- JPY weakness failed to materialize after Japan’s Q4 GDP came in way below expectations.

- Fear of looming BoJ’s intervention to put a halt to recent JPY weakness after MoF’s vice finance minister Masato Kanda’s warnings yesterday on the recent rapid moves in the FX markets ex-post hotter than expected US CPI data release.

- Short-term upside momentum of US dollar strength against JPY has started to ease.

Flash Q4 2023 GDP data for Japan has indicated that the Japanese economy slipped into a technical recession as it shrank – 0.1% q/q (-0.4% y/y) in the October to December period over a downward revised -08% q/q (-3.3% y/y) for Q3 2023 that shocked market participants as the consensus was in favour of +0.3% q/q (+1.4% y/y) recovery in Q4.

Interestingly, in the past where most of the time a deterioration in key Japanese economic data tended to inflict a significant intraday sell-off in the JPY as market participants inferred that the Bank of Japan (BoJ) was likely to maintain its decades-long of ultra dovish monetary policy and even evoke unconventional quantitative easing to spur demand growth which in turn resulted in a persistent weak JPY.

JPY did not sell off in light of Japan entering into a technical recession

This time around the JPY does the reverse, it has strengthened by +0.30% on an intraday basis against the US dollar at this time of the writing, and the 10-year Japanese Government Bond (JGB) remained steady at 0.72%, a similar level seen three weeks ago.

Two possible drivers can be explained by such abnormality in the current movement of the JPY.

A weak JPY is likely the indirect main driver of weak domestic consumption

Firstly, private domestic consumption which accounts for more than 50% of the Japanese economy has declined for the third successive quarter amid elevated cost pressures (-0.2% q/q in Q4 23 vs. -0.3% q/q in Q3 23), below the consensus estimate of 0%.

The indirect causation is the persistent weak JPY trend seen in the past two years that could not offset elevated external cost-push-driven global inflationary pressures that eroded consumers’ purchasing power and dampened demand.

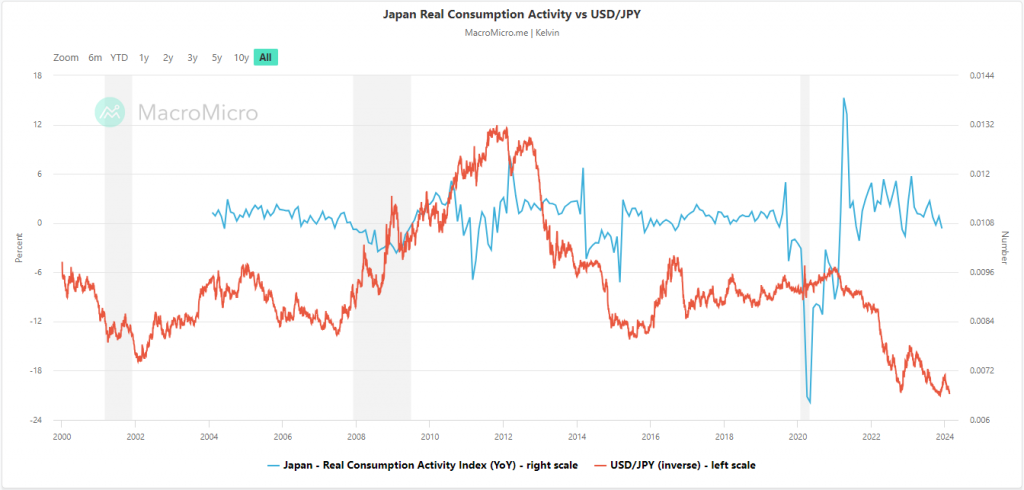

This direct correlation can be depicted in the chart (Fig 1) where the monthly Japan Real Consumption Activity Index peaked at +15.27 y/y in April 2021 and declined to -0.66% y/y most recently in December 2023.

Fig 1: Japan Real Consumption Activity Index vs. USD/JPY (inverse) as of 15 Feb 2024 (Source: MacroMicro , click to enlarge chart)

This trend of real consumption deflation has moved in synch with a weakening JPY by taking the inverse of USD/JPY over the same period.

