- GBP/USD is facing a key multi-month resistance level at 1.2850 after a positive run.

- The outcome of US inflation data and Fed Chair Powell’s testimony could significantly impact the GBP/USD exchange rate.

- A break above 1.2850 might require a catalyst, like a substantial drop in US inflation, while support levels are identified at 1.2750 and below.

Most Read: The Week Ahead – Will US Inflation Data Derail Market Optimism?

GBP/USD opened slightly lower last night due to the unexpected results from the French elections. This resulted in the US Dollar receiving a safe haven bid, with Friday’s USD shorts potentially covering their positions also playing a role. As a result, the US Dollar experienced temporary strength at the start of the week.

However, GBP/USD has since risen back to where it ended last week, just above the 1.2800 level, with a key multi-month resistance level ahead.

The positive momentum for GBP/USD following the UK elections appears likely to continue, bolstered by renewed optimism over potential rate cuts from the US Federal Reserve, which is weighing on the US dollar.

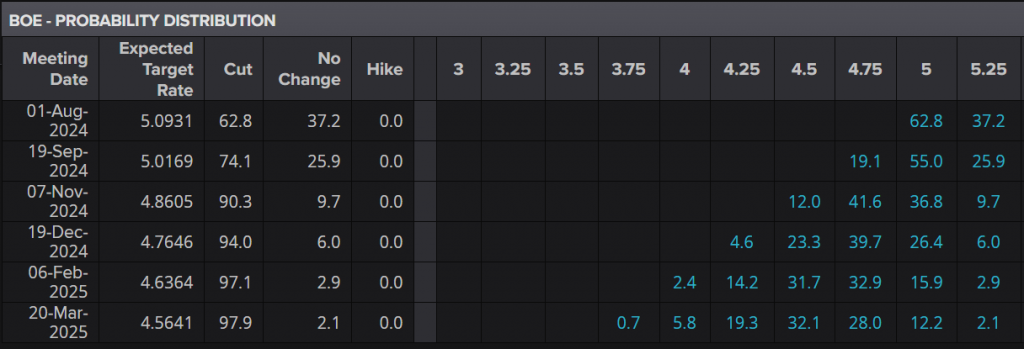

Interestingly, market participants are now pricing in a rate cut from the Bank of England at the August 1 meeting, after inflation returned to the Central Bank’s 2% target. The probability of a rate cut being priced is at 62.8% for the August 1 meeting and has increased substantially over the past week.

UK Interest Rate Probability

Source: LSEG

US Inflation Data Dominates

Looking ahead to the rest of the week, economic data is sparse from the UK with all eyes focused on incoming Prime Minister Keir Starmer and his new Finance Minister Rachel Reeves.

The US and market participants across the globe will have their gaze fixated on US inflation data released later in the week. Following the recent batch of data from the US which showed signs of weakness, the CPI print is significant. A drop off in inflation could lead to more aggressive pricing by market participants on the rate cut front which in theory could send the US Dollar tumbling.

There are also two days of testimony before congress from Fed Chair Jerome Powell. It is likely that the Fed Chair will face tough questions on the economy and his remarks could stoke some swings and volatility which are likely to be short-term in nature.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis on GBP/USD

Cable is on a 7 day winning streak rising from lows around the 1.2600 handle to trade above the 1.2800 handle. The advance may come under pressure as the multi month resistance level at 1.2850 may prove too big of a hurdle.

The 1.2850 handle has held since July 2023, with two unsuccessful attempts to break this level recorded in March and mid-June 2024. The selling pressure at this handle is evident and given the fundamental backdrop, this could remain a concern.

A break of the 1.2850 may need a catalyst, one like a significant drop off in the inflation print due later this week. This could be the type of change needed at a fundamental level to support a breakout and push toward the 130.00 handle.

Conversely, a pullback from here faces support at the 1.2750 handle before 1.2680, 1.2600 and the 1.2500 psychological level come into focus.

GBP/USD Daily Chart, July 5, 2024

Source: TradingView.com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.