- EUR/USD saw early gains on Thursday but fell as US PMI data exceeded expectations.

- Diverging economic paths and monetary policies between the US and Eurozone could impact EUR/USD.

- Technical analysis suggests a potential bullish move for EUR/USD, despite fundamental factors favoring the US Dollar.

Most Read: Gold (XAU/USD), Silver (XAG/USD) Print Fresh Highs as the DXY Eyes 105.00

The Euro has lost some of its early Thursday gains as US PMI data exceeded expectations. A weaker US Dollar has helped the Euro while the technicals have also been flashing signs of a potential bounce for the pair.

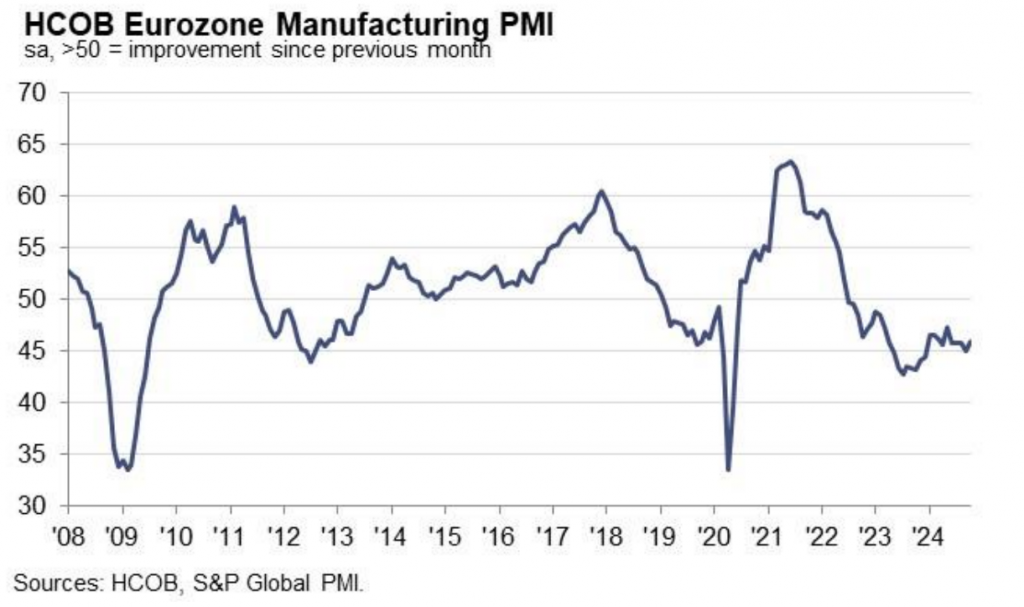

PMI Insights: A Story of Diverging Outcomes

Looking at the data today, Euro PMI data continued its decline. The HCOB Flash Eurozone Composite PMI increased slightly to 49.7 in October, up from a seven-month low of 49.6 in September, yet it fell just short of the predicted 49.8 and indicated a slight contraction in business activity. Growth in the services sector slowed a bit (51.2 compared to 51.4), while the decline in manufacturing eased (45.9 versus 45).

Source: HCOB, S&P Global PMI

Companies scaled back production due to weakening demand, with new orders decreasing for the fifth consecutive month. As a result, firms reduced employment at the most significant rate in nearly four years, and business confidence hit an 11-month low. Meanwhile, input costs rose at their slowest rate since November 2020, and output charge inflation dropped to a 44-month low.

Germany and France remained the main contributors to the decline, experiencing further significant reductions in business activity.

The US PMI data painted a completely different picture and thus raises concerns about a Euro recovery. The S&P Global US Composite PMI increased to 54.3 in October 2024 from 54.0 in September, indicating robust growth in business activity at the beginning of the fourth quarter, according to preliminary data. This growth was primarily fueled by the service sector, which recorded a PMI of 55.3, while manufacturing output saw its third consecutive month of contraction with a PMI of 47.8.

Employment experienced a slight decline for the third month in a row, reflecting uncertainty surrounding the upcoming Presidential Election. However, confidence looking forward improved after a steep decline in September, as businesses anticipated greater stability following the election. The survey also revealed a slowdown in inflation for both input costs and prices charged, with a notable decrease in inflation within the service sector.

The diverging paths of the two economies look set to extend into monetary policy as well. At Least this seems to be the biggest risk to a euro recovery as markets price in more aggressive cuts from the ECB than the US Federal Reserve. This could affect EUR/USD in both the short and longer term.

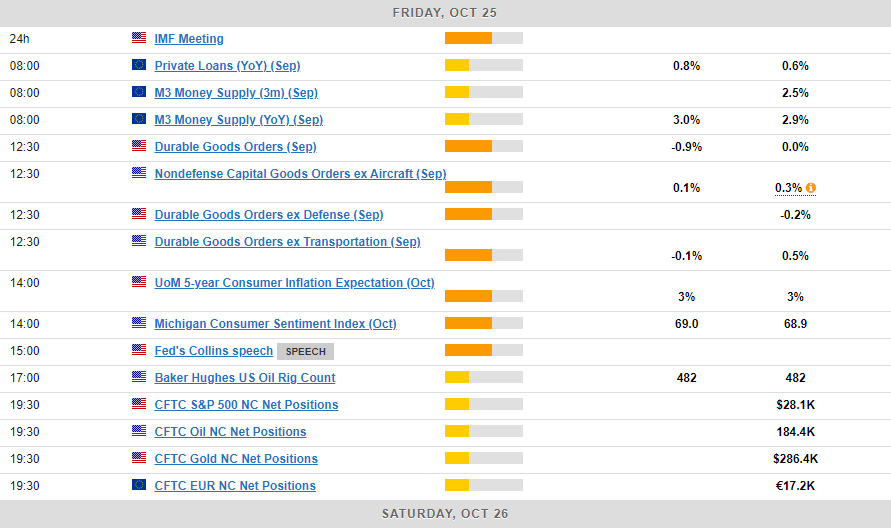

Tomorrow we have a bunch of medium tier data releases from both the US and the EU which should not have a massive impact on EUR/USD. A bunch of speakers from both the ECB and Fed are also on the docket and that see adjustments to rate cut expectations.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

EUR/USD has been on a move lower since forming a double top pattern at the key 1.1200 handle. The move has been swift and this leaves the door open for a potential retracement.

There is consensus beginning to build for a potential bullish move. The RSI on the daily has printed a higher low with price having made a lower low, this divergence in play. The RSI is also eyeing a cross back above 30 level hinting at shifting momentum.

Looking at the candlesticks and we could have a bullish engulfing daily close which would be excellent for potential longs. This would just add another form of confirmation to the potential setup.

This is a very technical setup, as I pointed out above the fundamental picture really points towards continued US Dollar dominance and weakness for the Euro. The technicals however are starting to paint an intriguing picture.

EUR/USD Daily Chart, October 24, 2024

Source:TradingView.com

Support

- 1.0755

- 1.0700

- 1.0600

Resistance

- 1.0800

- 1.0840

- 1.0900

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.