- USD/JPY has risen the most among the majors in the past month.

- The current swift up move of USD/JPY has prompted FX verbal intervention today from Japan’s Ministry of Finance.

- The current tonality of verbal intervention is the strongest since mid-August 2023 that occurred when the current upward trajectory of USD/JPY is fast approaching a key medium-term resistance zone of 148.40/148.85.

- Short-term upside momentum has started to wane.

This is a follow-up analysis of our prior report, “USD/JPY Technical: Bullish tone resumes, 148.20/85 next resistance to watch” published on 17 August 2023. Click here for a recap.

The USD/JPY has indeed staged the expected up-move in the past two weeks and surpassed the 147.20/147.50 resistance highlighted in our previous report as it printed an intraday high of 147.80 during yesterday’s US session, 5 September.

USD/JPY is the top performer among the majors in the past month

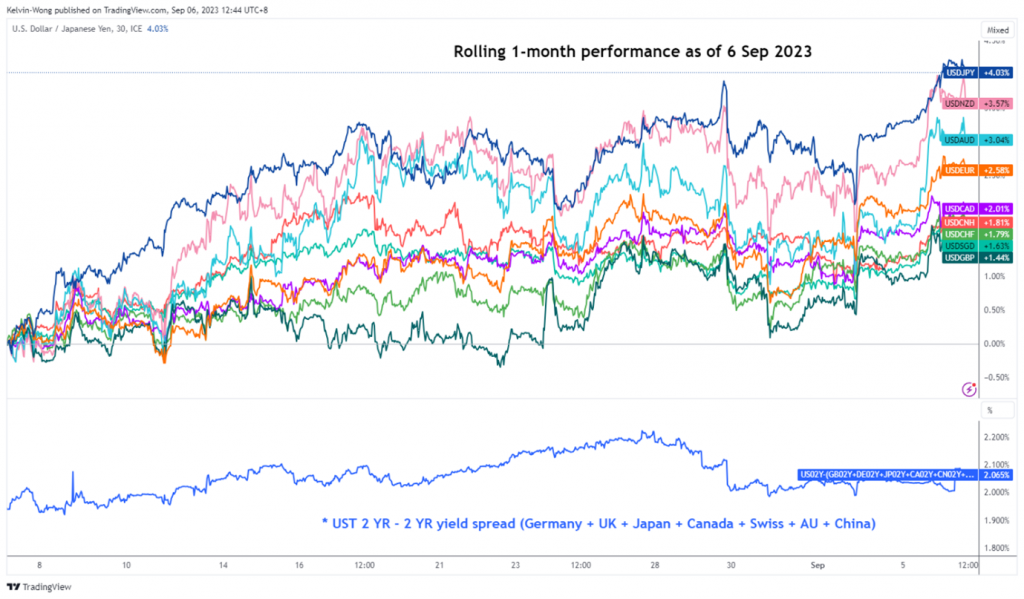

The recent movement seen in the USD/JPY has been fast and furious since last Friday, 1 September ex-post US non-farm payrolls data release. Based on the one-month rolling performances of the major currencies as of today, 6 September (at this time of the writing), the US dollar has strengthened the most against the JPY (+4%), a relatively stark USD/JPY outperformance versus other major pairs such as the USD/EUR (+2.6%), USD/CHF (+1.8%), and USD/GBP (+1.4%).

Fig 1: Rolling one-month FX majors’ performances against the USD as of 6 September 2023 (Source: TradingView, click to enlarge chart)

This recent bout of short-term shift rally seen in the USD/JPY has prompted Japan’s Ministry of Finance to issue a verbal warning to FX speculators this morning (Asian session) to negate the current bout of JPY weakness.

Vice Finance Minister Masato Kanda, the Japanese official in charge of foreign exchange matters said that authorities “will not rule out any options on currencies if speculative moves persist” and added “it is important for currency moves to reflect fundamentals”, a possible hint that the current level of USD/JPY does not reflect the latest set of Japanese inflation data where inflationary pressures in Japan have remained elevated excluding fresh food and energy components.

Interestingly, this latest tone of FX verbal intervention from Japan’s Ministry of Finance is the strongest warning since mid-August 2023 after the USD/JPY sailed past the psychological levels of 145 and 146.

From a technical analysis perspective, today’s verbal intervention materialized while the current impulsive up-move sequence in the USD/JPY has been fast approaching the key medium-term resistance zone of 148.40/148.85 (see daily chart below). Therefore, it reinforces the significance of the 148.20/148.85 zone on the USD/JPY.

148.40/148.85 key medium-term resistance to watch on USD/JPY

Fig 2: USD/JPY medium-term trend as of 6 Sep 2023 (Source: TradingView, click to enlarge chart)

Short-term downside momentum has started to ease below 147.90

Fig 3: USD/JPY minor short-term trend as of 6 Sep 2023 (Source: TradingView, click to enlarge chart)

Meanwhile, the hourly RSI indicator, a gauge of momentum has flashed a bearish divergence condition at its overbought zone yesterday and started to inch lower (below 70) in today’s Asian session.

These observations have suggested the short-term upside momentum of the recent up move from last Friday, 1 September low of 144.44 has waned and the USD/JPY now faces the risk of a minor pull-back on an intraday basis.

A breakdown below 147.20 may trigger the minor pull-back scenario to expose the intermediate support zone of 146.30/145.70 (also the 20-day moving average).

On the flip side, a clearance above 147.90 is likely to resume the impulsive up-move sequence to see the key medium-term resistance zone coming in at 148.40/148.45.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.