- The recent week of Japanese yen weakness is likely driven by “political jawboning”

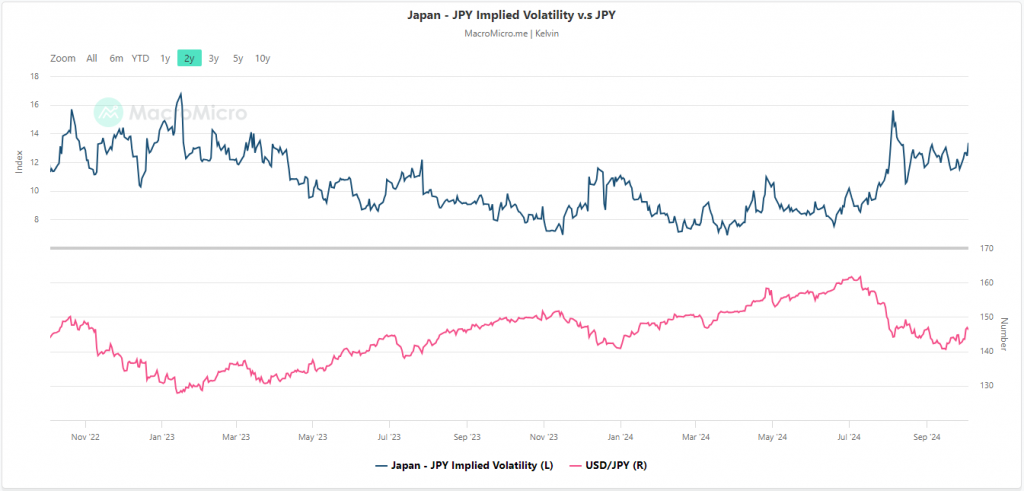

- The current jump in the JPY implied volatility index has reached an overstretched condition that suggests a potential pause in the recent USD/JPY’s up move.

- A break below 143.60 intermediate support on the USD/JPY may trigger renew weakness.

This is a follow-up analysis of our prior report “USD/JPY Technical: Mean reversion rebound in progress within a medium-term downtrend” published on 23 September 2024. Click here for a recap.

Since our prior publication, the price actions of USD/JPY have shaped the expected mean reversion rebound and hit the lower limit of the 146.90/149.30 key medium-term resistance zone (printed a high of 147.24 on Thursday, 3 October).

The USD/JPY rebounded by 5.5% (766 pips) from its 16 September low of 139.58 to its 3 October high and on Wednesday, 2 October, its daily gain of 2% was the most on record in the past two years.

Political jawboning led to the recent JPY weakness

The recent week of Japanese yen weakness has been primarily driven by “political jawboning” rather than a major change in Japan and the US macro drivers.

The newly elected Liberal Democratic Party leader and Japanese Prime Minister Shigeru Ishiba, a known supporter of higher interest rates to boost Japan Inc’s profitability has “abruptly’ reversed his preference to advocate an accommodative monetary policy in a press interview conducted on Sunday, 29 September.

In addition, after his meet-up with the Bank of Japan (BoJ) Governor Ueda on Wednesday, 2 October, Ishiba reiterated to the media that Japan is not in a conducive environment for additional interest rate increases.

The main reason for Japanese Prime Minister Ishiba’s current dovish stance on monetary policy is likely to be seeking for a higher chance of winning the electorate’s support for his Liberal Democratic Party in the upcoming 27 October snap election.

Technical factors are suggesting a potential pause in JPY weakness

Fig 1: JPY implied volatility index with USD/JPY as of 4 Oct 2024 (Source: Macro Micro, click to enlarge chart)

The JPY implied volatility index has staged a steep push-up from 11.51 last Friday, 27 Friday to a current level of 13.34 at this time of the writing and broke above the recent peak of 13.22 printed on 5 September (see Fig 1).

Hence, the movement depicted in the JPY implied volatility index suggests that the recent corresponding bounce seen in the USD/JPY over the same period is likely to have reached an overstretched condition that in turn may reduce the odds of a further upside movement at this juncture.

Daily RSI of USD/JPY has flashed out a bearish condition

Fig 2: USD/JPY medium-term trend as of 4 Oct 2024 (Source: TradingView, click to enlarge chart)

The daily RSI momentum indicator of the USD/JPY has staged an intraday bearish reaction right at a corresponding trendline resistance in place since 26 April 2024 which suggests a potential pause in the upside momentum of the recent price actions rally from 30 September to 3 October (see Fig 2).

A break with a daily close below 143.60 key intermediate support (also the 20-day moving average) may trigger a new potential impulsive downside sequence of its medium-term downtrend phase to expose the medium-term supports at 140.25, and 137.35 in the first step.

On the other hand, a clearance above 149.30 key medium-term pivotal resistance invalidates the bearish scenario for an extension of the mean reversion rebound for the next medium-term resistance to come in at 151.95 (also close to the 200-day moving average).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.