- Gold prices experience significant drop due to hopes of a Lebanon-Israel ceasefire and the announcement of Scott Bessent as US Treasury Secretary.

- US Treasury yields fall and the dollar weakens in response to Bessent’s expected policies.

- Technical analysis indicates a bearish trend for gold in the short term, with potential support and resistance levels identified.

Most Read: Markets Weekly Outlook – Inflation Data & Geopolitics to Dominate

Gold prices have fallen around $100 today as risk on sentiment returned. Geopolitics has taken center stage at the start of the week as rumors began doing the rounds that an Israel-Lebanon deal will be announced in 36 hours.

US Treasury Pick Confirmed

The return of risk on sentiment is also partly down to the announcement by US President Elect Donald Trump of Scott Bessent as US Treasury Secretary.

Market participants see the appointment of Bessent as a steadying influence in Trump’s administration. There seems to be a sigh of relief that Trump didn’t make another risky choice for the Cabinet. Bessent’s Wall Street experience reassures them, as they believe he’ll support balanced policies and help tone down some of Trump’s more extreme ideas.

Scott Bessent has talked about using trade levies in a way that’s less likely to upset markets or cause inflation compared to Trump’s previous plans. He has also shared ideas on reducing the budget deficit to 3% by focusing on deregulation, boosting energy production, and shifting parts of the economy back to private control all aimed at driving economic growth.

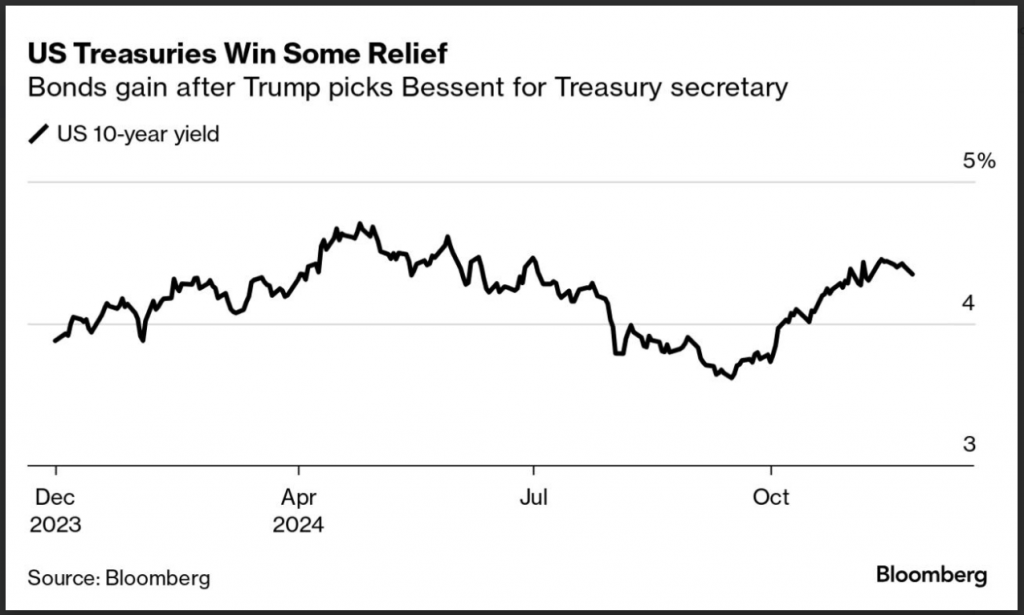

These views influenced markets on Monday, with 10-year Treasury yields dropping to 4.3%, as investors felt reassured. At the same time, the dollar lost some strength against other currencies because people believe Bessent will take a softer stance on tariffs than Trump.

Source: Bloomberg

Israel-Lebanon Ceasefire Deal Nears, Russia-Ukraine Rumbles on

Rumors began circulating in the European session that a ceasefire deal between Lebanon and Israel is drawing closer. This added to the precious metals woes setting it on course for its worst day since June 7.

According to officials, the Israeli security cabinet may vote on a Lebanon deal tomorrow. Such a move could lead to continued selling pressure on the precious metal.

What is interesting though is that rumors around Russia and Ukraine have actually intensified over the past 24 hours. Rumors have swirled that the UK and France are leading discussions to allow military personnel on the ground in Ukraine. This would be seen as a major escalation, hence my surprise at the drop in Gold prices. In theory, one would think that such rumors may at least keep Gold prices slightly supported moving forward.

This will definitely be a point of interest moving forward and could be the saving grace that Gold may need following the sharp selloff and drop in US Treasury Yields.

Economic Data Ahead

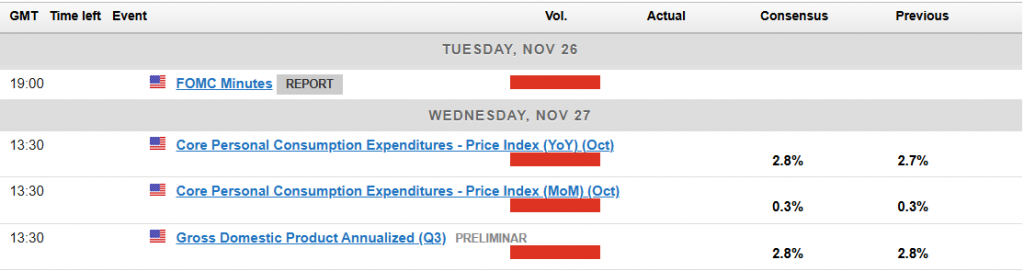

Looking at the data front this week, and tomorrow we have the FOMC minutes which may provide some insight into what Fed members think of a Trump Presidency and its potential implications. Despite Chair Jerome Powell insisting politics will not dictate policy, this seems a bit tone deaf in all honesty.

It’s no secret how President Elect Trump feels about the Fed and Jerome Powell. Given Trump’s rhetoric in the election and his economic plans, the Fed will not be able to just ignore it and wait on the data. However, I could be getting ahead of myself and the Fed minutes may not reveal anything about a potential Trump Presidency.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold is down around 3.21% at the time of writing. Last weeks selloff did find support at the 100-day MA before rallying to peak just above the $2700/oz mark.

Overall the trend on the daily is bearish from a price action point of view, with further downside a possibility. Gold has been largely driven by fundamental factors of late, which is not to say that the technicals have not given us any clues to the precious metals next move.

Looking at the selloff today and once could argue that the fibonacci retracement provided a hint that a selloff may materialize around the 2693 and 2735, which is the 61.8-78.6 fib retracement zone.

However, many may have been caught off guard given the bullish pressure we saw last week. I for one will have to admit i did not see such an aggressive selloff to start to the week, which begs the question… will the precious metal push lower or will the situation around Russia-Ukraine reignite safe haven demand?

immediate support rests at 2625 and 2600 which is just above the 23.6% retracement level which rests at 2596.

A recovery from the current price may face resistance around the 2639 handle before the 2650 and 2673 handle comes into focus.

GOLD (XAU/USD) Daily Chart, November 25, 2024

Source: TradingView (click to enlarge)

Support

- 2625

- 2600

- 2574

Resistance

- 2639

- 2650

- 2673

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.