- Oil prices rose due to lower-than-expected US crude oil stockpiles, but demand concerns remain.

- OPEC+ is worried about a potential increase in US oil output under a Trump presidency.

- From a technical perspective, oil prices are range-bound, and range trading might remain in play heading into 2025.

Most Read: USD/JPY rises ahead of BoJ meeting

Oil prices arrested a two day s;ump today to trade around 1% higher heading into the FOMC meeting. The early European session gains were largely down to lackluster overnight Crude stockpile numbers from the American Petroleum Institute triggering a floor for now.

API data last week indicated that U.S. crude oil supplies dropped by 4.69 million barrels, according to a report. Meanwhile, gasoline stockpiles increased by 2.45 million barrels, and distillate inventories went up by 744,000 barrels.

EIA Confirms Stockpile Drop, Supporting API Data

EIA data was released today and showed U.S. crude oil and distillate supplies went down, while gasoline stockpiles increased during the week ending December 13, according to the EIA on Wednesday. Crude oil reserves dropped by 934,000 barrels to a total of 421 million barrels, which was less than the 1.6 million barrel decline analysts had predicted in a Reuters poll.

The inventory data has definitely helped arrest a two day slide for oil prices but demand concerns continue to linger. Recent rallies to the upside have struggled of late, a clear sign that bulls remain concerned by the growing skepticism over 2025. This was further compounded by downgrades from both OPEC and the IEA.

OPEC + Concerned About Possible US Output Increase

In other news, delegates from OPEC + have stated that the group is wary of the potential for renewed rise in US output under a Trump Presidency.

OPEC has often underestimated how much oil the U.S. can produce, dating back to the start of the shale oil boom. This boom helped the U.S. become the largest oil producer in the world, now supplying 20% of global oil.

Some experts within OPEC are now more optimistic about U.S. oil production. They believe one key reason for this is former President Trump. After campaigning on economic issues and lowering living costs, his team introduced a broad plan to reduce regulations in the energy industry, boosting oil production.

As good as this sounds on paper though I would proceed with caution. The main reason being an influx of supply will lead to a drop in oil prices. This will lower profit margin and could make it unattractive for some companies. Hence why the balance around supply and demand in Oil markets are so important.

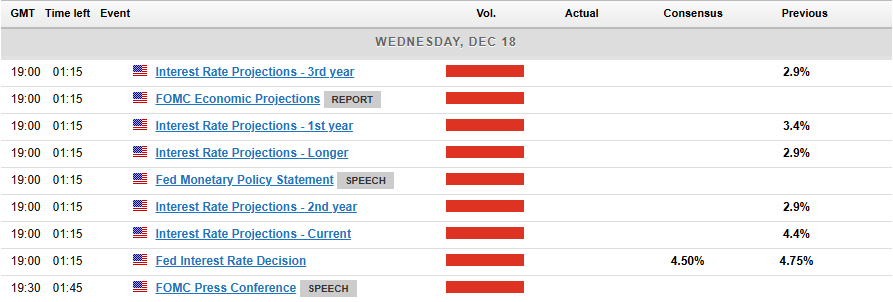

Later in the day we have the Federal Reserve meeting which could have a knock on effect on the Dollar denominated Oil price. Also, should the Fed signal less cuts in 2025, or adopt a more hawkish approach this could cause some panic among Oil traders who could view this as a negative in the battle between supply and demand. Higher rates could lead to lesser demand.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

From a technical perspective, Oil prices continue to toil in a tight range with the 75.00 handle serving as a strong area of resistance.

Bulls have struggled to push price beyond the 75.00 mark since early November as Oil fundamentals continue to point to excess supply in 2025.

Price action does not give us much and has been rather messy since with lower highs followed by higher lows. The mixed signals have been frustrating from a technical standpoint, however opportunities within the range have presented themselves.

Moving forward if the range between 71.00 and 75.00 continues to hold then it may be more prudent to look toward range trading as an alternative heading into 2025.

Brent Crude Oil Daily Chart, December 18, 2024

Source: TradingView (click to enlarge)

Support

- 72.39

- 71.00

- 70.00 (psychological level)

Resistance

- 75.00

- 76.35

- 79.00

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.