- USD/JPY rises for the fourth consecutive day, supported by US economic optimism.

- US employment data this week is crucial for Fed’s September rate decision and USD/JPY direction.

- Japanese economic indicators and seasonality may also influence USD/JPY’s trajectory.

Most Read: Markets Weekly Outlook – NFP Jobs Data to Rule Out 50 bps Fed Rate Cut?

USD/JPY continued its advance on a thin liquidity Monday. The greenback is up around 0.57% against the JPY and on course for a fourth successive day of gains.

The US Dollar has been on a steady rise over the past few days as investors remain optimistic about the US economy following last week’s GDP data. This was followed by a decent PCE print which went some way in allaying recessionary fears and offering the greenback some support.

There is a large swatch of data out of both the US and Japan this week which could shape the trajectory of the pair. The Japanese economy has been on an upward trajectory of late as speculation grows about further rate hikes from the Bank of Japan (BoJ). This is crucial as it comes at a time when Global central banks are looking to cut rates and not raise them.

US Employment Data is Key

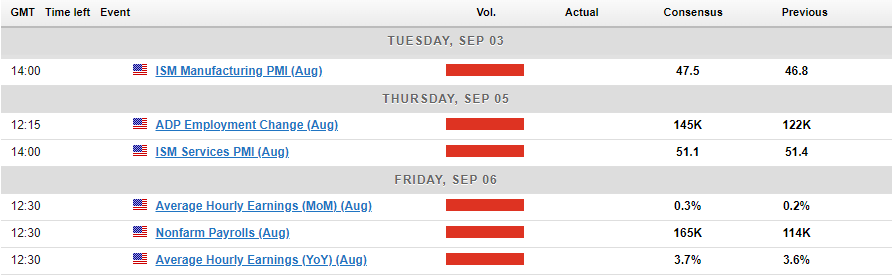

I think the biggest impact this week on USD/JPY will come from the US jobs report. The importance of this release has grown in stature since the massive downgrade in job numbers by the BLS. It led markets to start speculating on a potential 50 bps rate cut in September.

A soft jobs print could bring this conversation back to the fore and could play a major role in determining the Fed decision on September 18. A strong jobs number could finally put an end to that debate as it appears that many Fed members are uncomfortable with beginning the rate cut cycle with a 50 bps move.

There are some mid-tier Japanese data releases which should show continued improvement in the Japanese economy. For more information on this please read the weekly market outlook.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

From a technical standpoint, USD/JPY appears to have bottomed out just below the 144.00 handle before the recovery began. The pair has since posted 3 consecutive days of gains and is on course for a fourth.

Interestingly enough this comes despite the expectations of rate cuts from the Fed and rate hikes from the BoJ putting the two central banks on differing paths. In theory the Yen should be gaining ground against the greenback, however there could be an explanation as to why the greenback is on the up.

The answer may be two-fold as market participants appear to be betting on the US economy following a stellar GDP revision. Also, the initial USD selloff around the rate cut issue may mean that a lot of the expected 25bps cut in September has already been priced in.

Another consideration could be seasonality. Historically the US dollar enjoys a good month of September while US stocks seem to struggle. Will history repeat itself?

Today’s daily candle is on course to close above the 146.37 swing high which would signal a shift in structure where price action is concerned. This would increase the probability of further upside even if we do have a slight pullback first potentially to resistance turned support at 146.37.

USD/JPY Chart, September 2, 2024

Source: TradingView (click to enlarge)

Support

- 146.37

- 145.00

- 143.85

Resistance

- 148.00

- 150.00 (psychological level)

- 151.216 (200-day MA)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.