- Brent Crude oil prices opened lower due to renewed ceasefire hopes after a limited Israeli retaliatory attack on Iran.

- The attack didn’t target energy infrastructure, leading to a drop in geopolitical risk premium.

- CitiGroup lowered its Brent price target for the next three months to $70 a barrel.

Most Read: Markets Weekly Outlook – ‘Magnificent 7’ Earnings, BoJ Meeting and US Jobs Data

Oil prices opened $4 lower or 5.84% on renewed ceasefire hopes after Israel launched a limited retaliatory attack on Iran over the weekend. The attack by Israel did not target any energy infrastructure but rather focused on military targets. The scope of the attacks have led to increased hopes of a potential ceasefire.

The attacks have seen the premium priced in from Geopolitical risk largely fall away. My question would be whether such a move is premature? There are some analysts who share my view that a ceasefire in the Middle East is unfortunately still far away.

OPEC + continues to lower its forecasts as does the IEA with many hoping recent Chinese stimulus may help demand concerns. However, more importantly moving forward will be whether OPEC + proceeds with production increases as planned for the end of the year. Last week this seemed plausible as Oil prices appeared to be heading back toward $80 a barrel. The narrative has shifted after the weekend, at least from my point of view. If oil prices continue to languish in the low 70’s a barrel, i think OPEC + is unlikely to raise output in December.

After the developments over the last week, CitiGroup has lowered their Brent price target for the next three months to around $70 a barrel, from a previous $74. This is a significant downgrade in my opinion and it will be interesting to monitor whether other analysts or investment banks/houses do the same.

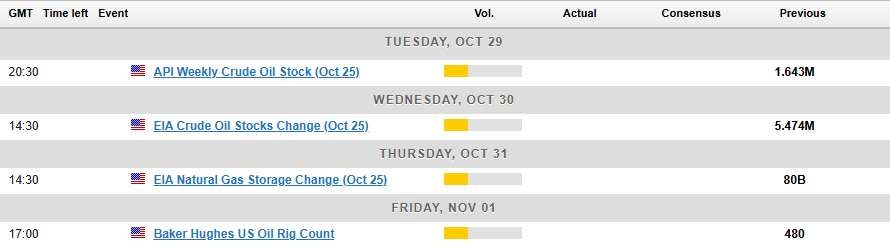

The week ahead usually brings the most recent inventory data which will once again be monitored. There is a lot of risk this week that relates to markets as a whole with US Earnings and Jobs data ahead.

Sentiment changes from these events could also have a knock on effect on Oil prices.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

From a technical perspective, oil has had a $4 gap to the downside over the weekend which does mess with the price action outlook. Following Friday, the technicals were hinting at a bullish continuation move for oil prices which could still materialize but seems less certain now.

Brent opened around the 72.35 mark having finished last week trading at 76.050 a barrel. As things stand, price is caught in a massive demand which would hint at a bounce. However, with the geopolitical premium out for now and Skepticism around global growth, could Oil prices decline further?

Immediate support rests at 71.50 before the psychological 70.00 mark comes into focus. Below this we have the YTD low just shy of the 69.00 to keep an eye on.

As much i would love a recovery and for Oil prices to close the gap, i am not sure if we have the right conditions for that at the minute. A move higher from here will have to negotiate the resistance area at 73.40 before 75.00 deserves attention. A break above 76.35 could lead to a speedy rally toward the 79.00 handle.

Brent Crude Oil Daily Chart, October 28, 2024

Source: TradingView (click to enlarge)

Support

- 71.50

- 70.00

- 69.00

Resistance

- 73.40

- 75.00

- 76.35

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.