- The Federal Reserve left interest rates unchanged, but the statement acknowledges a moderating job market and slightly elevated inflation, opening the door for a potential September rate cut.

- The US Dollar initially weakened after the FOMC meeting but has since rebounded, supported by the 104.00 level.

- USD/CAD faced resistance at 1.3850 and could potentially break higher if the US Dollar Index continues to strengthen. Will jobs data be the catalyst?

Most Read: Trump Courts Crypto Fans Amid Bitcoin’s Battle to Break $70k Barrier

FOMC Recap: Labor Market Concerns on the Rise, DXY Recovers

USD/CAD failed to break above a key resistance area around the 1.3850 handle as the FOMC meeting led to a selloff in the US Dollar. As expected the Federal Reserve kept rates unchanged while leaving the door open for a September rate cut.

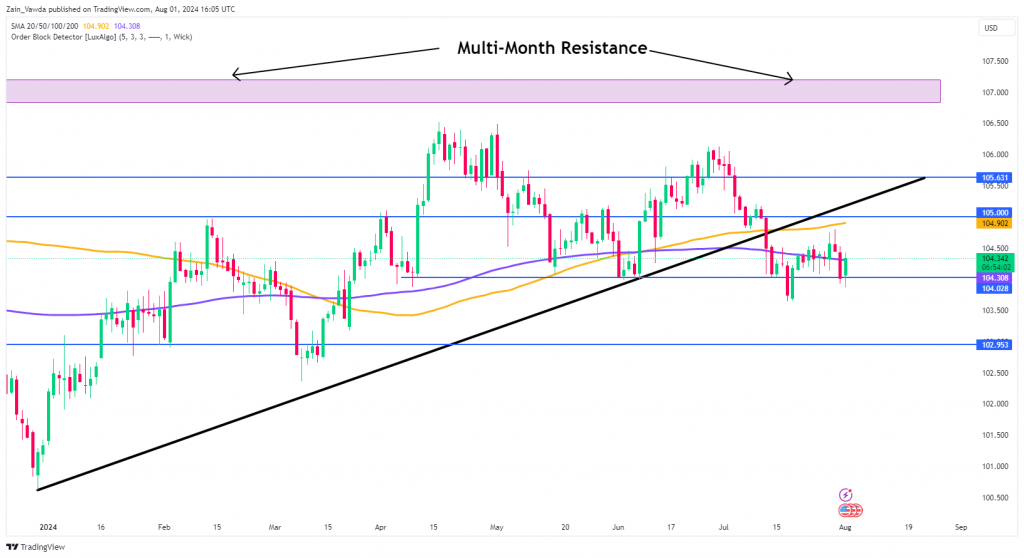

The US Dollar recorded initial weakness but has since put in excellent gains today as the 104.00 support held firm. For more technical analysis on the US Dollar Index click here.

US Dollar Index (DXY) Daily Chart, July 31, 2024

Source: TradingView (click to enlarge)

The new statement reaffirms that economic activity has continued to expand at a “solid pace,” but it notes that job gains “have moderated” instead of “remained strong.” It also acknowledges that the unemployment rate “has moved up but remains low,” rather than simply stating it “remained low.”

Progress towards the Committee’s 2% inflation objective has been upgraded from “modest” to “some,” and inflation is now described as only “somewhat” elevated.

Additionally, the risks to achieving the employment and inflation goals “continue to move into better balance,” and the Committee is now “attentive to the risks to both sides of its dual mandate,” rather than just focusing on inflation risks.

The other area of concern cited by policymakers is the uncertainty around the Middle East. Central Bankers fear that any regional escalation will lead to an increase in inflationary pressures, something which was cited by the Bank of England (BoE) today as well.

Market participants were a little disappointed by the lack of conviction from Fed Chair Jerome Powell. Many had expected some form of endorsement for a September rate cut which did not materialize. This could in part be down to the fact that there will be two more CPI Inflation releases ahead of the Fed’s September meeting which may give them more confidence regarding a rate cut.

Canadian Dollar Benefits from Oil Gains

The Canadian Dollar benefitted from a steep rise in oil prices yesterday following a rise in geopolitical risk and renewed supply concerns. US stockpiles continue to deplete while the OPEC + meeting threw up no surprises.

OPEC + kept oil output steady and is still on course to unwind output cuts from October. However the group said in a statement that the gradual phase out of the cuts could be reversed or or paused depending on market conditions.

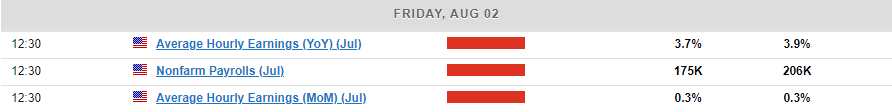

Economic Calendar

The last day of the week will bring high impact jobs data and the NFP report from the US. As the labor market cools more attention will be paid to the data as recessionary concerns may rear their ugly head.

A positive print tomorrow could be the catalyst needed for USD bulls to take control once more and push USD/CAD toward the 140.00 psychological handle.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

USD/CAD

From a technical standpoint, USD/CAD encountered resistance at the 1.3850 level. A brief pullback yesterday suggested the beginning of a potential correction as the weaker US dollar weighed on the pair.

However, a recovery in the US Dollar Index today has set USD/CAD on track to print a bullish engulfing candlestick on the daily timeframe, indicating potential further upside. Immediate resistance lies at 1.3850, with 1.3900 and the psychological 1.4000 level beyond that.

Conversely, another rejection from the 1.3850 level could initiate a corrective move in USD/CAD, possibly dragging the pair back towards the 1.3750 mark and a retest of the trendline.

Support

- 1.3750

- 1.3676

- 1.3650

Resistance

- 1.3850

- 1.3900

- 1.4000

USD/CAD Daily Chart, August 1, 2024

Source: TradingView (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.