- EUR/USD hovers near 1.0500 as traders await the outcome of the French no-confidence vote.

- ECB policymakers suggest a 25 bps rate cut is likely in December.

- Technical analysis indicates key support and resistance levels for EUR/USD.

Most Read: USD/JPY Technical Analysis: Is a Short-Term Pullback Imminent Despite USD/JPYs Slide?

The 1.0500 continues to serve as a magnet for EUR/USD with the pair moving higher or lower for brief periods before finding its way back to the psychological level. It appears market participants are waiting on a catalyst of some sort. Will the ‘French No-Confidence vote’ prove to be the catalyst?

France No-Confidence Vote

The French Government has faced its fair share of woes in 2024 while going through an election that surprised many. The current ‘kingmakers’ appear to be the so called right leaning National Rally headed by Marine Le Pen who some claim has never held more power in France than she does at present.

The vote of no-confidence stemmed from budget disagreements and spending on social issues and pensions. This came at a time when the French Government has been dealing with ongoing discontent from the agriculture community as well.

The fragile coalition assembled by PM Barnier following the election looks to be in jeopardy with the Euro facing downside risks as a result. If Barnier is removed, it could worsen the political crisis in the euro zone’s second-biggest economy. Add this to struggles by the euro zone’s most industrialized economy, Germany and the Euro may be at risk of parity against the US Dollar in 2025.

ECB Policymaker Comments

There was debate around the ECB this month regarding a 25 or 50 bps cut. A lot of the noise appeared to die down following an uptick in German inflation and better than expected consumer confidence data last week.

A 50 bps cut now looks unlikely with ECB policymakers this week reiterating such a stance. This morning we heard from ECB Policymaker Ollie Rehn who said he sees more grounds for December rate cut and more policy easing ahead. Fellow Policymaker Boris Vujcic stated that small steps are better given the uncertainties present.

This leads me to believe that a 25 bps cut is the most likely outcome and could explain why the EUR/USD selloff has struggled to gain momentum below the 1.0500 handle.

ECB Rate Probabilities – December 2025

Source: LSEG (click to enlarge)

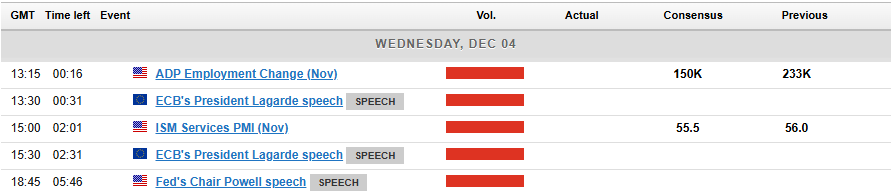

ECB President Lagarde speaks later in the day as well as policymaker Makhlouf. On the calendar front we have a few US data releases which could stoke some volatility but are unlikely to inspire a lasting break of the recent trading range.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

From a technical standpoint, EUR/USD has been using a 1.0500 handle like a magnet over the since a recovery on November 25 from lows around the 1.0350 handle.

The lack of acceptance above or below the 1.0500 handle has frustrated market participants but is understandable given the host of variables at play. The longer term view does favor further downside, however the immediate future of the pair is more of a mixed bag.

There are growing signs that a breakout is imminent with my belief that a short-term bounce may be on the cards before a break of the recent lows at 1.0350 comes to fruition. I could be wrong and US data this week could tank that idea. However, given that i expect labor data to come in as expected and not throw up any surprises, the data has proven less than trustworthy in recent months.

For now though, immediate resistance above 1.0500 rests at the 1.0600 and 1.0700 handles respectively.

Looking at the potential for a break lower and immediate support rests at 1.0460 before the 1.0400 and 1.0330 handles respectively.

EUR/USD Daily Chart, November 4, 2024

Source:TradingView.com

Support

- 1.0460

- 1.0400

- 1.0330

Resistance

- 1.0600

- 1.0700

- 1.0755

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.