- Brent Crude oil prices rose on Wednesday due to a larger-than-expected draw in US crude inventories.

- The market anticipates further inventory reduction, leading to potential support for prices in Q4.

- Technical analysis suggests bullish continuation, with a key resistance level at 87.90 and potential for a move towards 90.00 if this level is breached.

Most Read: UK Election 2024: Impact Analysis on GBP and FTSE 100

Brent Crude enjoyed a mixed Wednesday as European session losses were wiped out by EIA data. US Crude stocks fell more than expected in a move many had anticipated as the US summer holiday period gets into gear.

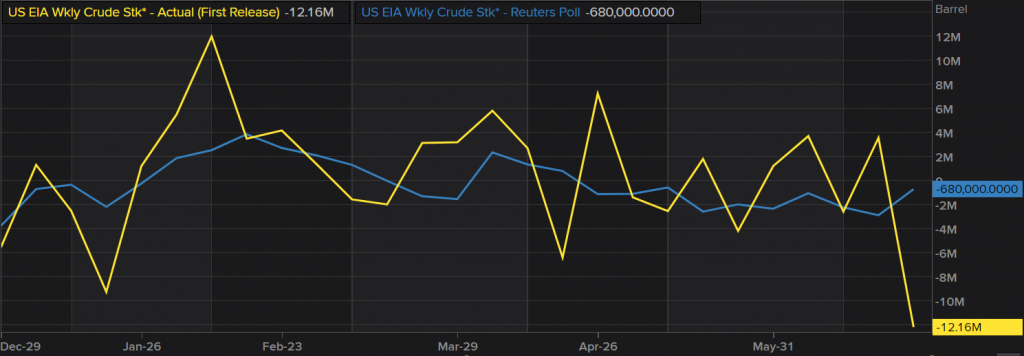

Crude inventories decreased by 12.2 million barrels, bringing the total to 448.5 million barrels for the week ending June 28, according to the EIA. This decline significantly exceeded analysts’ expectations in a Reuters poll, which had predicted a draw of 680,000 barrels.

This appears to confirm market participants’ recent optimism, suggesting that a reduction in inventories toward the end of the summer will likely lead to market tightness and support prices as Q4 approaches

The chart below shows US EIA inventory numbers based on the actual first release before revisions (yellow line). The (blue line) shows the expected inventory number based on Reuters polls.

Source: LSEG (click to enlarge)

US and Oil Rig Data Ahead

Today is likely to be a quiet one with the US independence day holiday and UK election. Liquidity might prove to be an issue and thus markets may experience sideways price action.

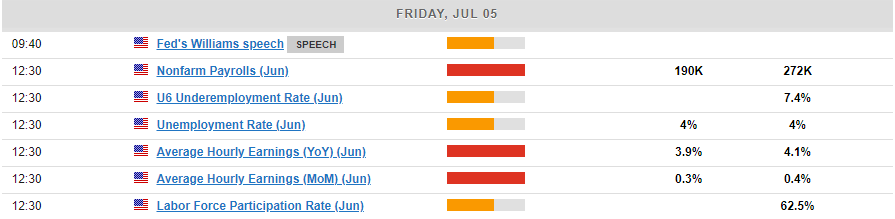

Friday could be a blockbuster end to the week, with NFP and jobs data from the US and the return of US markets. Baker Hughes oil rig data is also scheduled for release and could also impact oil prices ahead of the weekend.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis on Brent Crude Oil

Oil prices ran into resistance at 87.90 on Tuesday and looked set for retracement. The EIA data yesterday however, helped push oil prices back toward the key resistance level while printing a hammer candlestick on the daily timeframe.

This makes for an interesting day with bullish continuation and a break of 87.90 finally opening the door for an assault at the 90.00 psychological level. The recovery since the beginning of June has been steep with very little retracement, something which continues to concern me.

For now though, price action and EIA data support a move higher. Given the low liquidity environment expected today, there is a chance that oil fails to close above the 87.90 resistance level, in which case NFP data tomorrow could serve as a catalyst for either a push toward 90.00 or a retracement back toward the 85.00 handle.

Brent Crude Daily Chart, July 4, 2024

Source: TradingView.com (click to enlarge)

Key Levels to Keep an Eye on;

Support

- 86.21

- 85.00 (confluence area, MA, Psychological level and previous support)

- 83.70

Resistance

- 87.90 (last week’s highs)

- 90.00 (psychological level)

- 92.50

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.