- Gold prices advance, underpinned by ETF Flows, China stimulus and safe haven flows,

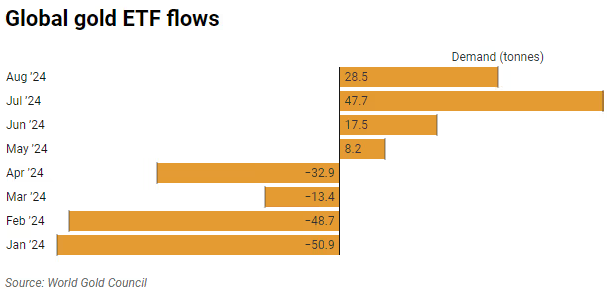

- Gold ETF flows have been positive, and if this trend continues, it could further support the upward momentum of gold prices.

- From a technical analysis perspective, gold is in overbought territory, but this may not be a significant obstacle. The psychological $2,650 and $2675 handles are the next key resistance levels to watch.

Most Read: China Slashes Rates – Stimulus Package by PBoC Welcomed by Markets

Gold prices continue to hold the high ground, underpinned by heightened tension in the Middle East and stimulus from China. The precious metal is enjoying its best year in 14 as a host of challenges and concerns plague market participants.

Gold continues to print fresh highs as geopolitical headwinds continue to sway back and forth. Earlier today we had a stimulus package announcement by the People’s Bank of China (PBoC) which has further aided the precious metal. As big as the stimulus package from China is, I do not believe it will hold a major sway on Gold prices but rather other metals in the sector.

Ongoing dovish comments from Federal Reserve officials only serve to add fuel to a fire which is already raging. Some policymakers have hinted at more aggressive cuts ahead which have underpinned gold prices to a degree overnight. The question regarding a lot of these events is how much of the premium is yet to be priced in given the current nature of the market.

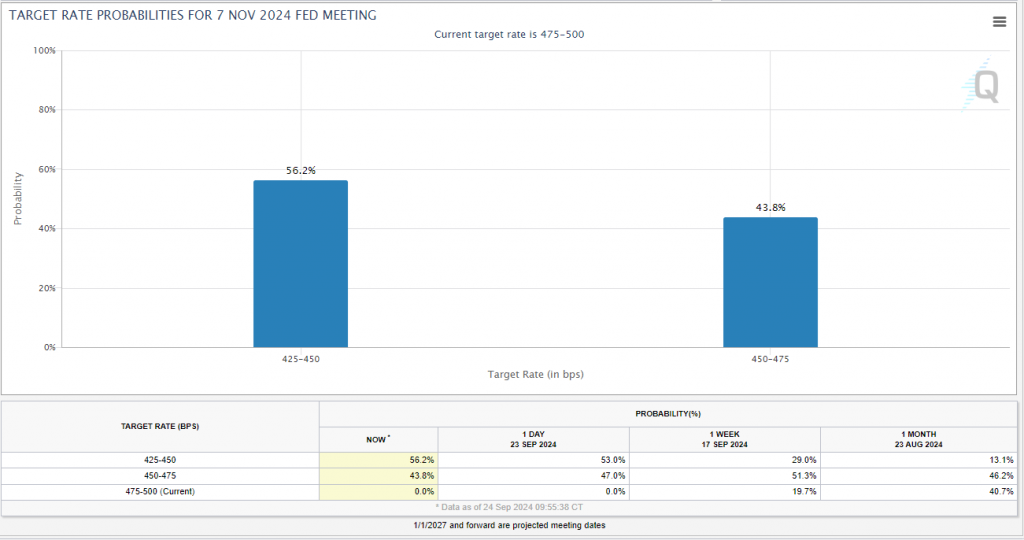

As things stand, markets are pricing in another 50 bps cut from the Federal reserve at the November meeting.

Source: CME FedWatch Tool

Gold ETF Flows Hint at Further Support

ETF flows remain positive following a huge spike in July to 47.7 tonnes. August came in more modest at around 28.5 tonnes the equivalent to $2.1 USD. North America led the way with the Western markets more active at present.

Source: LSEG, World Gold Council

Despite the excellent inflows over the last four months the year-to-date losses remain around 44 metric tonnes. The idea is that if these inflows continue however, this could keep the gold rally moving in the upward direction. Economists and analysts continue to upgrade their yearly forecasts.

JP Morgan for its part stressed that the retail-focused ETF builds will be key for a sustainable gold rally, raising its price target for the precious metal to $2850/oz in 2025.

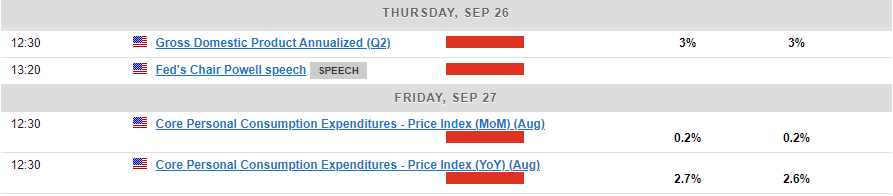

Economic Data

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

On the economic data front, we do have some high impact US data which could impact the US Dollar and thus gold prices. However, it would require the Core PCE data print to be extremely hot on Friday to see any lasting impact on the rate cut expectations from the Fed.

Despite comments from Fed policymaker Bowman today intimating that inflation risks remain this is a long shot and any uptick in inflation may just be a temporary reprieve for Gold prices on its march higher.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold is tough to read at the minute particularly where areas of resistance is concerned. As we continue to print fresh all time highs it makes it difficult due to the lack of historical price data to analyze.

To put things into perspective, the RSI on the daily, weekly and monthly timeframe are all in overbought territory. However, as we know an instrument can languish weeks and sometimes months in overbought territory on the larger timeframes so this seems to be irrelevant at present.

The psychological 2650 mark is the most immediate area i would keep an eye on as we may see a reaction or profit taking at this area. Market participants love whole numbers and when it comes to gold the ’50 and 75′ levels are always key.

Looking at support and the 2625 area has been key over the last two days serving as a base fro gold on the smaller timeframes as the precious metal advance toward the 2650 handle. This may be a level worth monitoring moving forward.

GOLD One-Hour (H1) Chart, September 24, 2024

Source: TradingView (click to enlarge)

Support

- 2625

- 2600

- 2587

Resistance

- 2650

- 2675

- 2700

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.