- GBP/USD is currently range-bound, consolidating within a narrow 30-pip range.

- US CPI and PPI data releases on Thursday and Friday could introduce some volatility.

- From a technical standpoint, the medium-term outlook still favors USD bulls, but a short-term bounce in GBP/USD is looking appealing.

Most Read: S&P 500, Nasdaq 100 – Futures Hold High Ground as US Considers a Breakup of Google

GBP/USD is in uncharted territory if i may so with the pair confined to a 30 pip range since early Monday morning. Cable is notorious for its significant moves in comparison to its major counterpart, EUR/USD.

However, As markets have grappled with shifting rate cut expectations from both the Federal Reserve (FED) and the Bank of England (BoE), GBP/USD has been relatively subdued to say the least. Of course the lack of high impact UK data releases has not helped matters, while a strong US Dollar and lack of US Data in the early part of the week have contributed as well.

Markets have already started preparing for the first budget from new Chancellor Rachel Reeves, expected October 30. Given the changes of late on the outlook for both Central Banks it appears the US Dollar will continue to find support ahead of the US election. This may leave cable vulnerable to further downside in the coming weeks.

Economic Data Ahead

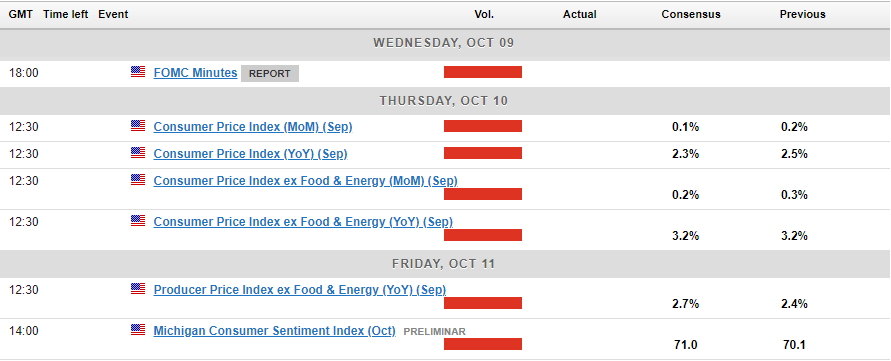

There is quite a bit of data ahead this week which could impact GBP/USD. A busy end to the week starts with the Fed minutes release later in the day which to me seems to be shaping up as a non-event.

Market participants may be keen to gauge the debates that led to a 50 bps cut in September, however the minutes are unlikely to have an impact moving forward. Given that the jobs data sent markets on a 360 roundabout, the entire narrative has since shifted, rendering the minutes somewhat irrelevant at this stage.

Thursday and Friday will bring US CPI and PPI data which could stoke a bit of volatility. Barring any significant uptick in inflationary pressures, this release is unlikely to alter the medium term narrative.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

Looking at GBP/USD from a technical standpoint, the four-hour chart below shows the red box within which price has been confined since Monday morning.

A four-hour candle close to either side of the box could be seen as a potential breakout. However, given the fact that the US Dollar has been on a tear this week, could we be in for a potential midweek reversal?

Should a midweek reversal come to fruition on the US Dollar, then we could see GBP/USD break to the upside. Any rally higher does face significant hurdles but my gut says that this could materialize in the next day or two.

Immediate resistance on the upside rests at 1.31050 before the 1.3143 handle and the 200-day MA at 1.3200 come into focus. Conversely, a move lower here needs to navigate past the previous swing low around 1.3040 before the psychological 1.3000 handle is reached.

All in all the medium term outlook still favors USD bulls. However, looking at the price action picture and a short-terms retracement higher is beginning to look more and more likely.

GBP/USD Four-Hour H4 Chart, October 9, 2024

Source:TradingView.com

Support

- 1.3040

- 1.3000

- 1.2942

Resistance

- 1.3100

- 1.3143

- 1.3200 (200-day MA)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.