Hence, a weak JPY is unlikely to be able to spur economic growth at this juncture for Japan which in turn may not yield any marginal benefits for BoJ to keep maintaining its ultra-accommodative monetary policy stance.

Risk of looming FX intervention

Secondly, considering the hotter-than-expected US CPI inflation data that shocked the markets on Tuesday, 13 February, the US dollar spiked up across the board, and it strengthened by almost 1% against the JPY.

It has immediately prompted Japan’s top official in charge of foreign exchange matters, Ministry of Finance vice-minister Masato Kanda to issue a remark that he believed that some of the recent movements in the USD/JPY are speculative in nature and undesirable.

He added that authorities are on call 24 hours a day, 365 days a year, and are always ready to take appropriate steps as needed. Given such “stern” verbal intervention, we cannot rule out that actual intervention may take place soon if USD/JPY continues to march northwards rapidly.

Short-term upside momentum is losing inertia for USD/JPY

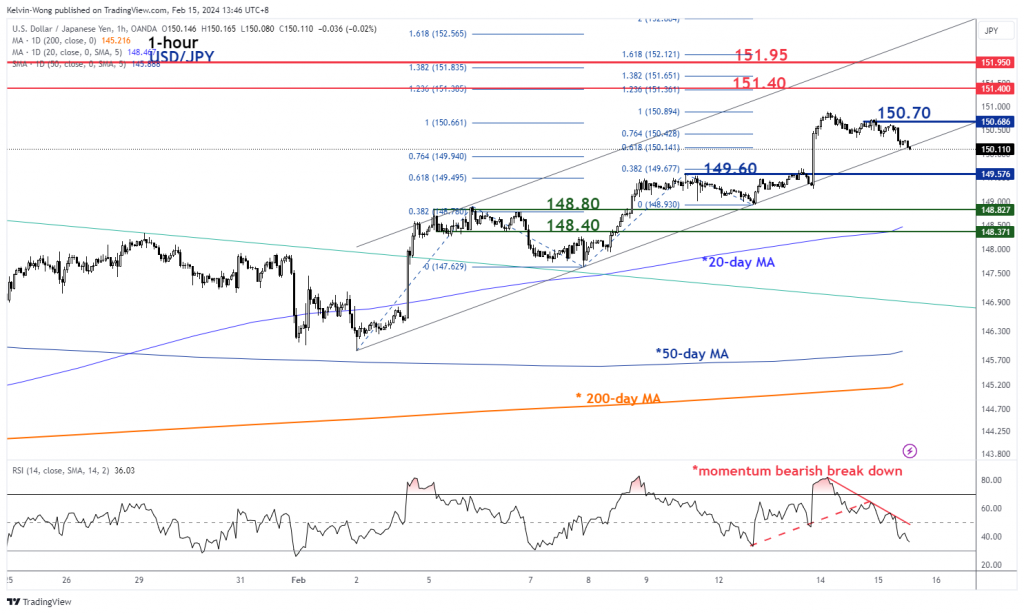

Fig 2: USD/JPY medium-term trend as of 15 Feb 2024 (Source: TradingView, click to enlarge chart)

Fig 3: USD/JPY short-term trend as of 15 Feb 2024 (Source: TradingView, click to enlarge chart)

The recent bullish momentum seen in the USD/JPY since the start of this week, 12 February has started to lose inertia.

The hourly RSI momentum indicator has staged a momentum bearish breakdown after it hit an extreme overbought condition on Wednesday, 14 February (ex-post US CPI).

These bearish observations have taken form right below the risk and major resistance zone of 151.40/151.95.

A break below the lower neutrality range level of 149.60 may see further near-term weakness to expose the next intermediate support zone of 148.80/40 (also the 20-day moving average).

On the flip side, a clearance above 150.70 (upper neutrality range) may see the major resistance zone coming in at 151.40/95.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.