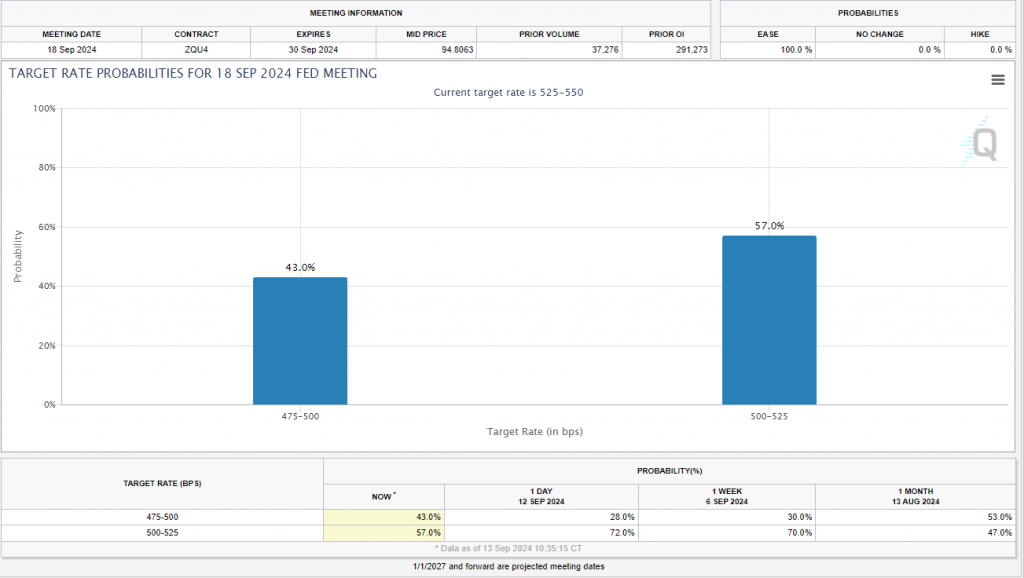

- Federal Reserve’s Upcoming Decision: Markets are split on whether the Fed will cut rates by 25 or 50 bps.

- Key data releases from China, Japan, the UK, and the US will shape market sentiment and potentially set the tone for Q4 2024.

- The DXY is nearing a critical support level, and its direction could determine the US Dollar’s trajectory ahead of the US election.

Read More: Germany 30 Technical: A potential bearish reversal looms

Week in Review: Market Participants Left with More Questions

As the week draws to a close, US data remained robust with a marginal uptick in both the core CPI and PPI prints. Data leading into Thursday’s US session seemed to solidify a 25 bps cut from the Federal Reserve, however the idea of a 50 bps cut gained renewed traction late in the day.

Comments from Former Fed Policymaker Bill Dudley, who explicitly said he would push for a 50 bps cut were he still in the committee. Some media outlets reported that it would be a tight decision between a 25 basis point and a 50 basis point change, which also played a role in the market’s dovish adjustment.

Market expectations saw a significant shift on Thursday with the probability of a 50 bps cut rising from 28% to 43%.

Source: CME FedWatch Tool

The most intriguing part of Dudley’s speech however was his comments about the Fed and surprises. Dudley said “It’s very unusual to go into a meeting with this level of uncertainty – usually the Fed doesn’t like to surprise markets”. Dudley hit the nail on the head as I for one cannot remember the last time I was prepping for a Federal reserve meeting with such uncertainty in play. There is growing chatter and something hinted at by ING Think Research as well in that if markets continue to aggressively price a 50 bps cut ahead of the Wednesday meeting, it could sway the Fed to deliver such a cut.

