- S&P 500 poised for best week since March

- Barkin and Waller resume hawkish Fed speak

- One-year inflation expectations fall to the lowest levels since March 2021

US stocks are ready for a long weekend as traders are exhausted from a week filled with high impact events that didn’t derail momentum in equities. The Fed’s hawkish hold was followed by further hawkish reminders by Barkin and Waller. Fed’s Barkin said that if the Fed backs off too soon, it risks having to hike more, while Fed’s Waller, a voter, stated that it is disturbing that core inflation is not moving and that it will probably require some more tightening.

The Nasdaq might be underperforming today compared to Dow and S&P 500, but don’t let that fool you. Wall Street remains upbeat that the AI wave won’t be going away anytime soon and that investors will prefer US stocks as we see diverging central bank policies worldwide. Despite all this talk of a couple more rate hikes, the S&P 500 is having one of its best weeks since March. This stock market rally seems a bit overextended but too much money remains on the sidelines, which means if the AI trade remains intact, this winning streak for mega-cap tech stocks can last a while longer.

US Data

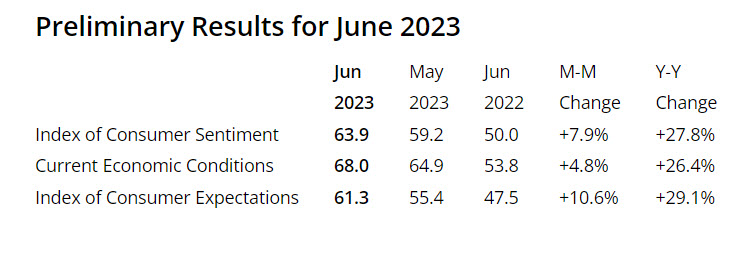

The University of Michigan’s preliminary consumer-sentiment survey supported hopes for a soft landing. Consumer year-ahead inflation expectations dropped from 4.2% to 3.3%. Sentiment and expectations improved as the labor market gradually weakened and following optimism from the debt deal that Congress was able to deliver. It is hard to imagine the US economic outlook can remain healthy and for the disinflation process to remain firmly in place.

Source: http://www.sca.isr.umich.edu/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.