- Gold and Silver prices reach new highs amidst a rising US Dollar, driven by global uncertainties and a potential Trump Presidency.

- Silver’s demand/supply dynamics bode well for further gains.

- The US Dollar Index (DXY) strengthens due to positive economic data and fading rate cut expectations, with a potential rise to 105.00.

Most Read: S&P 500, Nasdaq 100 – US Indices Eye Recovery as Earnings and Yields Weigh on Markets

Gold prices have smashed through the 2750 handle despite the US Dollar continuing its advance. The precious metal has attracted bids with some believing this could be down to markets preparing for a potential Trump Presidency in the US.

There does not appear to be a single factor driving Gold prices but rather a combination of rising uncertainties for global market participants to consider. Global conflicts, trade wars and a potential Trump Presidency are at the forefront and that is leaving out the uncertain economic situation in many countries.

Despite sky high stock prices in the US and what seems to be improving sentiment, Gold, a notorious safe haven bet reveals a different story. Gold prices have been on a tear this year and with many people still viewing the precious metal as a safe haven, are market participants telling us something?

Silver (XAG/USD) Demand/Supply Dynamics Bodes Well for Bulls

A commodity that has flown under the radar of late has been silver, as prices soared to new all time highs. Silver is trading in the mid 34’s at present with market analysts noting that more gains could be in store for silver prices.

Looking more closely at Silver, the appeal is quite evident. Silver is used in a host of electronic products manufactured today and the rise of tech is only going to increase the demand for silver.

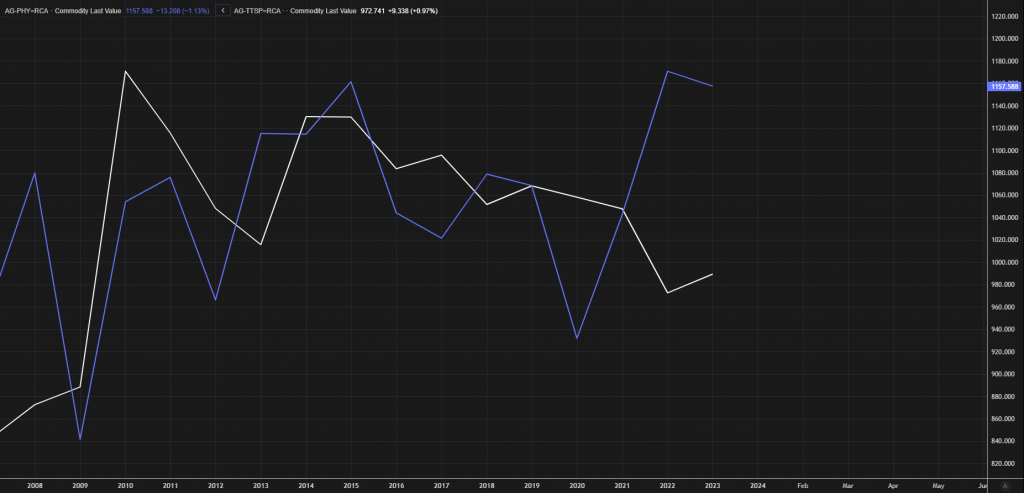

Given the physical shortage already present in silver markets there is a huge possibility that the rally could continue. Looking at the chart below, you can see the huge discrepancy between demand (blue line) and supply (white line) which I expect will underpin prices moving forward.

Source: LSEG Workspace

US Dollar Index (DXY) Eyes a Rise to 105.00 Key Level

The US Dollar continues its rise on positive data and fading rate cut expectations. Markets have been digesting comments from Fed Policymakers over the last week or so which has largely leaned on the hawkish side.

As markets adapt to fewer anticipated rate cuts in the US compared to more aggressive cuts by other central banks, the US Dollar may be set to keep rising. There is growing talk of a ‘Trump trade’ as US Treasury yields have experienced some interesting swings off late. This may be another area to focus on when looking at the greenback moving toward the US election.

US Dollar Index (DXY) Daily Chart, October 23, 2024

Source: TradingView

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold continues to print fresh highs and languish in overbought territory. As we know markets are able to languish in overbought territories for extended periods of time and thus the Gold rally could continue.

Gold is currently flirting with the key level at 2750 with a drop lower opening up a retest of the support area at 2739. Lower down we could look at areas of support around 2724 and 2714.

The upside provides us with less insight with today’s highs at 2758 an area to keep an eye on before the psychological level at 2775.

GOLD (XAU/USD) Four-Hour (H4) Chart, October 23, 2024

Source: TradingView (click to enlarge)

Support

- 2739

- 2724

- 2714

Resistance

- 2758

- 2775

- 2800

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.