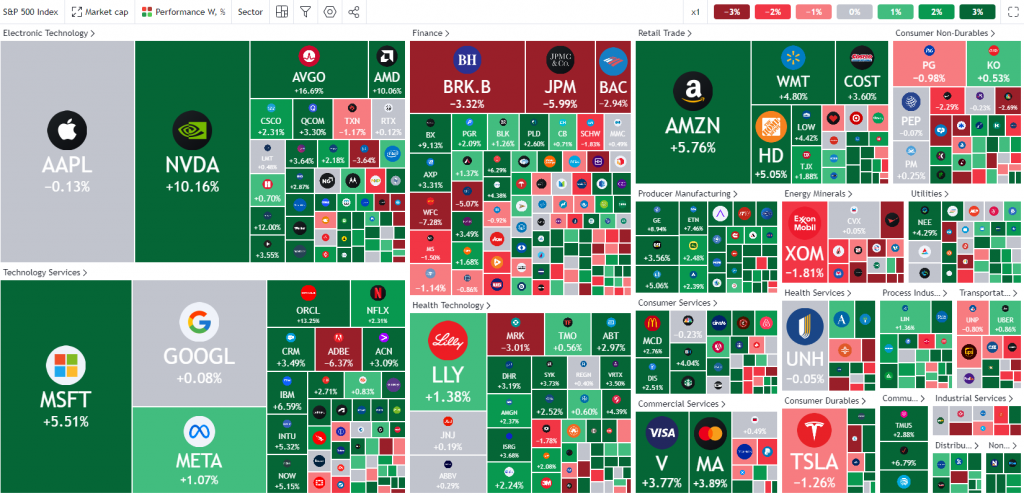

In light of the shift in rate expectations US equities continued their advance this week. The S&P 500 added around $1.8 trillion USD in market cap over the last week alone with NVIDIA up around 15% for the week. This leaves the S&P 500 just 1% away from all time highs, the Nasdaq 100 lags a little behind but is also within striking distance of the all time highs.

S&P 500 Weekly Heatmap

Source: TradingView

Gold received a shot in the arm Thursday afternoon following the rate cut chatter, coupled with rising concerns around the Russia-Ukraine conflict. This helped the precious metal push beyond the highs at 2531/oz before going on to print fresh highs around 2586/oz at the time of writing.

On the FX front we saw a recovery for both cable and EUR/USD with USD/JPY coming under pressure during the course of the week. The DXY remains a key player where FX moves are concerned and is heading into an important week which could set the tone for the US Dollar for the rest of the year.

The Week Ahead: Will it be a 25 or 50 bps Cut from the Fed?

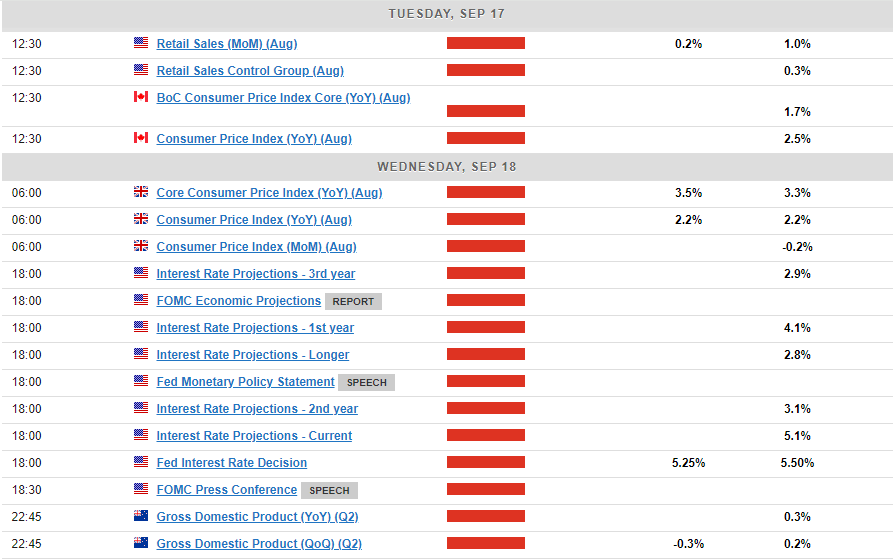

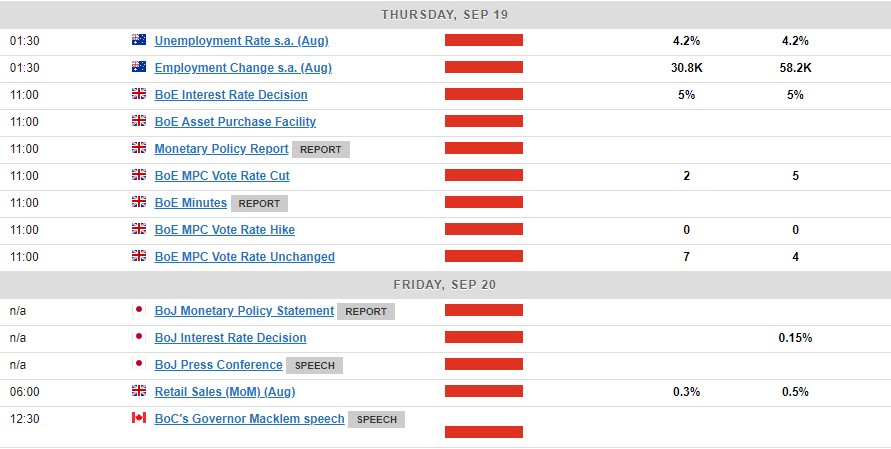

The week ahead is packed with high impact data releases in both developed and emerging markets. Three major central bank meetings and a host of other high impact economic data releases will drive market sentiment and could set the tone for Q4.

