The Japanese yen continues to lose ground this week. Currently, USD/JPY is trading at 110.67, down 0.30% on the day.

Earlier in the day, USD/JPY touched a high of 110.96. This was within a whisker of the 111 line, which has held since March 2020.

Dollar having its way with the yen

The yen has been a punching bag for the US dollar in 2021, with USD/JPY soaring 7.3 per cent. In March alone, the dollar is up 3.8%, as US Treasury yields continue to head higher and lift the US dollar. The 10-year yield rose to 1.77% on Tuesday, marking a 14-month high and is currently at 1.73%.

The US recovery has gained traction, boosted by the massive 1.9 trillion dollar stimulus package and an aggressive vaccine rollout. The dollar could make further gains before the day is out, with President Biden revealing some details of the 3-4 trillion infrastructure package and the ADP Employment report projecting a stellar gain of 552 thousand (12:15 GMT).

Meanwhile, Japanese numbers this week have been soft, reflecting a weak Japanese economy. Retail Sales, Industrial Production and Housing Starts have all recorded declines. Investors will be keeping a close eye on the Tankan indices for Q1, which should be treated as market-movers. The Tankan Manufacturing index is expected to improve to -1, compared to -10 in the previous quarter. The Non-Manufacturing index is forecast to edge up to -4, compared to -5 beforehand. If either reading is weaker than the forecast, we could see the shaky yen break above the 111 level.

.

USD/JPY Technical Analysis

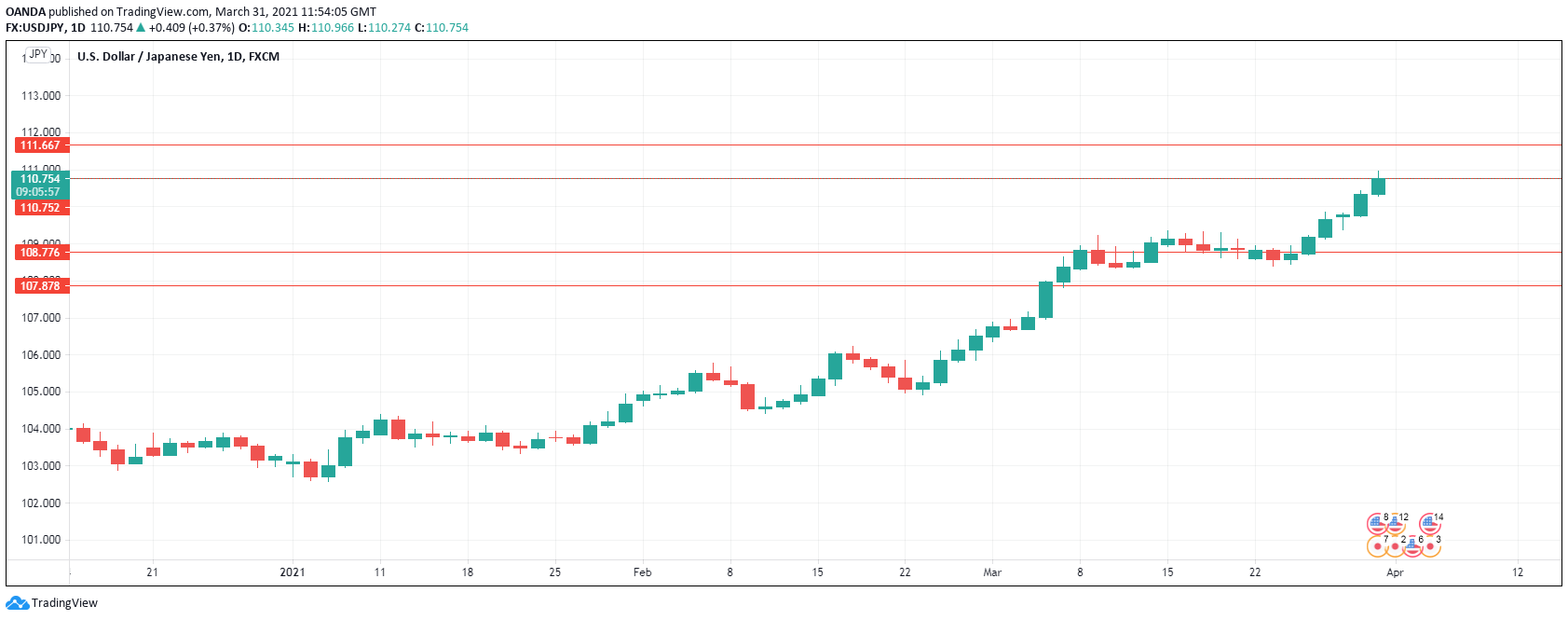

- On the downside, there is support at 108.78. Below, there is support at 107.87

- USD/JPY is testing resistance at 110.75, followed by resistance at 111.66

The dollar index rose 0.38% to 93.30 overnight, and is at 93.23 today in Europe. The index is now well clear of its 200-day moving average (DMA) at 92.50, with the technical picture suggesting further gains to 94.30 ahead.

For a look at all of today’s economic events, check out our economic calendar. www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.