to note is that this critical zone of 150.20/151.95 has led to a slew of verbal interventions by Ministry of Finance officials in the past 1 year to talk down the strength of the US dollar against the JPY as well as real intervention by BoJ to sell US dollars on 21 October 2022 (see Fig 3).

Given that both the long and short end of the yield spread between US Treasuries and JGBs are still hovering below their key resistance levels; 3.8% (10-year) and 5.11% (2-year), coupled with the USD/JPY that is now hovering at the 150.20/151.95 major resistance zone (see Fig 4), BoJ Governor Ueda press conference will be pivotal later as he will be likely quizzed to offer more concrete guidance of what it means by “nimble responses in the light” of rising long-term interest rates in Japan as well as any hints of further interest rate hikes in 2024.

Watch the key near-term support at 148.70 (also the 50-day moving average) on the USD/JPY.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.