Asia Pacific Markets

In Asia, the upcoming week data dumps for China and Japan as well as a raft of Asian central bank meetings make for a busy week ahead.

In China the August data release is set for Saturday morning, and we anticipate another month of tepid growth figures. Key economic indicators, including industrial production (previously 5.1%, now forecasted at 4.8%), fixed asset investment (previously 3.6%, forecasted at 3.5%), and retail sales (previously 2.7%, forecasted at 2.5%), are all projected to slow down.

Market participants will also keep a close eye on the 70-city housing price data, seeking signs of stabilization. Although price declines have slowed over the past two months, the ongoing drop remains notable.

The Bank of Japan is anticipated to maintain its current rates following the 15 basis point increase in July. Nonetheless, if the forthcoming growth and inflation figures align with the central bank’s projections, it is expected to restart its rate hikes in December. This is in line with comments late on Friday from Sanae Takaichi, a candidate for Prime Minister who stated the time is not right for another rate hike.

Europe + UK + US

A busy week in developed markets with both the BoE and Federal Reserve rate decisions taking center stage. There are a host of other data releases as well which are likely to be overshadowed by the Central Bank meetings.

The Bank of England faces a different challenge to the Federal Reserve as UK data has remained strong. Recessionary fears have faded and market participants have tempered their rate cut bets following the latest batch of data. Part of the caution stems from services inflation, which, at 5.2%, remains higher than that of the US and the eurozone, similar to the trend in wage growth. However, this figure is notably lower than the Bank’s latest forecast, and July’s numbers also fell short of expectations. For now it appears a hold may be the most appropriate course of action before a cuts closer toward the year end.

The Federal Reserve meeting has already been covered in depth above. The challenges for the Fed are clear as markets grapple with either a 25 or 50 bps cut next week. I am leaning toward a 25 bps cut but as I said earlier there are a host of uncertainties. If markets continue to price in a 50 bps cut ahead of Wednesday, will the Fed spring a surprise?

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Chart of the Week

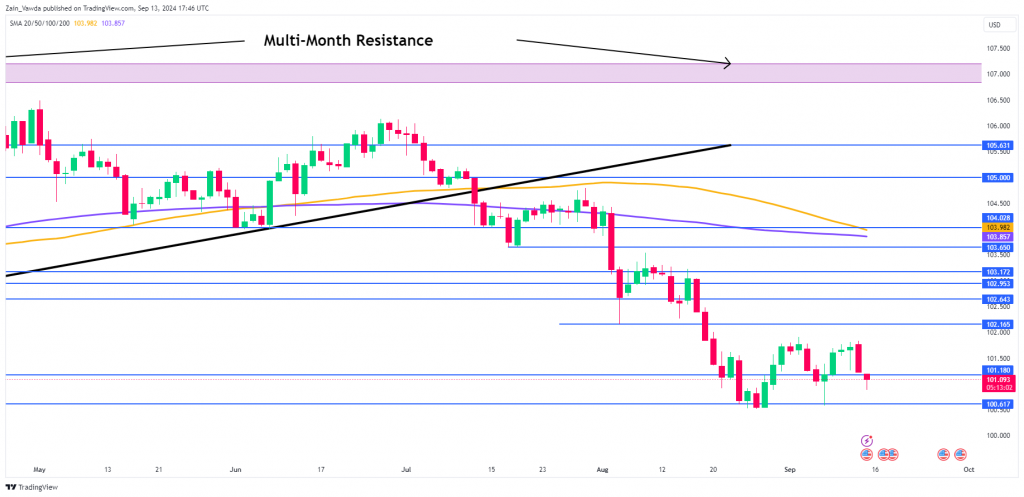

This week’s focus is on the US Dollar Index (DXY), which continues to be intriguing and surprising. The week ahead could be make or break for the DXY as it still remains within striking distance of the psychological 100.00 level.

The DXY put in an impressive start to the week before the momentum began to wane. Tuesday and Wednesday saw some sideways price action before a selloff on Thursday as rate cut bets changed.

The index is currently trading just below the support level at the 101.18 handle with 100.50 needing to be cleared if we are to finally test the 100.00 mark.

On the upside now we have created a key area of resistance that needs to be cleared at around the 101.77 if a recovery is to gain any traction.

US Dollar Index (DXY) Daily Chart – September 13, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 100.50

- 100.00

- 99.55 (July 2023 Low)

Resistance:

- 101.80

- 102.16

- 103.00

- 103.80 (100 and 200-day MA)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.