- UK labor data beats expectations, with regular pay rising by 5.1% and employment increasing by 265k.

- BoE faces challenges in balancing strong employment figures with moderating wage growth and rate cut hopes.

- US CPI and PPI, and BoE Deputy Governor Sarah Breeden’s comments, could impact GBP/USD’s trajectory.

Most Read: Is EUR/USD Vulnerable Ahead of ECB Meeting…? DXY to Play a Major Role

The GBP benefitted following a positive UK labor data release this morning. Cable rallied around 30 pips following the data release but has since surrendered the post data gains.

The implications for the Bank of England (BoE) will be interesting as the Central Bank was already expected to cut rates less than peers at the ECB and Federal reserve. The strong employment numbers will no doubt raise inflation concerns however, the moderation in wage growth may be a point that keeps dovish MPC members on board regarding further rate cuts.

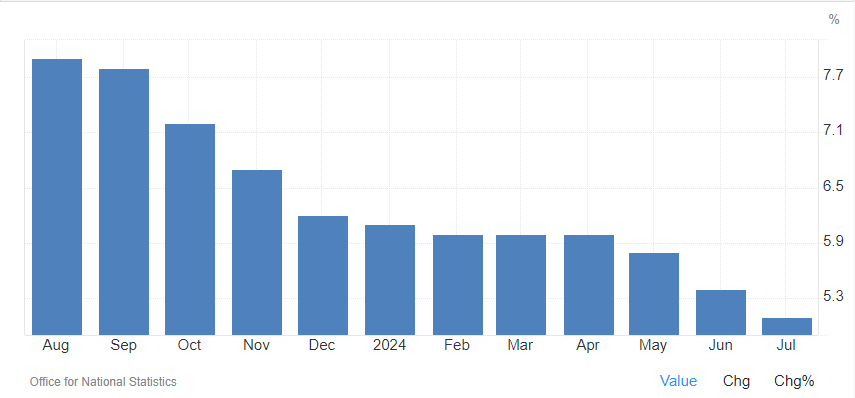

In the UK, regular pay, excluding bonuses, rose by 5.1% year-on-year to GBP 647 per week for the three months leading up to July 2024. This marks the smallest increase since June 2022 and follows a 5.4% rise in the prior period, aligning with market expectations. Wage growth decelerated in both the private sector, decreasing to 4.9% from 5.3%, and the public sector, dropping to 5.7% from 6%. The manufacturing sector experienced the highest annual regular wage increase at 5.9%, followed by the finance and business services sector at 5.4%, and the services sector at 5.1%.

UK Wage Growth YoY

Source: TradingEconomics, ONS

Employment increased by 265k smashing estimates of 115k which is the highest rise in employment over the past 18 months. The drop in unemployment to 4.1% is of course another positive for the UK economy but only compounds the headache facing the Bank of England (BoE).

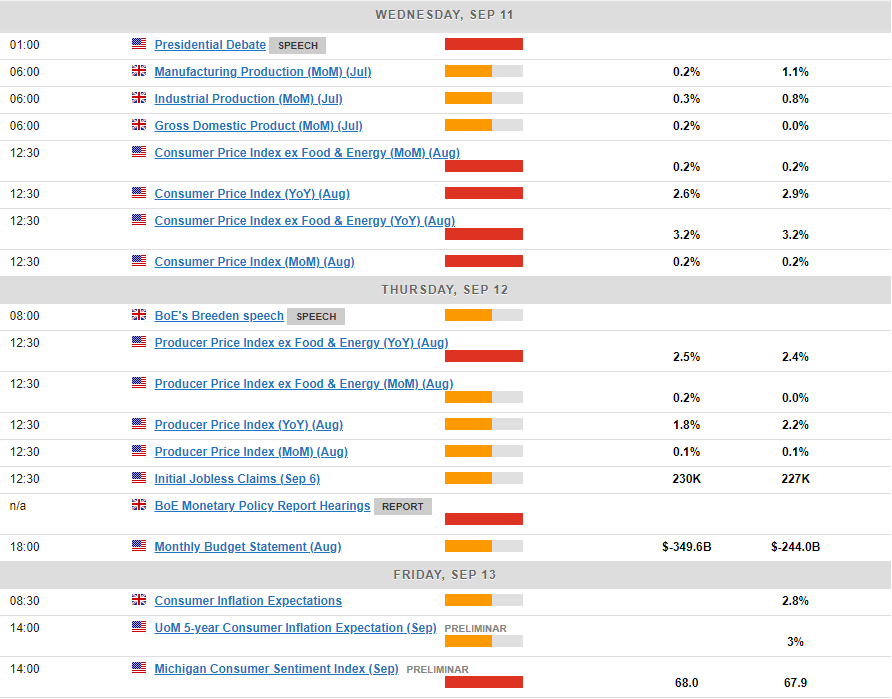

Economic Data Ahead

There is quite a bit of data ahead this week which could impact GBP/USD. The majority of the data comes from the US with CPI released tomorrow and of course PPI on Thursday.

However, I will be more interested in comments from BoE Deputy Governor Sarah Breeden. Given the labor data today it will be key to gauge where BoE policymakers stand regarding rate cuts moving forward. Any sign of diverging policy with the Federal Reserve could have medium to long-term implications for GBP/USD and could be key in where the pair may end up come year-end.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

Looking at GBP/USD from a technical standpoint and the pair does look like a move lower may continue to unfold. Cable is on a two day losing streak having printed a lower high last week Friday at resistance around 1.3181.

One of the concerns for bears from a price action perspective is that a lower low has already been printed which could pave the way for a short-term pullback. This coupled with UK labor data earlier in the day could prompt some short-term buying pressure.

Looking at the downside and immediate support rests at the 1.3000 psychological level, although cable may find support at around the 1.30400 handle which was the July 17 high.

Conversely, a move higher here will first need to take out the current daily high around 1.3100 before the recent swing high at 1.3181 comes into focus.

GBP/USD Daily Chart, September 10, 2024

Source:TradingView.com

Support

- 1.3040

- 1.3000

- 1.2942

Resistance

- 1.3100

- 1.3181

- 1.3250

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.